How could price seasonality impact domestic wheat futures? Grain market daily

Thursday, 2 January 2025

Market commentary

- UK feed wheat futures (May-25) ended Tuesday’s session (31 December) at £192.55/t, up £0.40/t from Monday’s close. The Nov-25 contract was also up £0.40/t over the same period, to close at £193.55/t. Markets were closed yesterday due to the bank holiday.

- Since our last Grain market daily (on 20 December), domestic wheat futures have edged higher, following Paris milling and Chicago wheat futures. The strengthening of sterling against the euro and weakening against the US dollar, is also having an impact on our relationship to the global market. Wheat prices find some support from an uptick in global demand, as well as weather risks for the northern hemisphere winter crop. An Egyptian grain state-buyer has reportedly secured 1.27 Mt of wheat, thought to fulfil requirements until the end of June, and is mostly of Russian origin (LSEG).

- May-25 Paris rapeseed futures closed at €508.50/t on 31 December, up €1.25/t from Monday’s close.

- Next Friday will see the release of the USDA’s January WASDE report, which could activate the market after the holidays and could give us a further trend in price movements. A key watchpoint will be the soyabean production forecast for the 2024/25 marketing year in Brazil and Argentina. Indonesia is delaying the implementation of its B40 biodiesel mandate from 1 January 2025, which could add some uncertainty to palm oil prices.

How could price seasonality impact domestic wheat futures?

As we head into the new year, it could be a good time to draw up some conclusions about price movement for grains and oilseeds in the last calendar year, and to plan a strategy for the new one. The decision of when to sell grain and oilseeds is always a difficult one to make, and in addition to cash flow considerations and the current global market drivers, another factor is price seasonality.

Recently, domestic feed wheat futures have largely been influenced by the traditional fundamentals of supply and demand, driven by export pace and weather. We also have needed to consider geopolitical and currency risk. Today, we are going to look into the trend in seasonality of grain prices over a longer period.

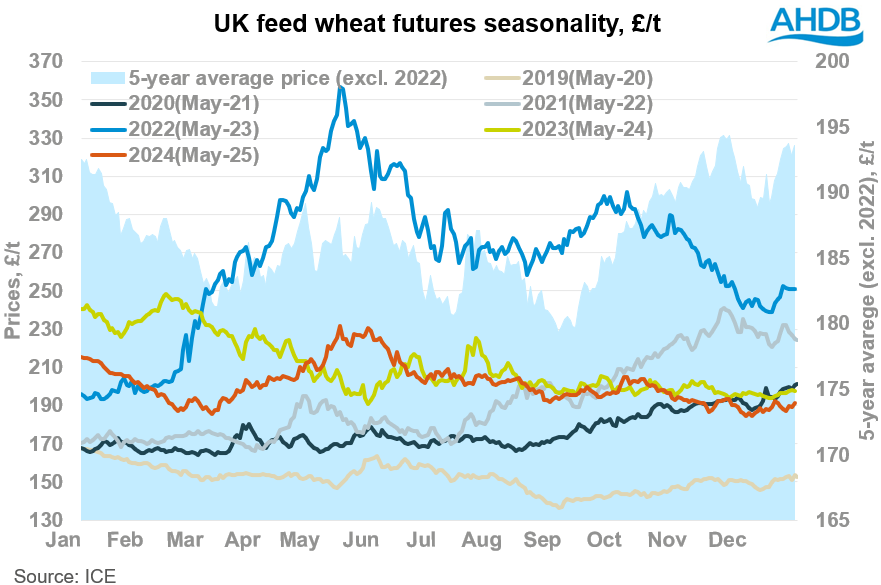

UK feed wheat futures (May) have been very volatile over the last 6 years. In fact, the highest price was £356.80/t in May 2022, while the lowest was £136.50/t in 2019. In 2022, we saw an abnormally strong rally in global wheat prices due to significant geopolitical impact. As such, we have excluded the calendar year 2022 from our analysis of the seasonality of UK feed wheat futures prices.

As a result, we obtained a five-year average of UK feed wheat futures prices, which helps us to identify some seasonality. In the first quarter of the calendar year, based on the five-year average, we can see UK feed wheat futures have tended to fall in this period. In the second quarter however, we have seen prices overall increasing. The direction in the third quarter is less clear, with multidirectional price movements. Finally, in the fourth quarter, on average we have seen UK feed wheat futures prices on the rise.

Looking ahead

There are many reasons why we see these trends throughout the year, for example it can be expected that we see pressure in domestic prices following harvest, with an influx of grain coming onto the market. Additionally, if we are holding a surplus of domestic grain, towards the end of the marketing year we would also expect to see some pressure against global price movement, with farmers with storage limitations selling ahead of harvest. This information can be useful as an additional factor in the final selling decision. Also, this seasonal tendency could be used for considering a forward contracts selling strategy.

Of course, it’s important to note that some unpredictable geopolitical and weather risks could mean that some years we don’t follow these historical trends (as in 2022), it is merely a factor to be considered in a marketing strategy.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.