What’s influencing global soyabean prices? Grain market daily

Wednesday, 7 August 2024

Market commentary

- Nov-24 UK feed wheat futures fell £0.30/t yesterday to settle at £191.75/t. The May-25 contract lost £0.45/t to close at £202.90/t over the same period.

- UK feed wheat did not track global wheat markets as both Chicago wheat and Paris milling wheat futures gained yesterday. The global rise in futures was mainly driven by a tender from Egypt for 3.8 Mt tons to cover imports between October 2024 and April 2025.

- Nov-24 Paris rapeseed futures settled at €449.75/t yesterday, down €4.00/t from Monday’s close. The May-25 contract lost €3.75/t over the same period to close at €452.25/t.

- Rapeseed prices followed the wider oilseeds complex down yesterday. Specifically, soybeans futures have continued to trend downwards on low demand and favourable weather conditions in the US. More details on this below.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

What’s influencing global soyabean prices?

Global soyabean futures have trended downwards recently, and pressure has at times filtered through to the wider oilseeds complex, including rapeseed. It’s therefore important to explore some of the key factors driving the price trend. In the short-term, improved US weather has benefitted the supply outlook, and longer-term lacklustre demand and plentiful supplies could weigh on prices further.

Improved US weather

In the last couple of weeks, as the crop progresses through its key development stage, we have seen welcomed rain in the US easing concerns over soyabean yields which were initially under pressure from hot and dry conditions. On Monday, the USDA’s crop progress report showed a slight uptick (1 percentage point) in the proportion of the crop rated good or excellent compared to last week.

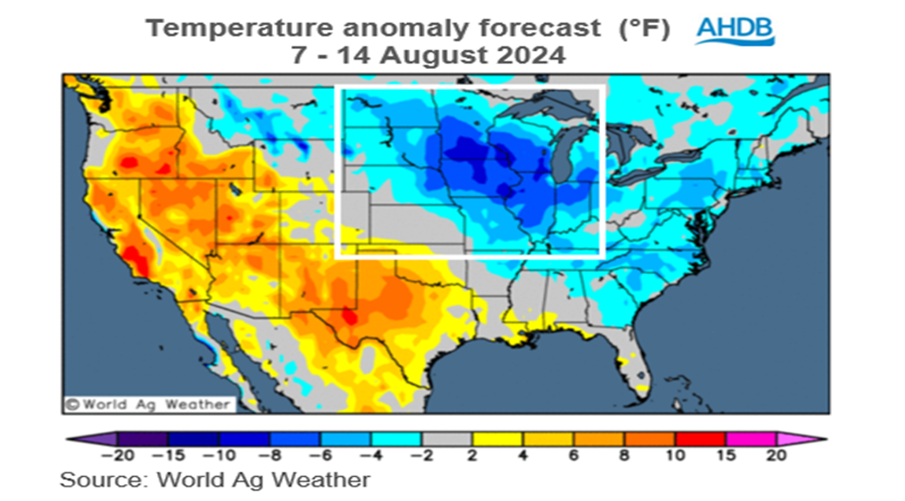

The weather forecast in the next seven days suggests cooler-than-normal temperature in the key soyabeans producing areas in the US. This is favourable to crop yield and could boost overall output.

Weak global demand

Another bearish factor is concerns over demand from the biofuel industry. In the US, soyabean processors have come under pressure from the shift in demand by biofuel producers to cheaper alternatives such as used Chinese cooking oil.

The National Oilseed Processors Association (NOPA) reported a 4.4% decline in soyabeans crushed in the US in June compared to May. This fell below market expectation, though is still historically high due to the expansion of plants and building of new facilities over recent years.

Recent concerns about weakening of the US economy and slowing economic growth in China are also important indicators to watch for consumer purchasing trends.

An oversupplied market

The forecast of a larger global soyabean crop this year has also been a key factor keeping prices lower. The USDA expects soyabean production by major exporters (incl. Argentina, Brazil, Paraguay and the US) to reach 351.4 Mt in the 2024/25 marketing year, surpassing the previous five-year average of 306.9 Mt. Meanwhile, ending stocks are forecast to reach 76.3 Mt compared to the previous five-year average of 61.6 Mt.

What does this mean for the UK rapeseed market?

Rapeseed futures have historically tracked movements in the global soyabean market. Therefore, as weather conditions in the US improve in the coming days, we could see some pressure weigh on rapeseed. Longer-term, heavy supplies will likely limit any price support too.

However, the current crisis in the Middle East is something to watch as it could affect crude oil production and lend some support to the vegetable oils market. Additionally, with lower rapeseed output from Europe and Australia, it could be that rapeseed extends its premium over soyabeans further.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.