What are the upcoming trends in UK feed barley? Grain Market Daily

Friday, 26 June 2020

Market commentary

- US maize futures closed lower with favourable weather for US maize and concerns over renewed lockdowns dampening sentiment. Sterling looks like a dead duck amid continued lacklustre performances against the euro and US dollar, just managing to scrape above £1=€1.10. But at least it helps protect UK wheat values with Nov-20 futures closing at £163.15/t down just £0.25/t from Wednesday. Nov-21 closed at £150.75, up £0.35/t on the day.

- International Grains Council forecast 2020/21 world wheat production at 768Mt (762Mt 2019/20), up 2Mt from the previous estimate as increases in China and Australia offset lower EU production. Global maize production is seen at 1,172Mt, higher than the last estimate of 1,169Mt.

- One to watch: Black Sea temperatures for Jun-Aug are forecast 1.5°C above normal which may threaten spring crops and maize yield potential.

Barley price focus

- July feed barley fob prices for 25-60kt - Russia, Ukraine and Romania all at $174/t. Adding indicative freight of $10/into North Africa gives a CIF value of $184/t or £148/t.

- French fob Rouen feed barley is quoted at $184/t and with $16/t freight looks uncompetitive into North Africa, but… winter barley harvest is underway with 2% cut by 22 June, so pressure on values may start to build as new-crop fills stores.

- UK fob values quoted at £134/t or $166/t this week for 4kt indicates that we may be competitive on coaster markets but not quite there yet on bigger vessels into non-EU countries.

What are the upcoming trends in UK feed barley?

Key Points

- Most harvest pressure likely early/mid-August from larger spring barley crop.

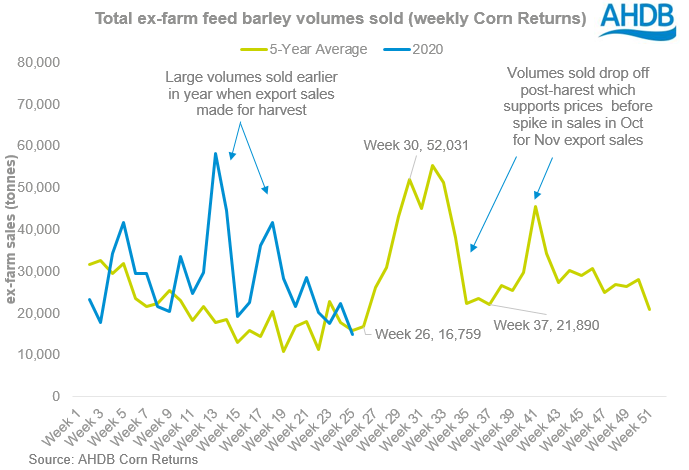

- Large export programme sold for harvest movement.

- Farmer selling usually slows post-harvest and the market tightens.

- Strong export business to EU needed in Oct-Dec, which will keep pressure on prices.

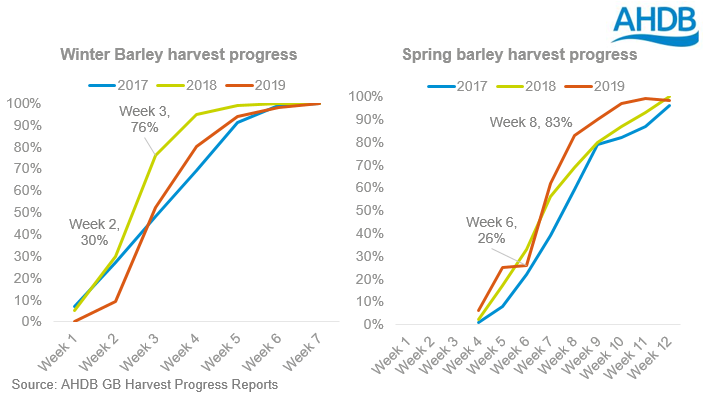

Barley harvests in the far south of England will usually start in the first full week of July, so we expect early progress in the week of 6th July. If we take this point as ‘week 1’ of harvest then using historic data we can map potential progress.

Winter barley harvest sees rapid progress in week 2-3 of harvest, so this year that could be 13 -24 July. Spring barley usually starts to come in later with a surge between weeks 6 and 8 of harvest, so this year that would equate to 10-28 August.

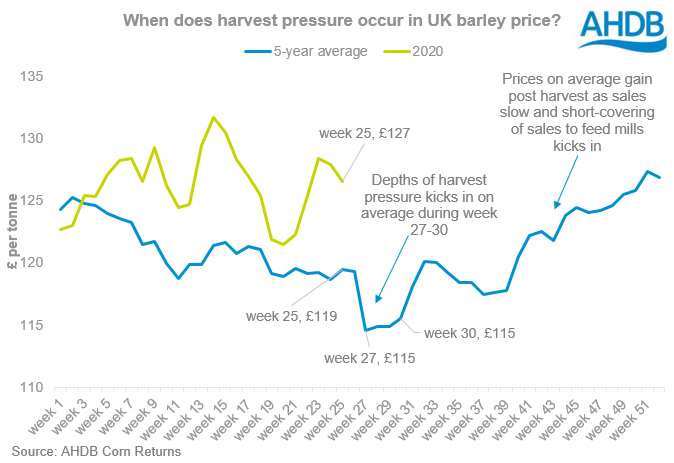

Looking at prices, we see on average most harvest pressure in weeks 27-30 of the calendar year, which is most of July. However, due to the smaller winter barley crop expected this year, the early movement of barley to ports and stores could not lead to much pressure. We’re more likely to see a second wave of harvest pressure from weeks 30-35 through August from the vastly larger spring crop.

We know that large volumes of export business have already been sold for harvest positions, from sales made earlier in the year. Despite these existing sales, spot harvest movement could still see price pressure later than normal due to the much larger spring crop.

Looking forward, once harvest is over, prices generally start to increase as farmer selling slows and those who have sold barley forward come into the market to cover their positions. The 5-year average UK ex-farm barley price rises 7.6% through the Oct-Dec period.

Although yields are uncertain, there will be another significant barley crop this year. Prices may see pressure later in harvest from the spring crop, and then may gain slightly as farmer selling slows. But the need to export to the EU, and then to third country markets means UK barley will remain pressured well into 2021.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.