UK Nov-20 wheat futures gain over the month: Grain Market Daily

Friday, 1 November 2019

Market Commentary

- UK feed wheat futures (Nov-19) fell slightly yesterday to £139.10/t, down £0.40/t from Monday.

- US export sales figures detail China purchased 481Kt in the week ending 24 Oct. Current wet weather has delayed US soyabeans harvests this week. As of 27 Oct, the US soyabean harvest was 62% complete,16 percentage points behind the five-year average.

- The ongoing French maize harvest is also behind. As at 28 Oct, 65% has been harvested. This is significantly behind last year, which was 96% completed in the same period, according to FranceAgriMer.

UK Nov-20 wheat futures gain over the month

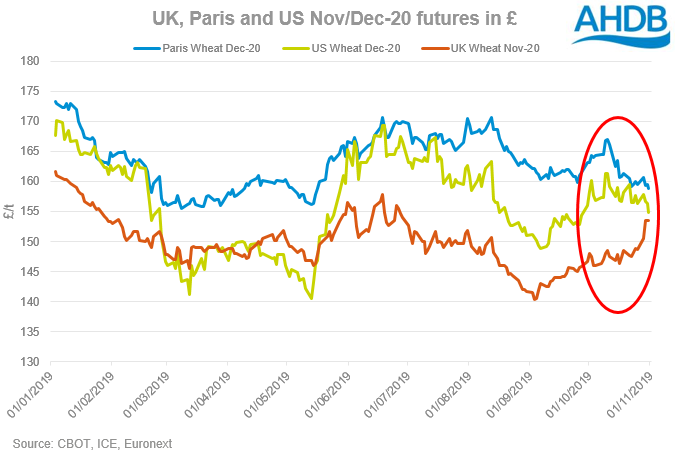

Looking forward into next year, global wheat futures for harvest 2020 will help provide insight into the potential route wheat prices may take over the next twelve months. Changes in Nov-20 futures will, to an extent, affect old-crop prices as markets either incentivise or not any carry into the next season. This is all in the face of a large global wheat supply, which remains a pressure point for futures markets.

A difficult start to UK winter wheat plantings has supported Nov-20 futures. In addition, the potential for a no-deal Brexit has decreased. Both of these factors have moved the price closer to Paris and US equivalents, which have tracked downwards over the last month. Nov-20 futures closed yesterday at £152.75/t, with the spread between UK Nov-19 and Nov-20 at £13.65/t.

The large carryout of wheat this season could become an increasingly limiting factor to cap UK Nov-20 increases. However, the UK has moved to complete large volumes of wheat exports already, pre the original anticipated 31 October Brexit deadline. The ability to continue this export pace could prove difficult in a currently undetermined political future.

French wheat plantings have also been delayed, tracking behind the two previous years, as wet weather has reduced field-working days. Even so, Paris Dec-20 futures have moved lower over October as the country faces a large carryover after a near-record wheat harvest this year.

Much of the downward pressure has stemmed from a larger outlook for US wheat markets. US winter wheat plantings are currently 3% ahead of the five year average at 85% completed as of 27 Oct. The latest supply and demand estimates forecast US wheat production 4% up on last year, at 53.39Mt. Since 04 Oct, US Dec-20 futures in sterling have declined 2.5% to within £0.67/t of the UK equivalent. Further declines could pressure UK futures to follow. UK winter wheat area figures will give a more quantifiable indication of the effect of the wet weather on drilling. The AHDB Early Bird Survey, released in the next few weeks, will provide an initial look at these numbers.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.