UK wheat imports continue at strong pace: Grain market daily

Wednesday, 15 May 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £218.00/t yesterday, down £7.00/t from Monday’s close

- More favourable weather forecasted in Russia has reduced concerns regarding crop production losses. In southern Russia, where there had been abnormal dryness, rains are forecast in the upcoming week. Also, in central Russia, where the wheat crop had been under pressure from frost, warmer temperatures have been forecast. Furthermore, US wheat crop condition scores remain at a four-year high, also weighing on global wheat markets

- Paris rapeseed futures (Nov-24) closed at €485.00/t yesterday, down €7.00/t from Monday’s close

- Last Friday, there had been speculation that imports of used cooking oil from China into the US could become subject to increased tariffs. Upon release of the tariff increases yesterday, the list did not include Chinese used cooking oil, which weighed on the vegetable oils complex. Furthermore, Conab increased the Brazilian soyabean production estimate yesterday by 1.16 Mt to 147.7 Mt, which added further pressure

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

UK wheat imports continue at strong pace

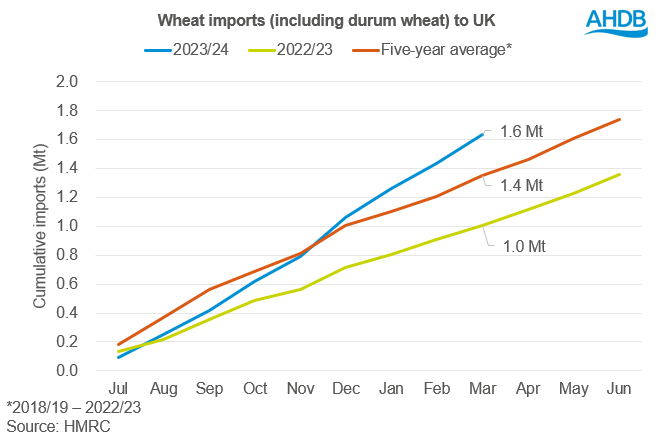

UK wheat imports (including durum wheat) for March totalled 199.0 Kt, meaning this season-to-date (Jul–Mar) imports have reached 1.6 Mt, up 63.0% on the same period last year.

Import pace had initially lagged behind the five-year average at the beginning of the marketing year (2023/24); however, since December, imports have surpassed average pace. From July to March this season, imports averaged 181.9 Kt a month, above the five-year average of 150.3 Kt and last year’s average of 111.6 Kt over the same period.

For wheat imports (incl. durum), the top five import origins are Canada, Germany, France, Poland and Denmark, which account for an 87.3% share of imports to the UK (Jul–Mar).

Given the lack of high-quality, domestically produced wheat available at the moment, it is expected that the majority of imports are high-protein milling wheat. As such, Canada has exported the largest volume of wheat to the UK, accounting for a 27.5% share of UK wheat imports this season so far. The share of imports from Canada and France are not too dissimilar from their respective five-year averages, with Canada down 1.1 percentage points and France 1.1 percentage points above. Despite expectations of a smaller German wheat crop, the share of imports from Germany are 6.1 percentage points above their five-year average, accounting for 17.4% of UK wheat imports.

What does this mean for milling wheat premiums?

Despite strong imports this season-to-date, and a particularly firm pace as of late, milling premiums remain historically high. As at 9 May, bread wheat delivered into the North West for May delivery was quoted at £279.50/t, at a £89.00/t premium to nearby futures. At the same time, six months ago (2 November), bread wheat delivered into the North West for November delivery was quoted at £269.00/t, at an £84.00/t premium over nearby futures on that day.

What could this mean going forward?

As it stands, it is likely that availability of UK milling wheat will remain relatively tight as we head into the next season. An estimate released by UK flour millers pegs Group 1 wheat production for harvest 24 at 2.07 Mt – down 38% from last season. This tighter outlook means premiums will likely remain elevated in at least the short to mid-term.

However, ongoing high levels of imported milling wheat will limit any major rises in premiums for now and could pressure prices in the longer term. Over the next few weeks, crop conditions and, therefore, availability from key import origin nations will be a watchpoint.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.