Weather uncertainty driving swings in UK futures: Grain Market Daily

Friday, 5 June 2020

Market commentary

- New crop UK, French and US wheat futures all lifted yesterday, as higher than normal temperatures are forecast for in parts of southern Russia and the US next week.

- Nov-20 UK feed wheat futures gained £3.35/t yesterday, closing at £171.75/t. Yesterday’s close is still below the start of the week, with sterling reaching a five-week high against the US dollar.

- As welcome rain arrived across Western Europe, French crop conditions were largely stable for cereals and improved for maize.

- The AHDB Spring Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops. Please help your industry to navigate these uncertain times by completing the planting survey form, click here to complete the form.

Weather uncertainty driving swings in UK futures

UK feed wheat futures prices have been variable over recent weeks, at least in part due to uncertainty over the impact of unfavourable weather on crops in Europe and the Black Sea region. The UK is on course for a small wheat crop this year and although our prices will be high relative to global levels to attract grain imports, they will still have to follow the global trend.

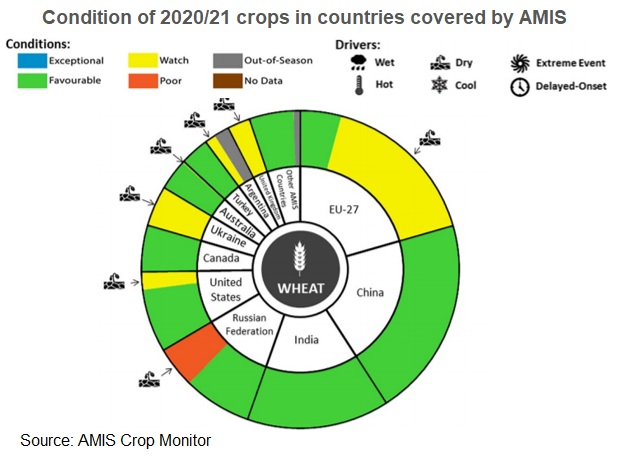

The AMIS Crop outlook highlights this uncertainty, with the large areas marked as ‘watch’ below. Crops are described as ‘watch’ when there is a risk to production but possibility for the crop to recover to average if climactic conditions improve. So given the development of winter crops, what happens in the next few weeks will be key to northern hemisphere wheat production.

Rainfall in the highlighted areas, especially in southern Ukraine, where its implied time is running out, will be key to yield potential. There may be further impacts in southern Russia, given the forecast for high temperatures this week. However, it’s important to note that conditions in the rest of Russia are still ‘generally favourable’.

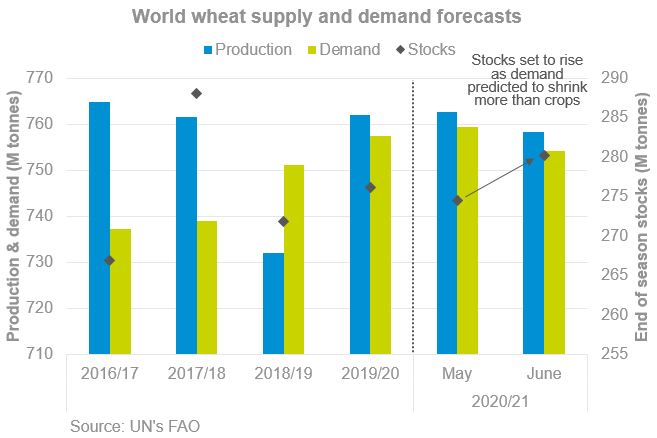

Based on the impacts already recorded, including the drought in southern Russia where crops are rated as ‘poor’ by AMIS, the UN cut its forecast of global 2020 wheat production by 4.3Mt, to 758.3Mt. This would put the crop nearly 4.0Mt smaller than in 2019/20, but still well above the 2018/19 crop. Furthermore, larger cuts to industrial and feed demand for wheat have so far offset the lower production number, with global stocks up as a result.

So what next?

Variability in UK prices is set to continue through the coming weeks as market participants try to work out what the changing weather conditions mean for yields.

An equally important factor for domestic prices is changes in exchange rates as markets process information about the impact of the coronavirus pandemic on different economies and this is unlikely to be resolved anytime soon.

Also, the future of the UK’s trading relationship with the EU will need to become clearer this month. The transition period that we’re currently in will run out at the end of this year, unless the UK requests an extension by 30 June. Developments in Brexit negotiations will affect both currency and physical trade.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.