UK trade data; wheat import reduction likely to continue: Grain market daily

Friday, 12 November 2021

Market commentary

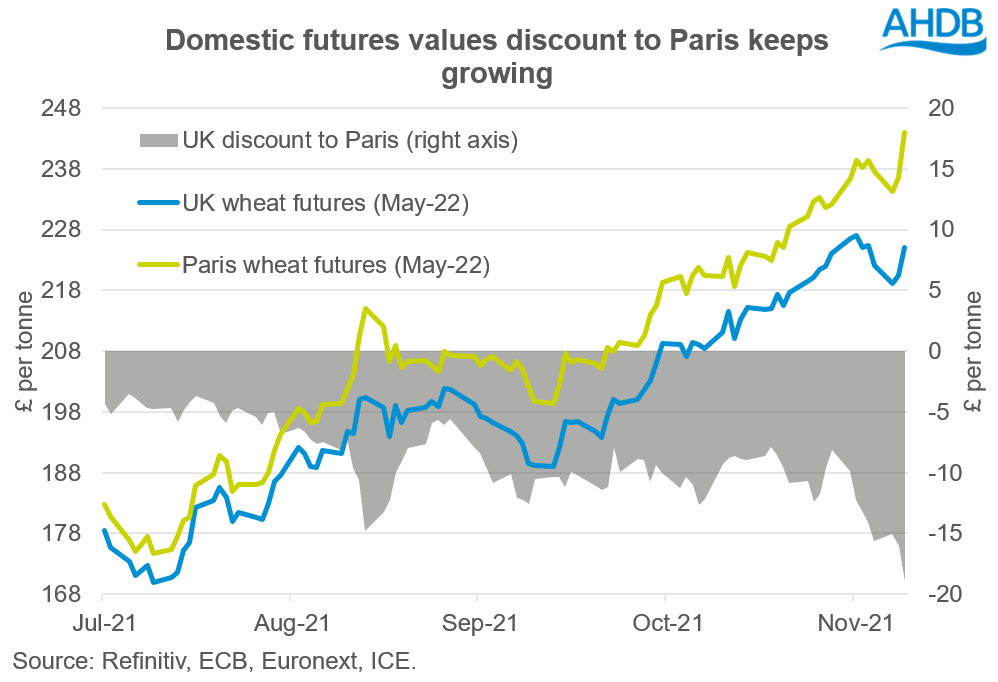

- UK wheat futures (May-22) closed yesterday at £228.90/t, gaining £3.90/t on Wednesday’s close. New crop futures (Nov-22) closed yesterday at £200.50/t, gaining £2.50/t on the day before. This set a contract high and broke £200.00/t for the first time.

- Domestic prices are following the global market trend. Paris wheat futures (May-22) gained 0.88% yesterday, to close at a contract high of €287.75/t.

- Adding support at the moment, is Russia’s plan to impose more export restrictions. This includes increasing their export taxes if international prices continue to rise, and talks of an export quota for the first half of 2022.

UK trade data; wheat import reduction likely to continue

Yesterday the latest HMRC trade data was released for September, and the key headlines are as follows:

- UK wheat imports (including durum wheat) for September were estimated at 154.9Kt, taking the season to date total to 626.9Kt, down 16% for the same period last year.

- UK maize imports for September were estimated at 69.1Kt, taking the season to date total to 316.0Kt, down 51% for the same period last year.

- Rapeseed imports for September were estimated at 145.8Kt, taking season to date total to 348.8Kt, up 168% for the same period last year.

- Barley exports for September were estimated at 101.7Kt, taking season to date total to 266.6Kt, down 4% for the same period last year.

Will wheat imports slow?

UK wheat opening stocks for 2021/22 are estimated to be the lowest this century, at 1.42Mt. With provisional production pegged at 14.02Mt this would indicate that the UK needs to import some grain this year marketing year to balance the books, but the exact amount is a little uncertain.

As stated above, UK wheat imports are down 16% from the same period last year. But since the start of this marketing year the UK’s trading relationship to Paris has changed when looking at futures contracts.

Looking at the May-22 contract (due to lack of liquidity in Nov-21), the graph above shows that since September our domestic market has extended its discount to Paris. Based on yesterday’s close, the discount was c.£17.24/t, meaning we are effectively pricing at export competitiveness.

Based on the latest AHDB published data, the UK feed wheat export price (Nov-21, quoted on 09 Nov) & delivered price (Nov-21, quoted on 04 Nov), into the East of England, were quoted at £223.00/t and £218.50/t respectively. Showing that there could be incentive to export out of the East, over domestic delivery.

With feed wheat delivered into Yorkshire (Nov-21) quoted at £231.00/t, this is a £12.50/t premium over East Anglia. but, is this enough to truck the grain north? And if it is enough, and most of all in the current climate, is the haulage available? Equally, exporting may seem attractive price wise, but freight availability may be hampering it in practice.

Concluding thoughts

If the UK trading relationship doesn’t narrow to Paris wheat, as worries around availability continue, we could see imports into the UK slow down. This in turn, could have implications for tightening ending stocks for 2021/22.

Between now and the end of this marketing year, there is a lot to play out and the on-going challenges with haulage and sea freight are only making things harder.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.