UK rapeseed; short and long term market factors: Analyst Insight

Thursday, 25 June 2020

Market Commentary

- Nov-20 UK wheat futures have continued declines this week, closing yesterday at £163.40/t, down £2.45/t from Friday. Over the short term, wheat markets are likely to see sustained pressure from the ongoing US wheat harvest.

- Chicago maize futures have faced further pressure from ‘near-perfect’ weather across the US MidWest, raising hopes of a bumper maize crop. Dec-20 CBOT maize closed yesterday at $3.33 per bushel ($131.39/t, £105.24/t). Maize markets look set to remain bearish for the foreseeable period.

UK rapeseed; short and long term market factors

What might affect the price direction of new-crop rapeseed? With harvest rapidly approaching, let’s revisit these factors and the impact they could have.

We know the UK + EU will face an increased need for rapeseed imports next season. While there are potential support veins for the UK rapeseed price, these are likely to be moderated by non-EU rapeseed availability and trends in other oilseed markets. Below are noteworthy factors that will likely offer price sentiment over the short and longer term.

Short-term

Rush to import?

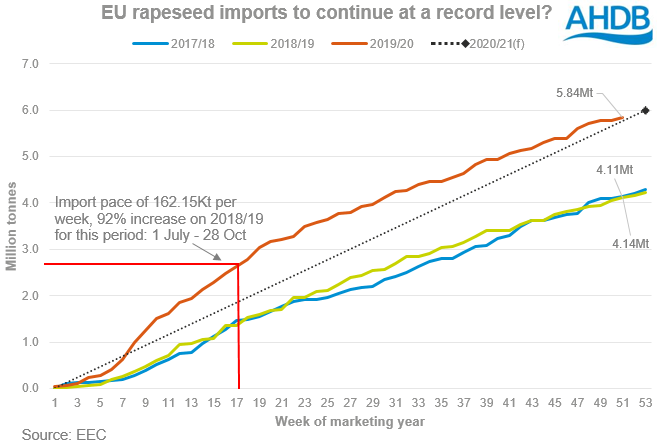

The degree of rapeseed imports into the EU could pressurise domestic prices in the short-term. Whilst the EU’s c.6.00Mt import requirement will persist throughout the 2020/21 season, an important feature of the 2019/20 5.84Mt (as of 22 Jun) import campaign was its beginning.

The start of the 19/20 campaign recorded EU rapeseed imports averaging 162.15Kt per week (01 July – 28 Oct), totalling 2.63Mt. This pace was a 92% increase on the same period in 2018/19. The weekly import volumes peaked at 351.90Kt in the week ending 25 Aug 2019.

Strategie Grains estimate the 2020/21 opening stocks at 1.40Mt, a fall of 0.60Mt from 2019/20. This, coupled with an estimated 16.53Mt EU-28 rapeseed crop, could likely translate to a rush to import early next season as purchasers look to replenish stocks.

The bulk of the early import origin will likely be Ukraine, owing to their rapeseed harvest beginning recently. Other origins are yet to start their new-crop harvests. UkrAgroConsult estimate the crop at 3.1Mt, of which 2.3Mt is to be exported into the EU. Ukrainian FOB prices (July) were quoted at $425.0/t (£342.07/t) as of 24 June.

EU + UK crush demand

Despite the effect of the coronavirus pandemic on biodiesel demand, EU-28 (FEDIOL) rapeseed crush volumes for Jan-May totalled their highest since 2017 as crush margins strengthened. April rapeseed crush volumes in particular, reached a 3-year high despite lockdown measures.

As more EU countries relax lockdown measures, the number of vehicle journeys will begin to return to average levels. This could translate into a rise in biodiesel demand and potentially a positive effect on rapeseed demand.

How much of this demand the UK sees could be somewhat limited by the temporary closure of the Erith crushing plant, which processes around 1.0Mt of rapeseed each year. The extent of the explosion damage is unknown at the time of writing, and therefore the impact it could have on domestic demand.

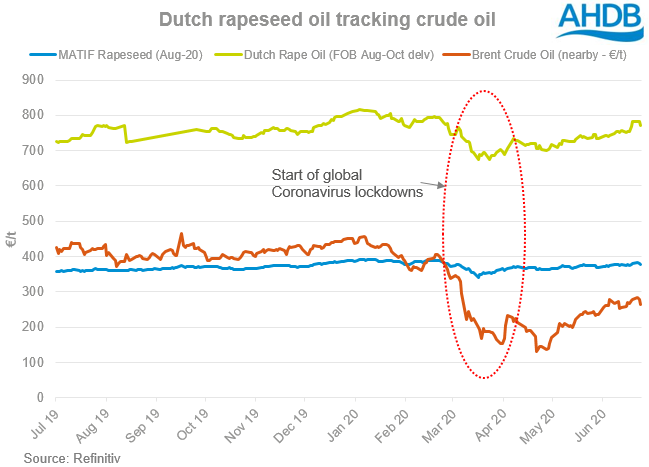

Crude oil recovering

Since the start of June, Brent crude oil has increased 5.19% closing yesterday at $40.31/bbl. This has offered some support to veg-oil markets, given both feature in biodiesel production.

Dutch FOB rapeseed oil values (Aug delivery) increased 3.77% over the same period, quoted at €770.00/t yesterday.

As more countries ease lockdown measures, further support for crude oil markets is then likely. However, declines have been recorded this week owing to fears of increased coronavirus infection rates in the US, Asia and the EU.

US Soyabean area

A further watch point for rapeseed markets is the confirmation of the 2020/21 US soyabean planted area, published on 30 June in the USDA Acreage report. Figures will highlight the degree that US farmers switched to soyabean acres in place of maize. Early trade estimates suggest a rise in soyabean area from the 83.50 million acres (33.79Mha) forecast in March. If confirmed in the report, an increase to the US soyabean area will likely pressure global oilseed markets.

Long-term

Other rapeseed import origins

The EU is estimated to import 2.32Mt of Ukrainian rapeseed, with Australia (1.62Mt) and Canada (1.89Mt) also contributing to the requirement. The Australian and Canadian canola harvests usually finish towards the end of the calendar year, with the bulk of their exports likely appearing towards the start of 2021.

Long-term, the EU looks relatively well covered to meet its import requirement. This would result in domestic rapeseed prices looking to price off import parity levels. However, harvests from some import origins are still a way off so many factors could affect their production. Above average snowfall in Canada this current season delayed canola harvests. An event similar to this could provide temporary price support, provided other origin import tonnages do not rise in place.

A fight for China

One significant price point for markets is the source of China’s soyabean imports. Since the start of the calendar year, a ‘tug of war’ had developed between the US and Brazil competing for Chinese purchases. A weakened Brazilian currency (BRL) against the Dollar earlier this year prompted Chinese buyers to opt for Brazilian origin.

Only really in the last few weeks has China returned to its ‘phase one’ deal commitments with the US following a strengthened USD/BRL exchange rate. Following this interest, from 1 June to yesterdays close, US soyabean futures (nearby) had increased 3.42%. This rise lent a degree of support to Paris rapeseed futures, which rose 1.62% over the same period.

Strong US export sales as of June 11 detail China had booked 3.05Mt of US soyabeans for delivery at any point after 1 Sept. Further trade between the two countries will ease concerns surrounding the trade deal commitments, with a look to support oilseed markets. It is worth noting however, the BRL currency has depreciated in value against the dollar once again, which could prompt a switch again for Chinese buyers over the next few months.

There are other market factors at play too for domestic rapeseed, including the strength of sterling and the impact of Brexit on logistics next year amongst others. These factors will be covered in future articles.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.