USDA's WASDE reduces maize ending stocks: Grain Market Daily

Friday, 11 April 2025

Market commentary

- UK feed wheat futures (May-25) closed at £169.00/t yesterday, falling £3.50/t from Wednesday’s close. The Nov-25 contract fell £3.85/t over the same period, to close at £184.40/t. New crop futures prices are now at a £15.40/t premium to old crop.

- UK feed wheat futures closed lower yesterday influenced by the global wheat market. Chicago wheat and Paris milling wheat futures May-25 were down 0.8% and 1.5% respectively. Currency volatility impacts the grains and oilseeds market. The strengthening of the euro against the US dollar put pressure on Paris futures, but supported Chicago futures.

- Paris rapeseed futures (May-25) closed at €512.00/t yesterday, up €4.25/t from Wednesday’s close. The Nov-25 contract gained €3.75/t over the same period, to close at €473.00/t.

- Chicago soyabean and Winnipeg canola futures May-25 were up 1.6% and 0.4% respectively. Chicago soyabean futures are back above the strong support level at $10/bshl. this week.

USDA's WASDE reduces maize ending stocks

This week has seen a lot of important information flow that has an impact on grain and oilseed prices. At the start of the week, we had information on the US tariffs and other countries' reaction to them, following the release of the USDA Export Sales and WASDE reports on Thursday.

As had been speculated by market participants, the US Export Sales report showed lower volumes compared to the previous week due to the impact of tariff concerns.

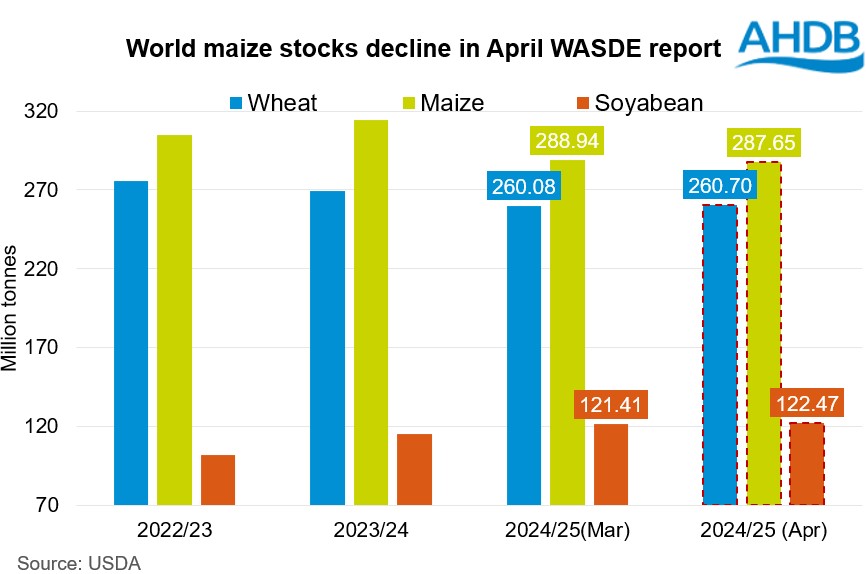

Yesterday’s World Agricultural Supply and Demand Estimates (WASDE) report provided information that supported Chicago maize futures prices, particularly for the old crop. Updated world maize ending stocks for the 2024/25 season are 287.7 Mt, down 1.3 Mt compared from the March report and below average trade estimates. The US maize ending stocks are 1.9 Mt lower than in the March report.

It's important to remember that global maize ending stocks are at their lowest levels in recent years, providing fundamental support for the old crop feed grain complex.

The USDA report leaves maize production unchanged for Argentina and Brazil. Conab estimates the Brazilian maize crop at around 124.7 Mt, including 97.89 Mt of second crop, up 1.98 Mt from the previous forecast (USDA 126 Mt). The Rosario Grains Exchange raised its own estimate for Argentina’s 2024/25 maize crop by 4 Mt to 48.5 Mt (USDA 50 Mt). Newly updated production data in Brazil and Argentina do not surprise the market for now.

Looking ahead

Ahead of the USDA's May WASDE report, which will provide the first estimates of the 2025/26 global balance, the focus will be on the April figures, particularly ending stocks, which could have an impact on the new season's grains and oilseeds balance.

The volatility of global grain and oilseed prices has had an impact on the domestic market, and the price difference between new and old crops is an important factor in decisions to buy or sell crops.

Global economic concerns are growing, resulting in currency fluctuations that are affecting global grain and oilseed prices. Next week, the European Central Bank (ECB) will announce its interest rate decision on Thursday 17 April.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.