What does the wheat supply and demand situation look like this season? Grain market daily

Wednesday, 20 September 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £189.00/t yesterday, down £0.30/t from Monday’s close. New crop futures (Nov-24) closed at £198.10/t, down £1.50/t over the same period.

- Both the Chicago and Paris market were pressured yesterday from technical selling and continued export competition from the Black Sea. It was reported yesterday that a vessel carrying grain left the port of Chornomorsk in Ukraine. This is the first vessel to depart this port since the collapse of the Black Sea Grain Initiative.

- This morning, the Office for National Statistics (ONS) released the latest inflation rate figures. The Consumer Price Index dropped to 6.7% in August, down by 0.1pp from July. The Consumer Prices Index including owner occupiers' housing costs (CPIH) dropped to 6.3% in August, also down by 0.1pp from July. This decline has taken inflation to its lowest level since February 2022, just before Russia’s invasion of Ukraine.

- When this ONS data was initially released this morning sterling weakened against both the US dollar and euro. Sterling has marginally started to recover against the US dollar but remains subdued against the euro. Trading as at 12:00 was £1 = $1.2366 and €1.1555.

- The Bank of England are expected to adjust interest rates tomorrow, with initial anticipations that interest rates could rise by 0.25% to 5.5%. However, the latest ONS data has reduced the odds of interest rates rising. The Bank of England will release the latest base rate at 12:00 noon tomorrow.

- Paris rapeseed futures (Nov-23) closed yesterday at €440.25/t, gaining €7.00/t from Monday’s close. Some of the support in rapeseed markets came from some initial support in Chicago soyabean futures. However, soyabeans ended the day down, with US crop ratings better than anticipated and export competition from Brazil. Further to that, US soyabean harvest has now started with 5% complete by last Sunday (17 September).

What does the wheat supply and demand situation look like this season?

Harvest 2023 could be described as somewhat challenging (to say the least). The weather this year led to an (im)perfect storm. The hot and dry conditions in the late spring/early summer accelerated crop growth and development and then the rain struck, leading to a delay to the start of harvest, with stop-start progress. While harvest progress finally started to pick up in mid to late August for most, these somewhat adverse conditions have led to a very mixed bag of quality and yields for wheat this season.

What are supplies looking like this season?

There is yet to be any official data released for harvest 2023. However, information obtained from the AHDB harvest reports and regional teams suggest that crop yields are very variable depending on variety, soil type and region. As at 12 September, 99% of the GB winter wheat area was estimated to have been harvested with yields ranging between 5–13 t/ha on farm, according to the AHDB harvest report. The GB average winter wheat yield at this point was estimated at 7.8–8.2 t/ha. So what does production look like for the 2023/24 season?

