Ukrainian maize situation for UK feed markets next season: Grain Market Daily

Wednesday, 16 June 2021

Market Commentary

- UK new-crop feed wheat futures continued their decline and fell £2.45/t to £170.70/t yesterday. The drop was echoed in May-22 futures which dropped £2.05 to £176.05/t.

- Germany’s wheat crop next season is forecast to rise 3.8% to 22.98Mt, owing to beneficial weather of late. The German winter rapeseed crop is forecast up 4.6% to 3.67Mt. Both forecasts are from the German Association of Farm Co-operatives.

- China’s pig producers have been urged to maintain production levels despite prices falling below cost of production levels. Live hog prices in China have dropped 60% since the start of the year. Should prices keep falling, farmers could cut herd sizes with a potential impact on feed demand. (Refinitiv)

Ukrainian maize situation for UK feed markets next season

Black Sea maize is a common sight in UK import programmes, especially in tight supply seasons. With maize markets enjoying a high-price season, will this carry on to new-crop and reduce the pressure that more “typical” maize prices have had on feed markets?

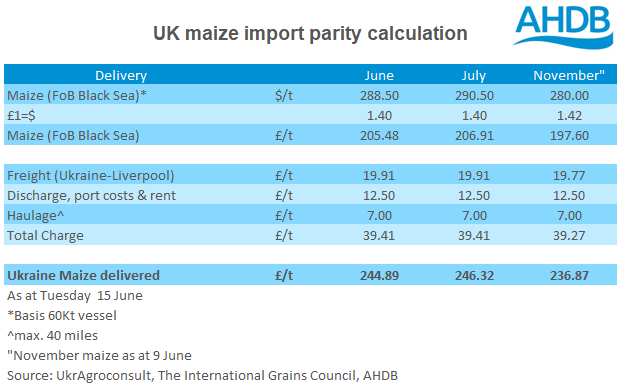

Forward FOB prices for Black Sea maize were quoted at $280.00/t (£198.42/t) for Oct – Nov shipment as of 09 June. Though a forward price, this does set a high ‘price floor’ for domestic feed prices to potentially base off. For context, feed wheat delivered into East Anglia was quoted at £175.00/t for November delivery as at 10 June.

Forecasts for the Ukrainian maize crop sit at 37.50Mt, 22% above the 5-year average, according to the USDA. Of this, 30.50Mt is signposted as an export figure, 25% above the five-year average. If realised, this could be a bumper year for the Ukrainian maize crop.

Due to an initial setback to the planting campaign, it is estimated maize crop development is 25-35% behind last season, according to UkrAgroConsult. Weather forecasts as always will be a key watch point to determine if crop yields have been affected.

The Ukrainian Grain Association recently signed a memorandum with China for ‘co-operation and agricultural development’. This positive relationship is a likely factor in increased Chinese imports of Ukrainian grain. Ukrainian maize shipments to China for Oct-April were at 7.34Mt, significantly higher than the 5.5Mt shipped for the entire 2019/20 marketing year.

Increased Chinese maize demand will likely account for a larger proportion of Ukraine’s maize exports, especially with the recent memorandum enhancing the relationship between the two countries.

From a UK perspective, this could be somewhat beneficial for grain prices, but perhaps less so for feed purchasers. Reduced UK imports of Ukrainian maize could lend support for new-crop barley prices, but only if other options are tight. With wheat making a return to feed rations next season, barley and imported maize demand could waiver should there not be the price incentive to maintain inclusion.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.