UK futures continue to rise amid poor new crop prospects: Grain Market Daily

Friday, 15 November 2019

Market Commentary

- Chicago wheat futures (May 20) closed yesterday at $189.58/t and have been declining week on week for the past four weeks, driven down by the Black Sea region offering competitive global pricing.

- Conversely, UK feed wheat futures (Nov 20) are still on the rise. Closing yesterday at £159.25/t, continued adverse weather and insufficient drilling continues to support the market

UK futures continue to rise amid poor new crop prospects

The Early Bird Survey of intended planted area will be released w/c 25 November and will provide an indication of the potential reductions in planted area.

We know the ongoing rainfall has impacted the ability to get winter wheat in the ground. From a price point, the relationship between old crop and new crop prices has stretched, as highlighted yesterday.

However, the same can’t be said globally. As domestic new crop prices move to hit the import ceiling, global markets will become of increasing importance.

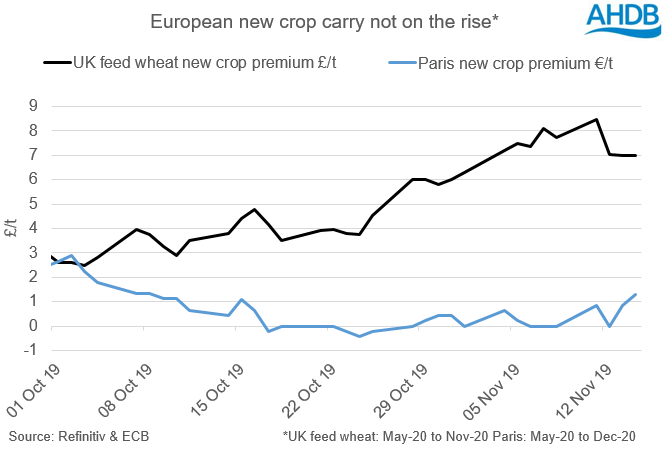

In continental Europe, although planting in France is behind, the relationship between old and new crop Paris milling wheat futures has recorded only a minimal change from the start of October.

This season, there is a requirement to export 3Mt more wheat than last season, at 20.5Mt. Yet French export pace would appear to be lagging. At 4.4Mt exported from July to September, this is only 223kt up year on year.

This need for old crop to remain export competitive and avoid significant carryover into the new crop season could well provide a cap for any new crop price gains.

With Paris milling wheat futures not recording the same rise into next season, the relationship between UK futures and Paris milling wheat has shifted significantly. New crop UK feed wheat futures are now unusually above that of Paris milling wheat (€3.70/t at yesterdays close).

For the 2013/14 season, November-13 UK feed wheat futures rose above Paris new crop milling wheat (Dec-13), reaching a maximum premium of €8.71/t during planting concerns. However by the time harvest was complete, UK feed wheat futures once again returned to a discount as imported wheat and maize options lowered the domestic pricing ceiling, presenting a potential risk yet again for 2020/21 markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.