WASDE – a first look at 2022/23 world ending stocks: Grain market daily

Wednesday, 11 May 2022

Market commentary

- Nearby (May-22) UK feed wheat futures jumped £8.20/t yesterday, closing at another contract high of £343.50/t. Nov-22 UK futures followed suit, ending yesterday’s session at a contract high of £320.00/t, a rise of £1.95/t on the day. Support from Paris wheat prices was felt, as dry weather continues to increase yield potential concerns in the European crop.

- A little relief was felt to global wheat supply in April, with India reporting a record 1.4Mt of wheat exports during the month. However, recent downgrades to Indian production my cap this pace going forwards.

- Paris rapeseed prices also jumped. The Nov-22 contract rose €4.25/t on the day, closing at €836.00/t.

WASDE – a first look at 2022/23 world ending stocks

Tomorrow, the USDA releases it’s latest World Agricultural Supply and Demand Estimates (WASDE) report. It is in the May report that the USDA give their first view on world ending stocks for 2022/23, as well as an updated outlook on ending stocks for the current season (2021/22). But what do the trade expect to see?

Wheat

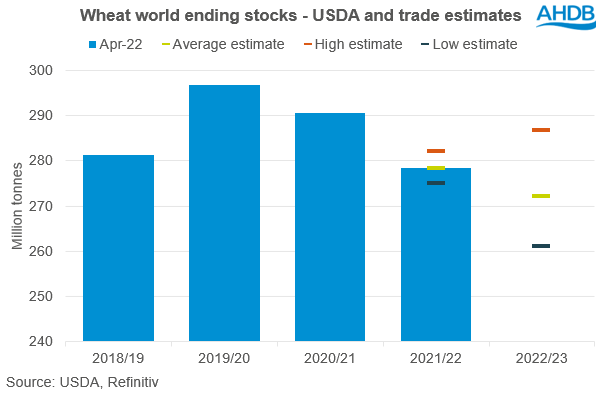

In April, the USDA forecast world ending stocks (including China) of wheat for the current season at 278.42Mt. This figure would have already reflected the war in Ukraine, and the challenged condition of the US crop after winter emergence. Since then, detrimental weather conditions are being felt in other key global wheat producers. India’s wheat crop has been downgraded to 105Mt this season, following March’s heat and drought. French wheat is needing rain, with the French agricultural ministry stating on Monday that dry weather will have a negative impact on production due to its effect on yield. Taking these factors into consideration, trade estimates are expecting wheat ending stocks for 2021/22 to be trimmed slightly, to 278.30Mt. These would be the tightest ending stocks since 2016/17.

Looking forwards to 2022/23, a further tightening of wheat ending stocks is expected, the forecasts averaging at 272.07Mt. Analysts are expecting the USDA to factor in high input costs and the ongoing Ukraine war significantly impacting global production, in conjunction with global weather impacts.

Maize

The USDA’s projections for maize are expected to follow a similar pattern to wheat. The April 2022 estimate of 305.46Mt is expected to be trimmed to 303.76Mt.

The outlook for 2022/23 ending stocks is even tighter. Slow planting in the US, high input costs globally and dry weather potentially affecting the yield potential of the Brazilian safrinha crop are all playing into this challenge. This is in addition to a sharp decrease in Ukrainian planted area due to the conflict. The first 2022/23 world ending stocks projection is pegged at 296.91Mt, which would be only the second time since 2014/15 ending stocks have fallen to under 300Mt (292.15Mt in 2020/21).

Soyabeans

World ending stocks for soyabeans are also expected to be reduced. April’s estimate of 89.58Mt is estimated to be revised down to 88.98Mt. Increased demand, with challenges in supply of other oilseeds, are expected to draw this figure down. In addition, Brazilian production is expected to be trimmed from April’s 125Mt. The latest figures from Conab pegged Brazilian production for 2021/22 at 122.43Mt.

However, the situation could look more balanced for 2022/23. A rebound is expected in stocks, with area increases in global exporters. The US area is up, and if margins remain, an increase could be seen in Brazilian soyabean area at the end of the year.

So what might this mean for the UK?

The market reaction to tomorrow’s WASDE report could well have an impact on global prices if USDA projections fall outside of these estimates. With the UK market tracking global prices so closely, these movements will be felt in UK prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.