US maize crop falls further behind amid cold weather: Grain Market Daily

Wednesday, 16 October 2019

Market Commentary

- Feed wheat futures (Nov-19) fell £1.90/t from Monday to close at £133.60/t, sterling rose 1% against the euro over the day.

- With trade seeing limited new purchases for October, we were again unable to publish a FOB price yesterday. The potential implementation of tariffs in the event of a no-deal Brexit have meant ports are currently ‘near to full’ for export schedules before the impending deadline.

- Chicago maize futures (Dec-19) declined $1.77/t yesterday from Monday to be at $154.82/t as fresh concerns arise over the current US-China trade war.

US maize crop falls further behind amid cold weather

The latest USDA crop progress report was released yesterday. US maize harvest progress was slower than pre-report market polls anticipated. In addition, maturity figures highlight 2019’s US maize crop remains the slowest maturing crop on digital record. The figures provide some insight into the potential scale of damage that may have been caused by the early heavy snowstorms affecting the upper Mid-Western states at critical maize growth stages.

The update has slowed declines seen in US maize nearby futures this week, caused by the latest twists in the US-China trade dispute. Initial reports suggest further negotiations are now needed between the two countries to complete the ‘phase-one deal’.

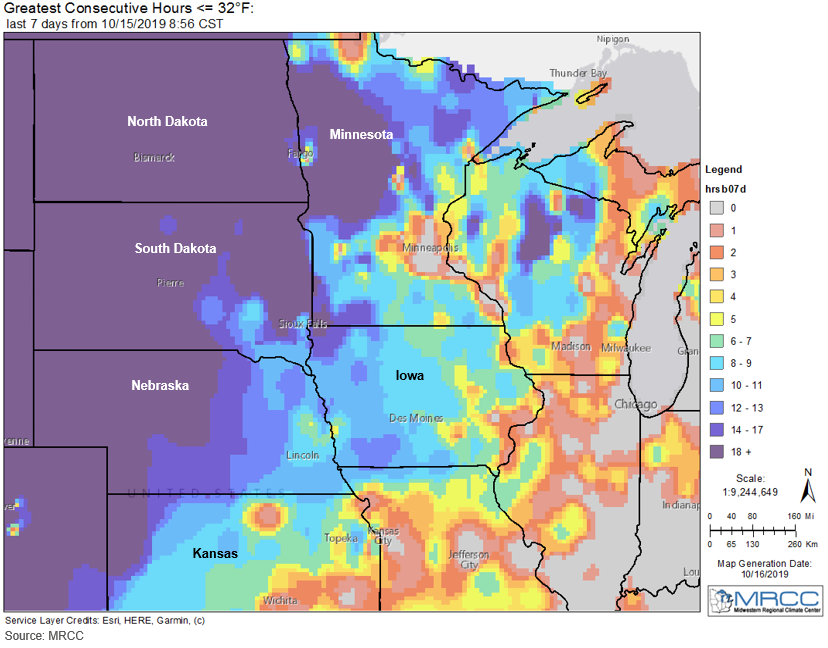

US maize harvest progress was at 22% as of we 13 October, behind the five-year average of 36%. Harvest pace could further fall behind with Northern corn-belt farmers reportedly struggling to access snow-laden fields.

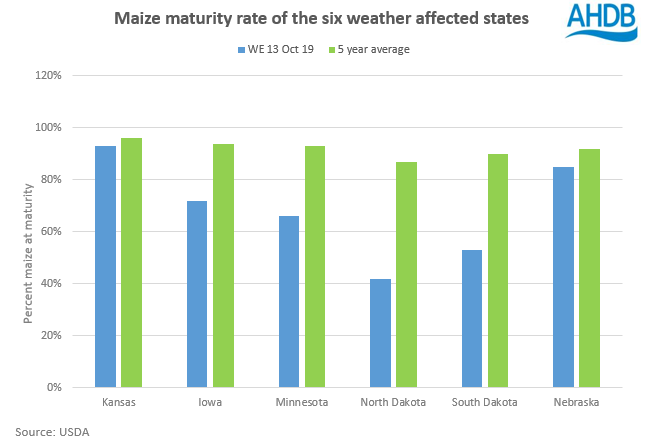

The largest corn area states affected are Kansas, Iowa, Minnesota, Nebraska and the Dakota’s. Immature maize in these regions is at the most risk of damage from freezing temperatures. Unharvested mature crops in these states average 69%, below the five-year average of 92%.

Examining the potentially worst affected state, North Dakota, the forecast maize area for grain is 1.396Mha, of which 1% is harvested as of we 13 October (11 percentage points behind the five-year average). This leaves 1.386Mha unharvested. In addition, the maturity rate is 45 percentage points behind the five-year average, at 42% mature, i.e. ready for harvest. South Dakota is also significantly lagging behind, back 37 percentage points on the five-year average at 53% mature.

Should weather conditions not improve, and continue to impact harvest pace and maturity rates, we may see an upturn in US maize futures as the markets price in the impact of the cold conditions.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.