What are wheat markets watching currently? Grain Market Daily

Wednesday, 17 June 2020

Market Commentary

- Paris rapeseed futures (Nov-20) have moved sideways this week, though closed yesterday at €378.75/t, down €1.75/t from Friday. This follows lower than expected US soyabean crush figures for May, which declined 1.3% from April.

- Chicago wheat futures (Dec-20) have continued declines this week, closing yesterday at $187.21, down $2.66/t from Friday. The contract has fallen a further $1.29/t this morning at the time of writing.

What are wheat markets watching currently?

Now that the latest WASDE report figures are known, it is important to examine the other factors that could provide sentiment for wheat markets between now and harvest.

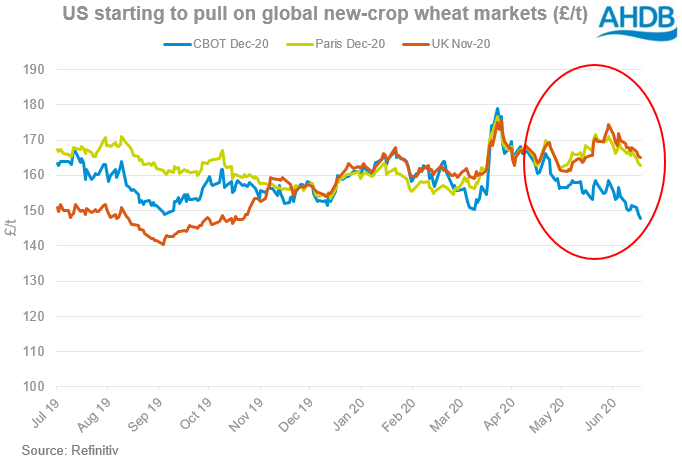

The UK faces an increased import requirement next season. Therefore, disruptions to the global supply and demand picture affecting import parity level could have a direct impact on the domestic price.

The US winter wheat harvest has now started, and has been fast out of the blocks. The harvest was 15% completed for the week ending 14 June, rising 8% on the week to sit at the five-year average. With the 10-day US weather forecast seemingly optimal, harvest pace could ramp up further, offering additional pressure for wheat markets.

We also need to pay attention to the French soft wheat crop. The condition rating is at the lowest since 2011, at 56% ‘good to excellent’ in the week ending 8 June. Forecasts for French non-EU wheat exports increased last week, now expected at a record level of 13.45Mt for the 2019/20 season. Thus, a reduced 2020/21 opening stocks figure, coupled with a smaller crop could provide somewhat of a bullish sentiment.

Finally, soil conditions across Ukraine remain on the drier side as the country approaches harvest. The Ukrainian economy minister reported a likely wheat production estimate of 23.0Mt, down from 28.3Mt in 2019. Ukrainian new-crop wheat export prices have seen incentives to rise over June as a result.

Reductions to EU and Ukraine wheat production figures offer bullish support to an extent, though somewhat countered by the presence of Russia and other exporters. Currency as well as other factors too, will play a part in price direction. UK wheat prices going forward, will likely sit close to import parity levels, as such, it is important to be aware of potential issues that could affect this level.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.