What could cap rapeseed prices? Grain Market Daily

Wednesday, 8 January 2020

Market Commentary

- Following some losses in US wheat and maize futures (May-20) from Thursday’s close to Monday’s close, both contracts flattened out yesterday. Chicago wheat (May-20) closed at $203.29/t and Chicago maize closed at $154.13/t.

- Despite a rise in UK feed wheat futures (May-20) to yesterday’s close of £152.25/t, the contract is still down £1.25/t from the 2 January when it reached its highest since July-19.

- The spread from old-crop to new-crop (May-20 to Nov-20) for UK feed wheat remains large at £8.75/t at yesterday’s close.

What could cap rapeseed prices?

Paris rapeseed futures (Feb-20) have been slowly rising over the past six weeks to close yesterday at a contract high of €416.50/t. This is the highest nearby price since March 2017.

Oilseed rape has been gaining some support from rises in US soyabeans since early December. US soyabeans have been gaining on the back of bullish sentiment surrounding progress in the US-China trade deal.

However, this bullish sentiment has been dampened in the past week following geo-political concerns between the US and Middle East. From Thursday’s close to yesterday, the Mar-20 US soyabean contract has lost $4.50/t.

There is also some question over the volume that China may purchase considering there is no confirmed volumes in the agreement. Along with this China’s hog industry is significantly reduced following the outbreak of African Swine Fever last year.

These factors could slow rises seen in European markets as generally Paris rapeseed follows similar trends to US soyabeans.

What does this mean for the UK?

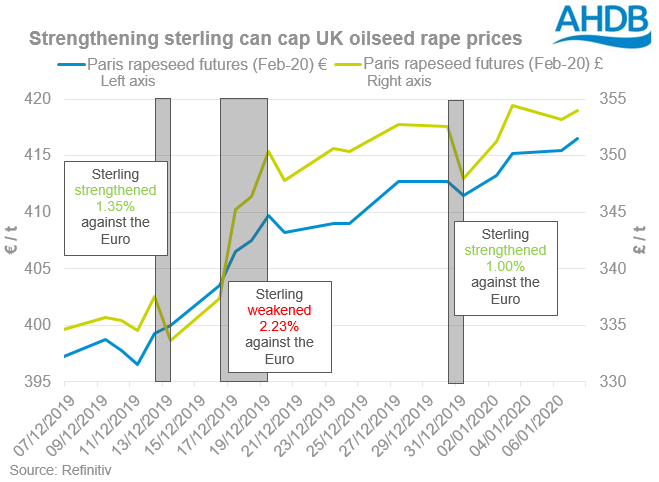

Rapeseed prices in the UK are generally based on the Paris futures market and therefore sterling comes into play also. The strength of the pound is a little all over the place at the moment. Post-election the pound strengthened to its highest value against the Euro since 2016. Since then it has dropped 1.85% to close yesterday at £1=€1.1765.

Due to the relationship with European pricing sterling really dictates what support is seen in physical UK pricing. In euro terms, Friday’s close of the Feb-20 Paris contract to Mondays close recorded gains of €0.25/t. However, in sterling terms there was a loss of £1.26/t due to the strengthening of the pound against the euro.

If sterling continues to strengthen then this could further cap the ability for gains in the UK.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.