Volatility in pork export prices varies globally

Tuesday, 1 September 2020

By Bethan Wilkins

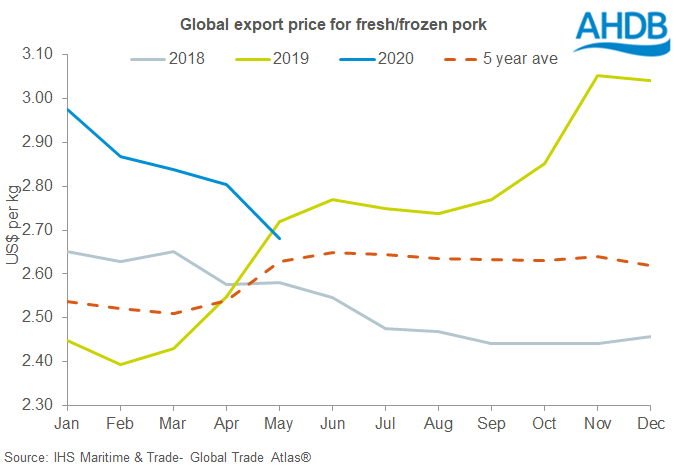

Calculating an average global pig price is virtually impossible, as producer prices are quoted on a different basis in different countries. However, the export price for fresh and frozen pork offers a good indication of overall trends.

Based on figures from the four leading global exporters, the EU, US, Brazil and Canada, prices have been volatile since Autumn 2019. Having peaked at over US$3.00/kg at the end of last year, the average price was back to $2.68/kg by May.

Despite the recent peak, prices have remained below the record levels recorded in 2014, when the average exceeded $3.50/kg. This was during the PEDv outbreaks in the US and Asia. The Chinese yuan is also weaker against the dollar than in 2014, limiting export prices to this key importer in dollar terms.

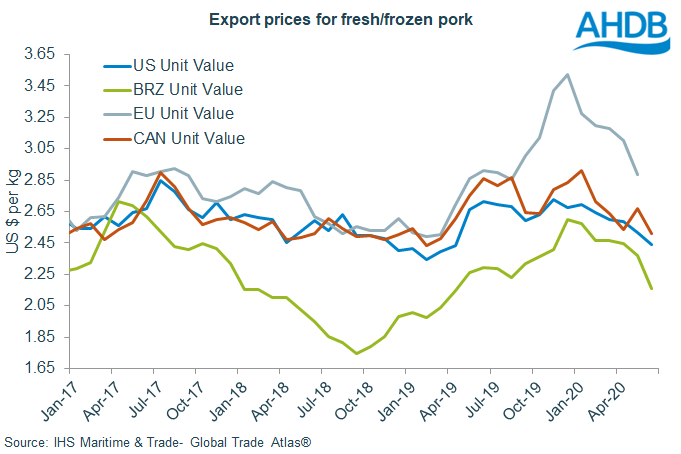

The extent of price volatility has been mixed between the individual exporters. Prices for US, EU and Canadian exports were relatively similar up to mid-2019, but have since diverged, with EU exports priced significantly higher than those from elsewhere.

EU prices ended 2019 averaging $3.52/kg, but decreased by 18% by May. US prices have been more stable, albeit at a consistently lower level. Canadian pork has been similar to US product, but did experience a stronger peak of US$2.91/kg in January. Brazilian prices have remained the lowest of the key exporters, and have recently experienced a sharp fall (-9% from the end of 2019).

The differing levels of price volatility reflect the differing markets’ fortunes regarding opportunities to export to China and reaction to the coronavirus pandemic. EU exporters were well-placed to capitalise on strong Chinese demand at the end of last year, with US and Canadian access hindered by market access challenges (US pork faced additional tariffs and Canadian pork was banned for the second half of last year). This generated a large premium for EU product as well as increasing demand for Brazilian pork, which also saw relatively strong price growth.

This year though, the value of EU pork has been knocked by falling domestic demand due to the coronavirus pandemic. The supply-demand balance in Europe has distinctly tipped towards extra supply. However, the situation in the US and Canada is less clear-cut, at least at wholesale level. Supply chain disruption has limited the supply of pork meat, and export relations to China have also improved. Hence, the change in market fortunes has been less dramatic in these nations.

Going forward, reports indicate Chinese orders are picking up in Europe, and foodservice has normalised a little in recent months. Nonetheless, with rival exporters in a better position to supply China than last year, EU prices might not be expected to return to the previous highs.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.