UK dairy farm remains middle of pack for profit

Wednesday, 23 February 2022

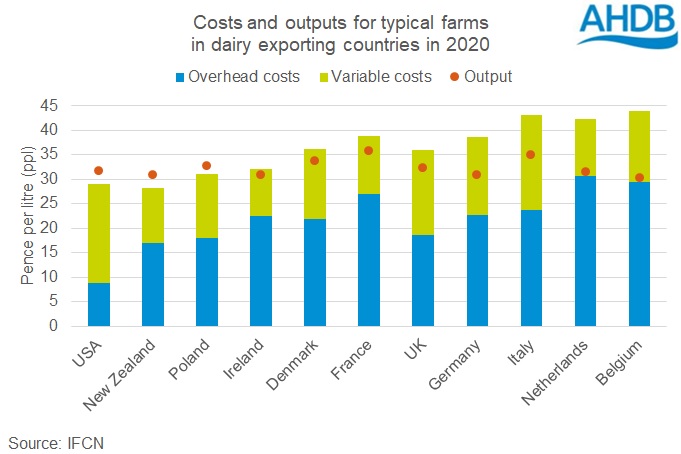

The typical UK dairy farm is in the middle of the pack when it comes to profit, compared with its competitors abroad.

The chart below shows farms in major dairy exporting countries ranked by their profits for 2020. This is the latest data from the International Farm Comparison Network (IFCN).

The UK’s position relative to the other farms is unchanged from 2019. However, net margins fell for most of these farms in 2020, due rising costs and lower milk prices.

As a result, only three farms in the group had a positive net margin in 2020 and the UK farm lost 3.8ppl. Farms with lower costs tended to be more profitable.

Since 2020, costs and milk prices have both risen significantly and the overall effect on the UK’s competitiveness remains to be seen. IFCN is currently collecting data for 2021 from its participating countries.

Tips for reducing costs

Here are some approaches AHDB’s Strategic Farms have used to help drive down their costs:

- Find out how Rhual Dairy got its cost of production down to 28.2ppl

- Read how Chance Hall Farm in Cheshire reduced feed costs

- Take a look at Tyddyn yr Eglwys farm’s approach to lower overheads

And some tools to help apply things on your own farm:

- Try our collection of tools to minimise overheads

- Use KPI Express to compare your costs with targets

About the figures

- This data is from the International Farm Comparison Network (IFCN), which compares performance of ‘typical farms’ that represent the most common farm types in each country. Figures are for individual typical farms and are not national averages.

- To allow like-for-like comparisons between countries with different milk butterfat and protein levels, IFCN has standardised all figures to ‘solids corrected milk’ (SCM) of 4% butterfat and 3.3% protein.

- Output excludes coupled and decoupled subsidies.

Sectors: