Updated planting figures show wheat area at 1,504Kha: Grain Market Daily

Wednesday, 19 February 2020

Market Commentary

- UK feed wheat futures (May-20) continued their rise this week to close yesterday at £154.15/t, up £1.65/t from Monday. This rise extended to new crop UK wheat futures (Nov-20) which also increased by £1.65/t to £162.80/t. Global wheat markets have seen increases this week as Australia wheat harvest fell below its production forecasts, with some reports expecting further declines to the drought-affected crop.

- The Brazilian soyabean harvest was at 27.4% completed by the end of last week, according to Arc Mercosul. Whilst this is below last year’s harvest pace, it continues to track above the five year average with beneficial weather currently in most regions. US soyabean futures (nearby) have seen declines of $0.70/t from Friday to close yesterday at $327.66/t, as the Coronavirus outbreak continues to affect global demand.

Updated planting figures show wheat area at 1,504Kha

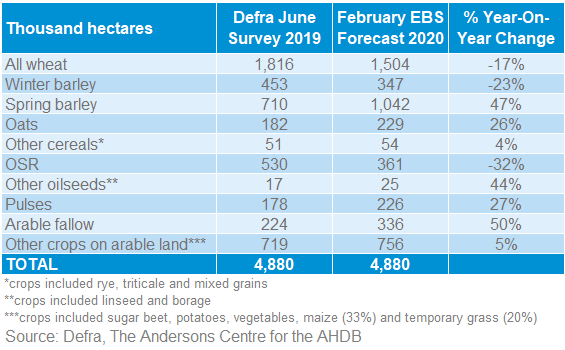

Today sees the release of the updated 2019/20 Early Bird Survey. This survey is reviewing the current position of planted area and what is still intended to be planted for harvest 2020. The main headlines are as follows:

- Wheat area seen at 1,504Kha (down 17% from 2019 June Survey)

- Winter Barley area at 347Kha (down 23% from 2019 June Survey)

- Spring Barley area at 1,042Kha (up 47% from 2019 June Survey)

- Oilseed Rape area at 361Kha (down 32% from 2019 June Survey)

- Oat area at 229Kha (up 26% from 2019 June Survey)

Winter or Spring Wheat?

In one of the biggest planting changes seen for many years, the area intended for spring wheat plantings has surged. Reports suggest large volumes of imported seed has come into the UK to supplement domestic supplies.

Spring wheat area intended is forecast at 200Kha, with only 2% planted so far. Given the weather that we have seen over the last two weeks. We must assume that these intentions are still flexible and will depend on soil conditions over the coming days and weeks.

For winter wheat, 93% of the intended area was planted as at February 14. The remaining winter wheat to be planted is most likely to be Skyfall, with planting dates to mid-March possible if conditions allow.

In total, UK growers still intended to plant 287Kha of both winter and spring wheat varieties at February 14th. Whilst spring is only just around the corner, the intentions of growers and final planting area will still be dominated by the weather and if soil conditions dry sufficiently to allow for drilling to recommence.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.