Weather conditions fare well in Europe: grain market daily

Tuesday, 26 January 2021

Market commentary

- UK wheat futures (May-21) closed yesterday at £206.85/t, up £1.85/t on Friday’s close. While new crop futures (Nov-21) gained £2.65/t, to close at £165.20/t.

- Support in global wheat markets at the moment is from hopeful U.S. export prospects as Russian exports decrease and the EU have limited export supplies.

- The Russian government has formally approved the increased export tax on wheat, which will commence on March 1. This will increase to €50.00/t from the €25.00/t tax, which will start in February.

Weather conditions fare well in Europe

Current weather in Europe can drive the continental market, which will influence our domestic price.

If UK growing conditions fare well over spring, the UK will likely need to export wheat next season. This means our new crop prices will have to continue to trade at a discount to Paris milling wheat futures, in order to create export trade.

Therefore, it is critical to have an insight into what conditions are like in Europe. Their production will influence the price against which we will have to compete.

Weather conditions in Europe

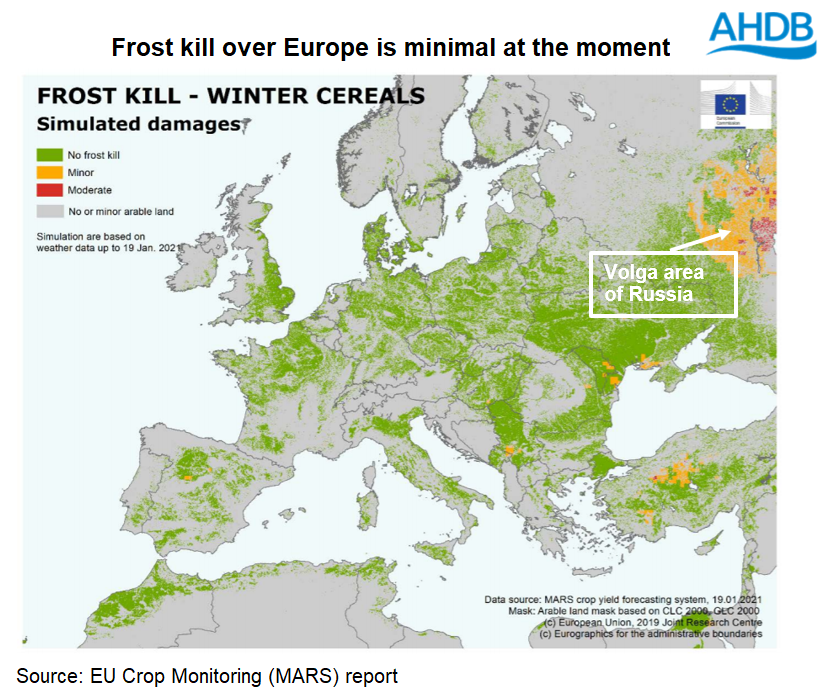

The latest European crop monitoring (MARS) report suggests that temperatures (From 1 December to 18 January) were warmer-than-usual in large parts of South-Eastern Europe. As a result, frost tolerance remains weaker in these areas.

There were cold spells in the UK, Ireland, Iberian Peninsula and Western France. The number of cold days (days that are < 0 °C) in these regions were substantially higher than usual.

As Storm Filomena hit Spain at the beginning of January, there were large area of the country covered in snow. This cold spell meant that there was a small amount of localised frost damage.

There were also further reports of damage in the Volga area of Russia, Northern Romania, the central Balkans and North Western Turkey.

Why does this matter?

Within the report, the long-range weather forecast suggests the coming months are likely to be warmer than usual for most of Europe.

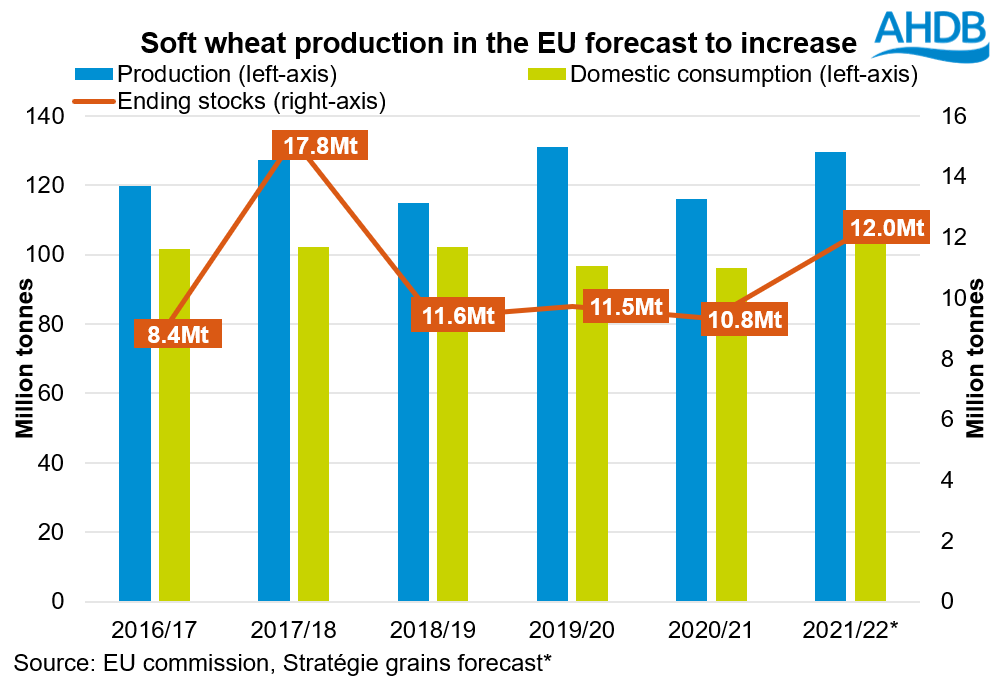

The warmer weather will bring less winter kill, and assist growing throughout spring, which could increase the production of wheat in Europe.

It is paramount to keep monitoring these conditions. Stratégie Grains currently predict EU-27 soft wheat production for next year at 129.7Mt, but exports are expected to decrease 2% year-on-year. As a result, EU wheat stocks are forecast to increase this season.

If Russia impose a floating export tax next year and constrain supply, we could see many net importers turn to the EU for additional supplies. An increase in EU exports could reduce the amount of stock build up and offer some support to EU prices.

As mentioned at the beginning, EU production will contribute to the benchmark which our domestic grain will price off.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.