What could 2022 bring for UK sheep meat imports?

Wednesday, 26 January 2022

AHDB will release its next Agri-market outlook covering all the AHDB sectors on Thursday 27th January. For the lamb sector, imports from New Zealand, and increasingly Australia, are a key concern for the industry. Let’s take a closer look at situation in New Zealand and Australia and see what that might mean for the UK. Prices in both New Zealand and Australia have been high recently, although have eased slightly, especially in New Zealand which is headed into peak production time.

New Zealand

New Zealand sheep meat production stood at 442,000 tonnes for the full 2021 calendar year, down 4% on 2020 levels according to Statistics NZ. This was largely due to changes in the timing of slaughter; if we look at the data on a NZ lamb crop year (Oct-Sep), production in 2019/20 and 2020/21 years were similar.

Looking at calendar quarter four alone, which is the first quarter of the production year, we can see a sharp drop in production volumes (-9%).

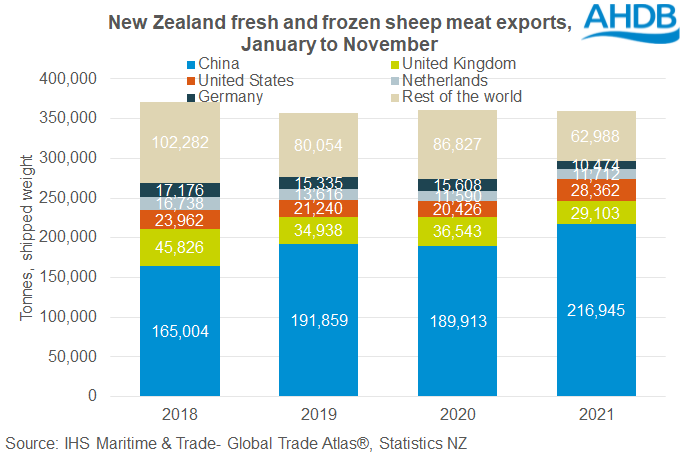

Trade data is only available up until the end of November. In the year-to November volumes had changed little compared to the same period in 2020, and were slightly above the five-year average. However, there was a change in destination, with volumes to Asia rising and a fall in volumes to Europe. Although some of this shift is part of a longer-term trend, it has only been further encouraged with the high freight rates seen in 2021.

Australia

Australia is currently in a flock rebuilding state, following several years of drought. Data on Australian production only covers the first three quarters of 2021, but a clear up-tick in production can be seen, +2% to 491,000 tonnes, according to the Australian Bureau of Statistics. A clear drop in adult sheep kill can be seen suggesting fewer flocks are being liquidated. An increase in lamb availability offset this to support total production.

In the year-to November, Australian exports of sheep meat totalled 397,000 tonnes, only a 1% rise on the year.

2022

Overall, in 2022 we are expecting to see many of the above trends continue. New Zealand will continue to look mainly at Asia. Industry reports suggest the Chinese sheep meat market is cooling slightly, however, it is coming off a very high boil. In New Zealand there are reports that some abattoirs are struggling for staff, with concerns only increasing as omicron cases rise.

For the UK, we are unlikely to see any real up-tick in volumes, partially due to the strength of the Asian market, but also the current state of the freight industry. Shipping capacity continues to be squeezed and this is set to remain the case at least through until the end of 2022. Australia recently signed a trade deal with the UK, and once this is ratified we do expect to see an increase in volumes from Australia. But, this is most likely to come at the expense of volumes from other nations. Australia itself sees an increased market share of the UK, but the total size of the UK import market remaining steady.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.