What could happen to the UK rapeseed area over the coming season? Grain market daily

Friday, 17 June 2022

Market commentary

- UK feed wheat futures (Nov-22) saw a slight increase yesterday, closing at £311.30/t, up £1.25/t from Wednesday’s close. May-23 was up by £1.50/t over the same period, settling at £317.10/t.

- Hot weather concerns for US maize are supporting Chicago futures ahead of their Juneteenth public holiday, the Dec-22 contract closing at $289.37/t yesterday, up $5.51/t from the previous day’s close.

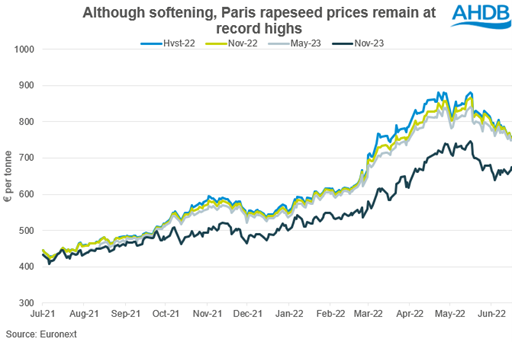

- Paris rapeseed (Nov-22) saw a €3.00/t rise from the previous session, closing at €757.25/t.

What could happen to the UK rapeseed area over the coming season?

Rapeseed area in Britain has declined significantly over the last few years. In 2018, before the ban of neonicotinoids came into force, we saw around 582Kha of rapeseed being grown, significantly more than the 2021 figure of 306Kha. In addition to the weather challenges experienced in recent seasons, many growers chose to stop planting the crop, as cabbage stem flea beetle and pigeon damage contributed to lower yields or failed crops entirely.

Currently, the percentage of winter rapeseed in excellent or good condition is at (as at 24 May) 19% and 51% respectively, and is reportedly faring well for many. Combined with higher prices, could we see more farmers choosing to increase their rapeseed area next season?

Incentives

Not only are crop conditions currently largely faring well, but new-new crop Nov-23 Paris futures have already hit contract highs of €746.00/t (16 May) since the contract began. This is mainly a result of the conflict in Ukraine and compounded by a very tight global balance sheet for the entire oilseeds complex. These supportive factors could well be in place for some time. Domestic physical prices have been following suit, with nearby delivered prices into Erith topping out at £820.00/t on 08 April.

These high prices mean that even though winter rapeseed seed costs and other input costs have risen, gross margins could well be supported. In fact, looking back to May’s gross margins analysis, winter oilseed rape is calculated to be the third and fourth most profitable crop for harvest 2022 and 2023 respectively.

Regional Variation

It’s important to point out that different parts of the country saw greater OSR area reductions between 2018-21 than others, and that there is a degree of variability in crop conditions between these regions.

For example, 90% of Yorkshire and Humber winter OSR was said to be in excellent or good condition in the crop report as at 24 May 2022. In this region, the OSR planted area has reduced 34Kha between 2018-21. Meanwhile, the East Midlands saw an area reduction of 90Kha (64%) over the same period. This region also recorded fewer OSR crops at an excellent condition in May, with only 5% reported to be at this condition, compared to the UK average of 19%. This variation could mean that while price incentives are there, certain areas may not take the risk of a lower yield or failed crop.

Conclusion

High prices, if realised, could soften some of the impacts of high input costs for winter OSR production next season. So, if rotations allow, we may well see an OSR area uptick in those areas where conditions have been better. However, parts of the country that have experienced greater pest pressure may not want to run the risk of a failed crop. How these motivations balance out on a national level will become clearer as the drilling window for OSR opens, later in the summer.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.