US pig prices suffering, despite strong pork exports

Wednesday, 12 August 2020

An estimated 2 million pigs hogs are still backed up on farms in the US, according to analysis by Steve Meyer, an economist with Kerns & Associates. The US’ National Pork Producers Council is warning that if more disruption occurs at processing plants in the coming weeks or months due to Covid-19 worker infections, then “the number of hogs backed up on farms will swell precipitously.”

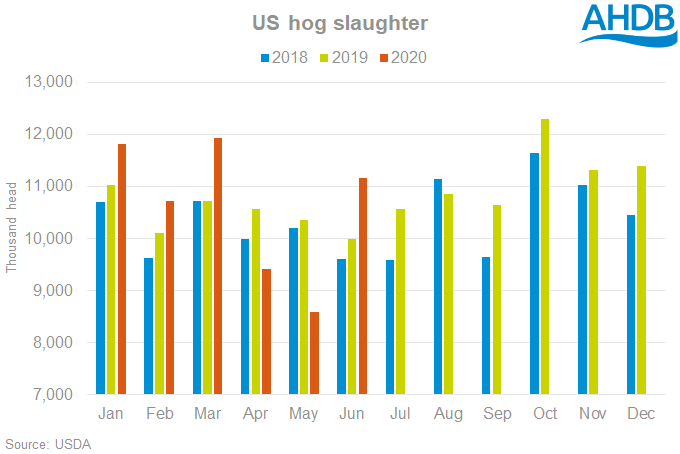

According to the USDA, 63.66 million pigs have been slaughtered in the first six months of the year, compared with 62.80 million during the same period in 2020. This includes over 180,000 more sows, which could inhibit further growth in the coming years. Although, reports indicate that at least some of these “sows” may be oversized finished pigs.

The US pork industry has been growing strongly in recent years, in terms of both supply and slaughter capacity. But, although more pigs have been slaughtered so far this year, even more have been available to kill. Meyer said in an interview this week that the US pork industry has slaughtered about 1.1 million more pigs from 1 June to mid-July than it would have without Covid-19. The industry has rebounded sharply, but is still recovering from the interruptions.

US exports of fresh and frozen pork have been strong over the first six months of 2020, increasing by 35% year on year to 1.24 million tonnes. Exports to China have increased more than threefold to nearly 450 thousand tonnes, and account for the export growth. Even more so in recent months, as exports to Japan and Mexico have fallen.

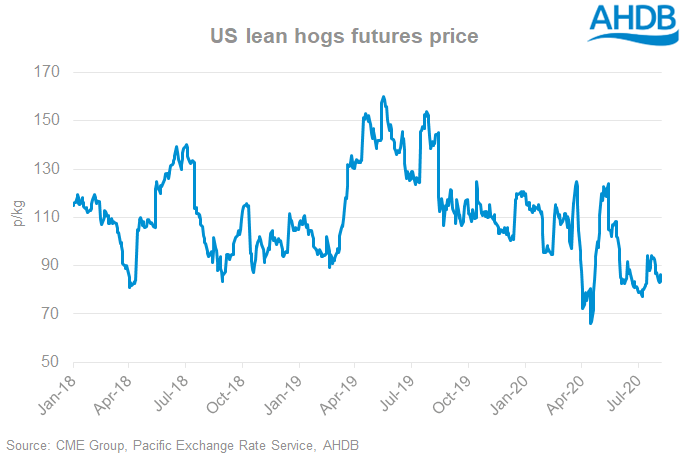

However, while slaughter capacity in US processing plants has recovered significantly since the spring when as much as 40% was offline, it is thought that the industry “is still hovering around 5% idle capacity,” and that “that loss is more or less permanent.” Meyer expects the backlog of pigs to expand to as much as 1.6 million by the end of August and to 2.5 million by the end of the year. None of this is positive for pig prices, which have been under pressure for some months.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.