US harvest pressure weighs on prices: Grain market daily

Tuesday, 21 September 2021

Market commentary

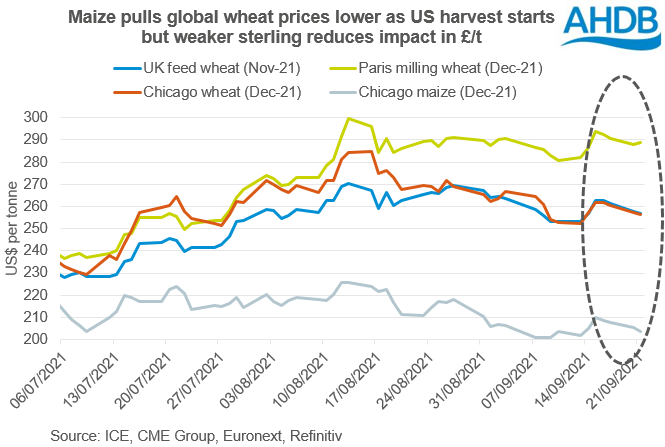

- Most global grain and oilseed futures contracts fell yesterday. This followed a fall in crude oil prices, the advancing US harvests and a stronger US dollar. Data showing the ongoing impact of damage from Hurricane Ida on US exports and selling by speculative traders were also factors.

- Nov-21 UK feed wheat futures fell £1.50/t to £188.80/t, but Nov-22 prices gained slightly (£0.20/t) to £178.25/t.

- For Paris rapeseed futures, the Nov-21 contract fell €1.50/t to €599.25/t or approx. £514/t. The Nov-22 fell €2.25/t to €488.75/t, approx. £419/t.

- The EU’s crop monitoring (MARS) report showed mixed planting conditions for 2022 winter rapeseed crops. Wet weather caused delays in some parts of Germany, and the UK, but planting got off to a good start in Hungary and Ukraine.

US harvest pressure weighs on prices

The advancing US maize and soyabean harvests contributed to the fall in global grain and oilseed prices late last week and yesterday. There’s still uncertainty about yields, but clarity is now close. This is likely to be pulling some risk premium out of the market in the short term.

Longer-term, the outlook is still very uncertain, with low grain and oilseeds stocks. Also, the possibility of another La Niña weather event casts uncertainty over South American crop potential. But, the market will still ‘feel’ more secure for a little while, now the US crop is entering sheds and silos.

The US maize harvest reached 10% complete by 19 September, compared to 9% on average (USDA). The soyabean harvest is also underway with 6% cut, in line with the five-year average.

Currently, the US sentiment is the driving factor for markets. But, from a European perspective, grain supplies might be tighter than previously thought. The MARS report cut its yield forecasts for EU-27 maize yesterday. If confirmed by harvest, European grain prices might not feel the full influence of US prices.

Conditions for crops in western and central Europe remain positive. This includes major European producers France, Germany and Poland. However, hot, dry conditions in southern Europe, including Romania, dented yield potential. The EU-27 maize yield forecast is now 7.78t/ha by MARS. This is only just above the 5 year average of 7.75t/ha and slightly below the EU Commission’s estimate at the end of August.

Ukraine’s maize, sunflower and soyabean harvests are also in the early stages (UkrAgroConsult). Maize and soyabean yields will be above average according to the EU crop monitoring (MARS). If high Ukrainian maize yields are confirmed, this could also add short term pressure to prices.

Ukrainian sunflower yields are not expected to fare quite as well due to the heatwave in July, but still be above average. There is also some concern that the heat might have reduced oil contents. The final sunflower seed crop size in Ukraine, and globally, will affect rapeseed prices. Both these oilseeds have high oil contents and can have similar food uses, but different industrial uses.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.