Analyst Insight: What does the UK-US deal mean for the domestic grain market?

Thursday, 15 May 2025

Market commentary

- Global wheat markets edged up yesterday after hitting recent lows. Chicago wheat and Paris milling wheat futures (Dec-25) rose by 1.2% and 0.1% respectively. In the US, prices were supported by short covering, while wheat stocks for next season came in higher than expected. In Europe, prices were lifted by news of potential export demand and lower stock estimates for the current season from FranceAgriMer.

- UK wheat markets did not follow the global trend, with Nov-25 feed wheat futures falling £0.25/t from Tuesday’s close, to settle at £180.05/t.

- Paris rapeseed futures (Nov-25) closed at €487.75/t yesterday, down €5.00/t from Tuesday’s close.

- Chicago soyabean and Winnipeg canola futures (Nov-25) were up 0.2% and 0.3% respectively.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

What does the UK-US trade deal mean for the domestic grain market?

Earlier today, AHDB’s economics team released an article assessing the impact of the UK-US deal on UK agriculture. More specifically, it highlights how the deal likely poses more threats than opportunities for the UK ethanol market.

Ethanol – likely more threats than opportunities

The UK-US EPD will remove the current 19% tariff on ethanol imports and replace this with a duty free TRQ of 1.4 billion litres. While this sets out to lower costs for manufacturing sectors which use ethanol as a raw material, it could pose as a considerable threat to agriculture. The UK imported an average of 559 million litres of US ethanol between 2022 and 2024 and the US is the main import origin for ethanol, followed by the Netherlands.

The US is the world’s largest producer of ethanol which is primarily produced from maize, which the country has an abundance of. The ‘corn belt’ states in the Midwest account for the majority of US ethanol production due to high production levels and existing established biorefinery infrastructure. As a result, the US can produce bioethanol at a low cost and export it at a competitive price on the international market.

British ethanol is mainly made from feed wheat which supports farmers not only locally but across the country. As the two bioethanol plants in the UK are situated in the North, feed wheat naturally travels towards this demand centre. Bioethanol plays a big part in decarbonising the transport sector by creating E10 petrol blend to reduce emissions. The process also creates two important by-products of carbon dioxide and high protein animal feed.

With the new tariff changes there is a risk that more competitively priced US ethanol imports will be preferred, causing pressure on UK ethanol production. The UK bioethanol plants have the capacity to purchase around two million tonnes of wheat each year, so many farmers would lose a reliable market for their feed wheat. In addition, this may lead to higher animal feed prices as this would not be being produced as a by-product. Other industries and sectors such as the NHS also rely on the carbon dioxide produced in ethanol production.

UK bioethanol has already been struggling due to competition from the US so this will make things tougher for the sector. With the news of US ethanol tariff changes, both UK plants have stated that UK bioethanol production is at risk.

What could this mean for UK cereals prices and trade?

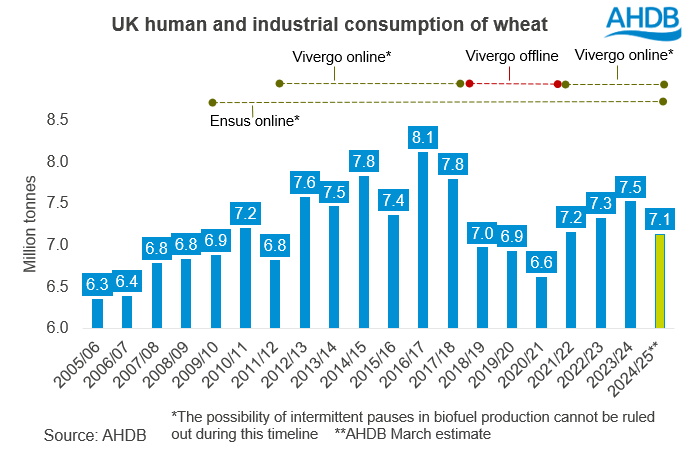

Wheat usage by the two main UK bioethanol plants (Ensus and Vivergo) feeds into human and industrial (H&I) consumption figures outlined in AHDB’s UK cereals supply and demand estimates. Over the last 25 years, H&I consumption has fluctuated greatly, largely in line with the openings or closures of one or both bioethanol plants, with the human aspect remaining more stable.

With H&I usage accounting for around half of total domestic wheat consumption over this period, changes in demand could have considerable impact on the domestic balance. With all wheat used for bioethanol of feed quality, and a relatively low proportion of imported wheat used, a loss of demand from this sector, in an average production year, would likely leave the UK with a surplus of home-grown feed wheat.

In terms of what this means for prices, looking at the change in regional basis last season (a relatively strong bioethanol production year) compared to before the opening of the plants in 2010 and 2012, we can get an idea of potential impact. The average basis of spot ex-farm feed wheat to nearby UK feed wheat futures in March from 2006/07 to 2008/09 in the North East (where both plants are now located) was -£3.80/t, compared to -£5.90/t in the Eastern region. Last season, the basis in the same month in the North East averaged +£11.07/t versus +£2.77/t in the Eastern region. This suggests more support for prices in the North East on the back of increased biofuel production. As such, a lack of bioethanol demand in the North East could lead to pressure on basis in this region.

To balance UK feed wheat supplies if bioethanol demand dropped, the market may also look to export a greater volume of the grain. However, as it stands, domestic prices would need to be more price competitive in order to gain access to global markets, with export pace particularly lacklustre this season.

AHDB will continue to monitor any updates on this topic, and assess any impact on the domestic supply and demand balance, and therefore prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.