Wet soils persist for key European grain producers: Grain market daily

Thursday, 29 February 2024

Market commentary

- UK feed wheat futures (May-24) closed at £165.00/t yesterday, down slightly by £1.40/t from Tuesdays’ close. The Nov-24 contract also fell by £1.80/t over the same period, ending yesterday’s session at £182.30/t.

- UK wheat futures followed the EU and US wheat markets yesterday, dropping slightly. Argentina’s maize crop condition rating is up from last week as rainfall has favoured crops in key producing regions. In addition, competitive Black Sea prices continue to pressure grain markets with plentiful supply reaching the market. Ukraine’s grain exports so far in February (1-27) have exceeded the same period last year by 12% (Ag Ministry).

- Paris rapeseed futures (May-24) remained unchanged yesterday, closing at €415.00/t. New crop futures (Nov-24) were up €1.00/t over the same period, ending the session at €421.50/t.

- Paris rapeseed futures saw no change to the old crop price, but a rise in the new crop price. Once again reductions have been made to Brazil’s soybean harvest forecasts, this time by the Brazilian trade association Abiove, supporting global prices with a reduced supply. However, gains were limited by the ongoing Brazilian harvest bringing fresh supplies to the market.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

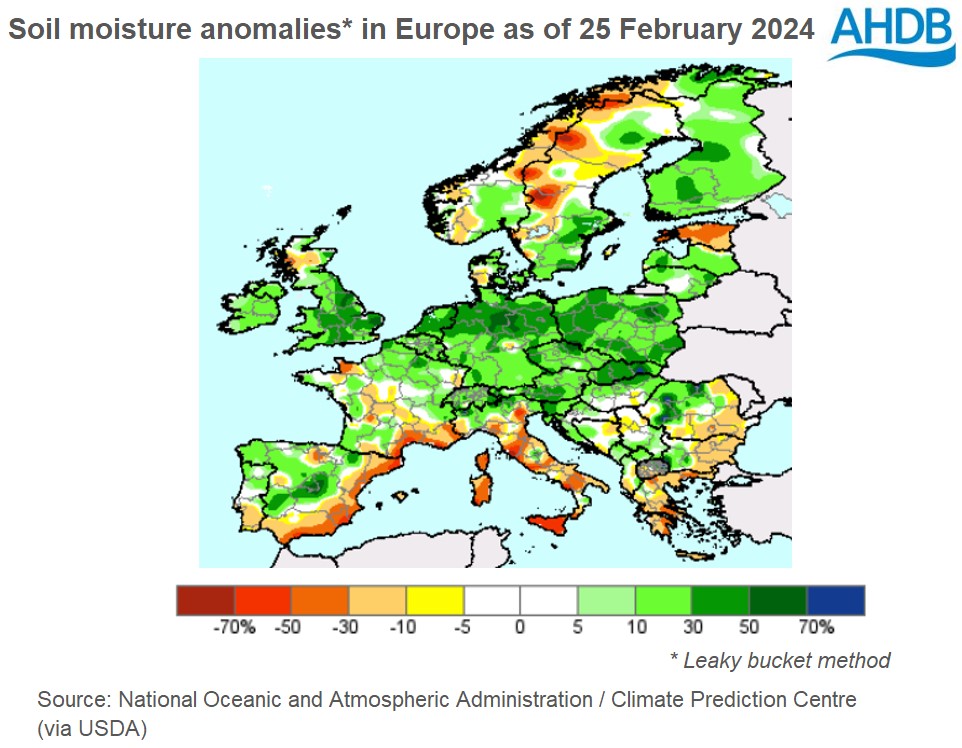

Wet soils persist for key European grain producers

Through February, large areas in key grain producing countries in Europe have continued to receive above-average rainfall keeping soils wet. These include parts of the EU-27’s second, third and fourth largest wheat growers Germany, Poland and Romania. Conditions also remain wetter than usual for the Scandinavian countries and Finland, along with parts of northeastern France.

As we know only too well this winter, wet soils are challenging for winter crops and make preparations for spring planting difficult.

Initial projections suggest the EU-27 wheat crop is likely to shrink in 2024; Stratégie Grains projects a year-on-year fall of 2.5% to 122.6 Mt. Meanwhile, a rise in barley output is also projected as yields recover from 2023’s lower levels and spring plantings expand.

There are some signs a break in the weather is coming. World Ag Weather projects drier weather for the coming fortnight for many countries in the EU affected by the wet autumn and winter. In particular, drier weather is forecast for Germany, Finland and eastern Europe over the first two weeks of March.

How the weather progresses from here will be important to final cropped areas and yield potential. If the weather stays wet, current crop forecasts for wheat, and potentially barley could decline, while drier weather could support the current forecasts. If production in Europe does fall further, it could offer some support to prices relative to world levels and potentially more.

Drought in North Africa

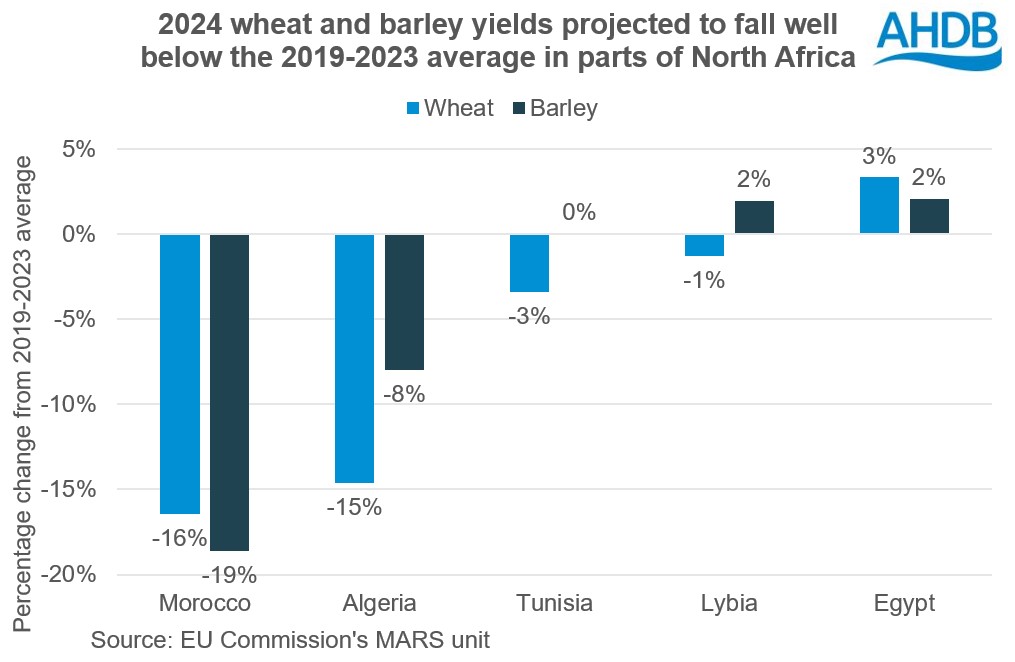

While northern Europe has received above normal rainfall, North Africa continues to struggle with drought. Planting of winter crops was delayed in Algeria, Tunisia and western Libya. While rain in December and January helped crops in parts of Algeria and Tunisia, the EU Commission’s MARS unit projects yields in Morrocco and Algeria to fall well below average in 2024. Prospects are more positive in Egypt.

With crops generally at late vegetive growth stages, the MARS unit reports limited possibilities for recovery. Often in years of lower production in the region, this leads to higher import requirements. This seems likely to be the case in 2024/25, and could present barley export opportunities for the UK, if our weather enables the intended larger spring barley area to be planted.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.