What could more Russian wheat do to the global wheat balance? Grain market daily

Friday, 29 July 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £268.75/t, gaining £0.50/t on Wednesday’s close. The May-23 contract closed at £273.15/t, gaining £0.40/t over the same period.

- New crop UK feed wheat futures (Nov-23) had greater gains closing at £243.05/t, gaining £3.00/t over the same period.

- Underpinning current support in wheat markets, is the need for crucial details to be rectified before the first grain shipment departs Ukraine through the Black Sea, according to the UN.

- Hot and dry weather in parts of the US Midwest is adding support to grain and oilseed markets, as their soyabean and maize crops have now entered critical development stages. This is filtering into support for Paris rapeseed futures (Nov-22) which closed yesterday at €679.75/t, gaining €12.25/t on Wednesday’s close.

- The Cereals and Oilseeds at a glance page has recently been updated with the latest infographics on market information.

What could more Russian wheat do to the global wheat balance?

Northern hemisphere wheat harvests are currently progressing. Within the next few weeks there should be clearer understanding of global wheat supplies for the 2022/23 marketing year. With our domestic market following volatile global market movements, as harvest news evolves, this will filter into domestic ex-farm prices too.

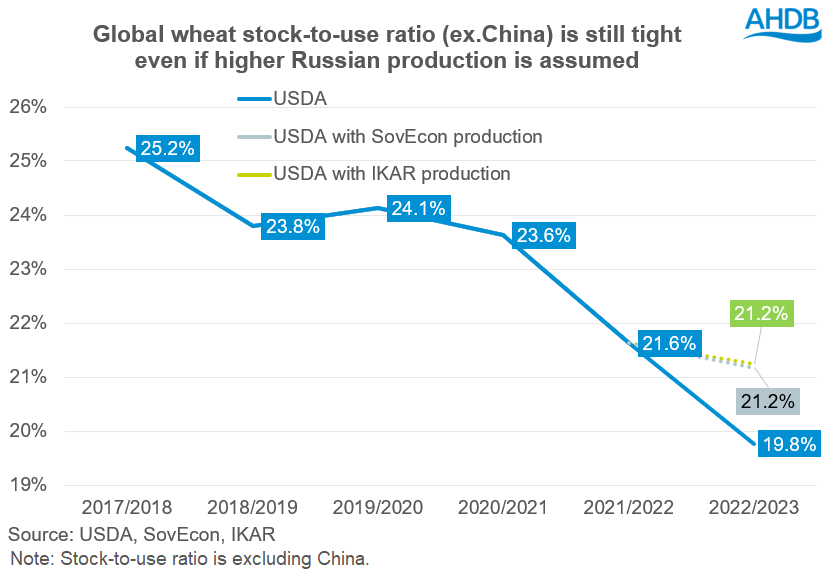

Globally (excluding China) for wheat we are going to be tighter this season (2022/23), with world stock-to-use ratios dropping to 19.8%, down from 21.6% in 2021/22 (USDA).

Amidst the current volatility, accurate data is key to setting global market sentiment, and publications like the USDA World Agricultural Supply and Demand Estimates can change this.

However, what if there are differences in data forecasts, such as the Russian wheat production for harvest 2022? Could this change market sentiment for the 2022/23 marketing year?

Russian wheat production

Within the last 15 years, Russia has risen to be a major player in global wheat markets, being the largest global exporter of wheat currently. Due to this, Russian production can be a market sentiment setter.

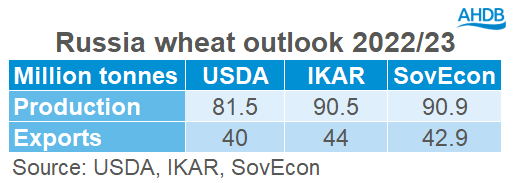

The USDA currently estimate Russian production and exports for 2022/23 marketing year at 81.5Mt and 40Mt, respectively. This is quite different from Russian consultancies such as SovEcon and IKAR, who expect production to be higher.

Both SovEcon and IKAR estimate the Russian crop to be near 10Mt higher than the USDA’s estimate. The International Grains Council peg the Russian crop higher too than the USDA, at 85.2Mt.

With this potentially higher Russian crop, what does this do to global stock-to-use ratios if we take these higher production estimates?

Global stock-to-use with larger Russian crop

If we were to take the USDA global wheat balance and assume no change to consumption, global stock-to-use ratios (excluding China) will still drop for the 2022/23 marketing year with IKAR and SovEcon wheat production figures.

As shown in the graph above, even should a higher Russian production be realised, globally we are still going to be tight for the 2022/23 marketing season, with stocks-to-use (excluding China) forecasted at 21.2% instead of 19.8%.

Conclusion

Although wheat prices have eased from their peak in May, they are still currently historically high.

Even should a larger Russian crop be realised, potentially bearing on the market, we are still globally tight in supply. This could mean that ex farm prices in turn remain elevated from historical average prices.

This is withstanding there isn’t any major consumption changes, as global economic conditions deteriorate. But as Meg outlined on Wednesday, there is news aside from strong demand that is causing volatility and support in global markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.