US maize harvest progress review: Grain Market Daily

Wednesday, 30 September 2020

Market Commentary

- London Nov-20 wheat futures closed last night at £180.20/t, a loss of £1.60/t from the previous close. However, it still maintained a premium over May-21 of £0.70/t.

- London new crop (Nov-21) futures firmed yesterday to close £154.15/t, and increased of £0.55/t from the previous close but still below Friday’s close of £155/t.

- This morning, the Russian agricultural ministry increased its harvest 2020 grain crop to more than 125 million tonnes, including no less than 82 million tonnes of wheat. This is an increase of 7Mt of wheat from their last estimate of 75Mt.

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

US maize harvest progress review

The latest US crop progress report for the week ending 27 September has shown good harvest progression for maize.

The maize crop is currently 15% harvested, just 1% lower than the 5-year average of 16%. This is up from 8% last week and also above the 10% harvested this time last year.

The crop conditions have not changed week on week and currently stand at 14% poor to very poor, 25% fair and 61% good to excellent, slightly better than this time last year when 57% of the crop was rated good to excellent.

There have been few early yield reports so far, but in the latest USDA WASDE report, yield predictions were cut from 12.23t/ha to 12.00t/ha. Total area harvested was also cut by 0.5 million acres to 83.5 million acres. The recent storm in the Mid-Western corn belt, coupled with drought in the West have pressured the crop.

However, while this may tighten supply slightly, the US is still set to reach a production figure of 378.47 million tonnes, the largest since 2016. In the face of this increased supply, the September WASDE also predicted 100 million fewer bushels used in bioethanol due to the knock-on effects of coronavirus. While this was offset by an increase in forecasted exports, the demand shifts had little impact on the increasing stocks figure expected from the WASDE.

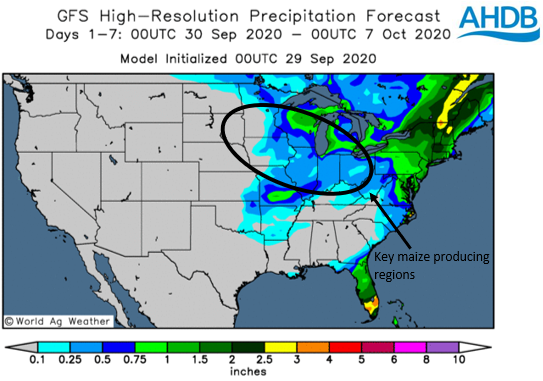

As we can see below, there is some rainfall forecast in the main maize producing areas in the coming week that may slow harvest progress, but aside from this, there don’t seem to be any other major weather concerns on the horizon for the rest of the maize harvest.

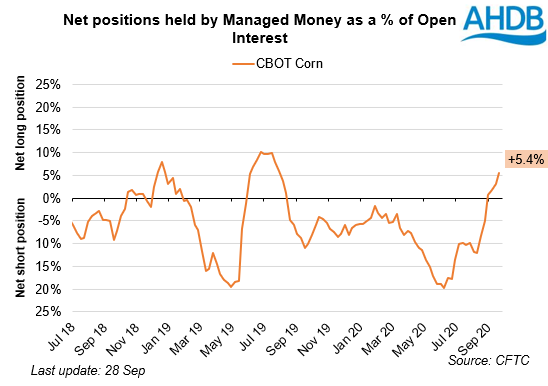

Chicago Dec-20 maize prices had rallied through August and most of September due to the storm mentioned above. These weather concerns lead to Managed Money funds moving from a net short of roughly 10% to a net long of over 5% and will have helped accelerate the price rally. As these weather concerns eased, prices have started to weaken and from last Monday (21 September), continued to decline throughout the week. They firmed slightly on Friday and Monday but not enough to regain Thursday’s loses. Last night’s close was $143.90/t, a loss of $5.42/t since the close on Friday 18 September.

While the latest crop progress report is unlikely to have a large impact on prices in the short term it will help contribute to overall market sentiment. As the US harvest continues over the next 4 to 6 weeks and approaches completion it will pretty much set the northern hemisphere market fundamentals, and with no fresh news to feed the bull run this may be the end of the maize price rally in the short to mid-term.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.