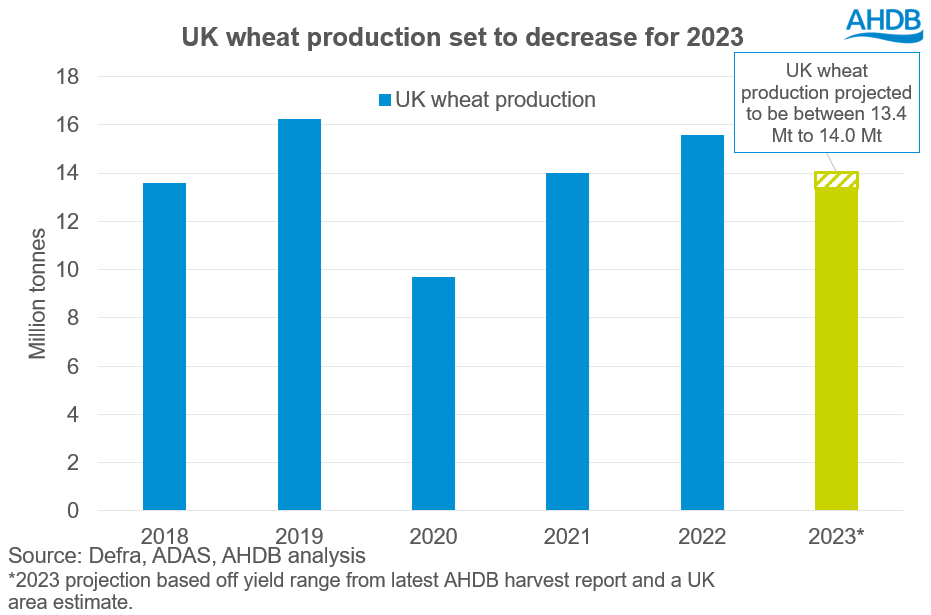

We now know that the area planted to wheat for harvest 2023 in England was lower than initially anticipated in the results of the Defra June survey; it is estimated at 1.580 Mha, down 5% on the year. Using the results from the AHDB Planting and Variety Survey and an estimate for Wales, an area forecast for the UK can be made. As such, at a projected 1.713 Mha, the UK wheat area is 6% lower than in 2022. Applying the average yield range from the harvest report to the area outlined above, UK wheat production for harvest 2023 could be between 13.362–14.047 Mt. Taking into account anecdotal comments from the trade and the AHDB regional team, it is likely that production this season will be nearer the higher end of that range, given yields are generally expected to have been near average (2018–2022 average Defra yield for wheat is 8.01 t/ha).

Given the information we have available, if wheat output is circa 14 Mt this season, it would be around 1.5 Mt lower than last season. The projected drop in output this season is likely to outweigh the rise in carry in stocks, leading to a smaller domestic availability. However, does this mean the UK will need import more wheat this season?

Demand expected to remain lacklustre

As well as varied yields this season, the quality of the domestic wheat crop is expected to be mixed, even within regions. While the overall quality of this year’s crop is not expected to be a ‘disaster’, the smaller crop size means that there will be a smaller pool of high specification milling wheat available. If this is the case, then we could see imports of high specification milling wheat increase this season. In terms of demand from flour millers overall, as has been the case for several years now, usage is expected to remain relatively stable.

In terms of other human and industrial demand, bioethanol usage will remain a watch point as always. As it stands at the moment, bioethanol demand for wheat is expected to remain relatively stable this season, with strong demand by the starch and distilling sectors set to continue.

While no monumental demand shifts are expected in 2023/24 for the human and industrial sectors, animal feed demand is expected to be somewhat lacklustre again. Last season we saw animal feed production fall, leading to a decline in wheat usage in rations. The poultry industry, the largest consumer of wheat across all the animal feed sectors recorded the largest drop in feed production. While lower input costs for both layers and broilers have eased the tight squeeze on margins seen last year, margins remain relatively tight, with the industry unlikely to recover fully this season. Therefore, it is likely feed usage by this sector will remain below the previous five-year average. Likewise, for the pig sector, no major recovery in the UK pig herd is expected this calendar year, with clean pig throughputs currently forecast to be down 14% on the year in the second half of 2023 (AHDB estimates). While the UK breeding herd is expected to slowly recover, it’s unlikely we will see the impact of that on feed demand until the later part of the season.

In terms of ruminant feed demand, there have been reports of good forage availability from this summer, which may lead to less substitute feeding. Likewise, with milk prices still subdued, we could see this capping feed demand. However, as is always the case, the spring weather will remain a big watch point for ruminant feed demand, as a soggy spring could soon lead to a rise in feed demand.

Steady demand to counter lower supply?

If the final UK wheat production does come in at near 14 Mt, then the UK will have a tighter supply of wheat this season, despite higher opening stocks. Whether that means we will need to import more wheat really depends on the quality, as there could be a higher requirement for imported hard wheats for the milling sector. While supply may be lower, demand could also be relatively low driven by another year of subdued animal feed demand, with producer margins continuing to be relatively tight and slow recoveries in the monogastric sector expected. With a smaller crop and surplus, its likely exports will slow leaving a relatively ample balance if demand does remain subdued this season.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.