What's supported rapeseed prices recently? Grain Market Daily

Tuesday, 14 January 2020

Market Commentary

- Old crop UK feed wheat futures (May-20) have strengthened this week, ending yesterday at £156.25/t as sterling continues to weaken. New crop futures (Nov-20) have also followed this trend, increasing £1.65/t from Friday, to close at £164.55/t yesterday.

- Egypt’s state grain purchaser (GASC) has opened a tender to purchase an unspecified volume of wheat for March shipment. The most recent GASC international wheat tender on 8 Jan saw 300Kt of wheat purchased for February shipment. Results are expected to be published later this afternoon, with Russia currently the cheapest FOB offer at $235.30/t.

What's supported UK rapeseed prices recently?

Taking a look at the vegetable oil markets can be an important guide for the direction of rapeseed prices going forward. UK rapeseed (delivered, Erith, Feb) was quoted at £359.00/t on Friday, an £8.00/t increase on the previous quote (20 Dec).. Now that Ukraine’s front-loaded export schedule has reached completion, the rapeseed supply picture going forward seems increasingly tight.

Despite falls early this week, support for rapeseed prices on the back of firm oil markets is likely to remain.

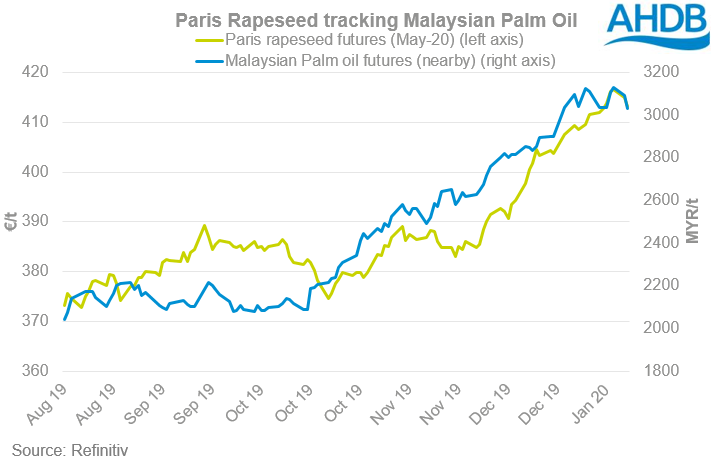

Rapeseed oil in particular, has strengthened recently, seeing support from an increase in palm oil prices pushing up the bottom end of the vegetable oil market. Nearby Paris rapeseed futures increased €32.50/t from early December to yesterday’s close, following gains in wider oil markets.

Global palm oil prices have seen large rises throughout the second half of this year, monthly average prices are up 51% from July-19. Nine-year low production figures for December combined with high export figures has resulted in Malaysian end-Dec palm oil stocks reaching a 27 month low. Much of this price rise has supported vegetable oil markets recently.

Throughout December, nearby soyabean oil prices saw rises, ending the month $99.87/t higher from 2 December. Support came from raised palm oil prices and a weakening US dollar against the Euro, coupled with an agreement in the US – China trade dispute enabled soyabean oil prices to increase.

Reductions to crude oil production estimates (OPEC) had offered support to rapeseed markets recently as crude oil prices saw rises throughout December. However, as crude oil prices start to withdraw from highs caused by US – Iran political issues at the start of this month, this contributing support could start to fall away.

With tightness in EU rapeseed this season, imports of biodiesel could well rise, with Argentina a likely source. The main Argentinian oilseed crusher has temporarily paused production owing to financial difficulties. This could also support EU rapeseed prices in the short term.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.