UK cropping intentions shift to spring following delayed autumn planting

Tuesday, 26 November 2019

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £156.75/t, up £1.10/t. Wheat markets have been supported in the last few days by wet weather in Western and Eastern Europe. Furthermore, dry weather and strong demand in the Black Sea region, and question marks over the size of the US winter wheat area have offered support.

- Chicago soyabean futures (Jan-20) fell $1.65/t yesterday, to close at $327.94/t. Improved crop conditions in Argentina and Brazil with welcomed rain, coupled with China sourcing soyabeans from Brazil has meant futures have hit a two-month low.

UK cropping intentions shift to spring following delayed autumn planting

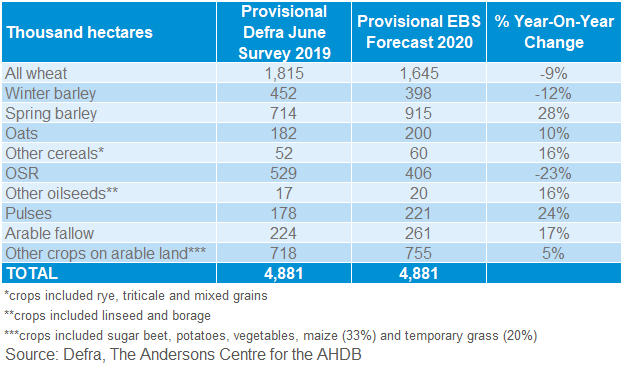

An early recording of GB planting intentions for the 2020 harvest suggests a sharp fall in winter crops, largely because of the extremely wet weather throughout the autumn planting window.

An anticipated 13% fall in UK winter wheat planting but considerable (358%) rise in spring wheat would result in the lowest wheat area since 2013, a year which also followed a very wet winter. The intended winter barley area is 12% down, partly from rain interruptions but also a lower planned area.

Oilseed rape intentions are for a lower planted area (-23%). This includes a considerable amount of crop which might not survive through to harvest, partly because of rain and also CSFB damage.These problems combined has meant that much of the planted crop was slow developing and may suffer further losses.

Meanwhile, spring barley, oats (largely spring) and pulses areas are anticipated to rise sharply in 2020, by 28%, 10% and 24% respectively.

Joe Scarratt & Graham Redman, The Andersons Centre 01664 503200

- Winter wheat, winter barley and OSR area is falling sharply for the 2020 harvest.

- Spring crops; barley, oats, pulses and other cereals and break crops are seen rising, along with a rise in fallow arable land.

Provisional results from the survey shown in the table have been extrapolated onto the data from Defra’s provisional 2019 UK June Survey to produce forecasted crop areas for the 2020 harvest. Autumn drilling conditions have been awful in many parts of the UK with excessive rain for most. This meant far less winter drilling has taken place so far than usual.

The wheat area is forecast to fall by 9% which, if correct, would result in 1,645Kha for harvest 2020, this would be the lowest wheat area since 2013, another year that experienced a winter drilling window. The spring wheat proportion within total wheat is seen rising a considerable 358%. It is thought that potentially half the UK winter wheat crop is still not planted though, so the decline could end up larger than the survey currently suggests.

The winter barley area is expected to fall by 12% to about 398Kha, although still higher than 2018. Oilseed rape is currently experiencing a 23% reduction to about 406Kha. This would be the smallest area drilled since 2002.

The area of spring crops are expected to increase in 2020 and could further rise depending on the next couple of months. Spring barley is anticipated to rise by 28% to 915Kha, a level not seen since 1988, when over a million hectares was cropped.

The survey suggests that the pulse area may rise by nearly a quarter to 221Kha, almost to levels seen in 2016. This is likely led by spring pulses but it is also noted that winter beans can generally be planted quite late in the season. Unsurprisingly, the fallow area is also thought to be rising (17%).

Other arable crops are all seen rising for 2020. This includes other combinable cereals up 16% (rye, triticale and mixed grains), other oilseeds also up 16% (linseed and borage) and other non-combinable crops on arable land (including roots, vegetables, and a proportion of maize and temporary grass crops) up 5%.

This survey is focused on the arable farm rotation rather than all arable land, which would include grass and forage rotations. For this reason, an estimate of the total amounts of these crops are used to include in the “other crops on arable land” figure. Crops of smaller area have a lesser area coverage in the survey, so these results are subject to greater uncertainty.

There are more planting intentions in this survey than usual due to the delays in winter drilling. Provisos therefore exist in whether this pattern will actually happen.

We note it assumes the weather returns to ‘normal’ levels of winter rainfall from now on and sufficient spring seed is sourced for the plans to be achieved. We also note that most growers will still, where possible drill their purchased seed as it is generally not possible to return it now, so late winter drilling may restart when conditions allow. These variables mean the actual harvested crop may still turn out to be different to what respondents reported in the survey.

Due to these reasons the Early Bird Survey will be rerun in the New Year to ensure it reflects the latest intentions of growers as the winter progresses and weather conditions change.

Closing Comment

The survey carries a track record of very accurate figures. Nonetheless, the survey only represents a snapshot at a given point in time and therefore, should be interpreted carefully, especially this year with so much still to play for. Look out for the updated survey in the New Year.

The Early-Bird Survey (EBS) is undertaken each autumn to assess national cropping intentions. It is carried out by The Andersons Centre with the help of the Association of Independent Crop Consultants (AICC) and other agronomists. Over 80 agronomists took part in the survey contributing over 615Kha of arable land stratified across all regions of Great Britain to establish cropping changes on individual farms as a representation for the national change in cropping. The survey was conducted during the first fortnight of November, three weeks later than usual because of the adverse conditions. In previous years, the survey has been a very accurate forecast of actual harvested areas. Over the last three years, the area surveyed has more than doubled, with c.45Kha of additional area added in this year’s survey. Final results, including a breakdown of regional data for the main crops, will be released following publication of the final Defra June survey results for 2019, which is scheduled for release in late December.

The survey is based on measuring cropping change from the harvest just completed to the current growing season and plans for spring drilling. Rotational area surveyed is selected as those with no net change to their arable area, or where there is change, it can be reconciled within the rotation. In other words, because the survey measures the percentage change of each crop, the total crop area has to remain unchanged overall. Using the provisional results from DEFRA’s UK June Survey, it is then possible to predict crop areas for harvest 2020.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.