UK cereal markets need to remain export competitive: Grain Market Daily

Tuesday, 15 October 2019

Market Commentary

-

The value of the pound continues to push higher. At £1=€1.1480 by 12pm today (15 Oct), the pound has strengthened by 6.9% from the lows on 9 August. A more positive tone toward gaining a deal with the EU has pushed the pound back toward previous levels of £1=€1.16-1.18 recorded earlier this year.

-

The further strengthening of the pound has led to a fall in the value of UK feed wheat futures (Nov-19), closing at £135.50/t yesterday, back at prices recorded in mid-September. Meanwhile Paris milling wheat futures (Dec-19) remain 5% higher than four weeks ago, highlighting the ongoing domestic market currency risk.

UK cereal markets need to remain export competitive

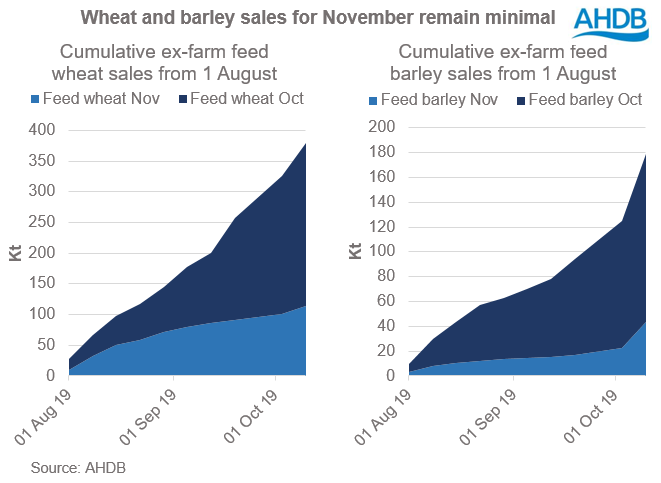

As October is fast drawing to an end, and what is a very uncertain November fast approaching, ex-farm sales of wheat and barley for next month have remained minimal.

With exports of feed barley having been booked in prior to November, there has been a jump in the volume of barley sold for October with some additional purchases likely required to fulfil export commitments. The discount of feed barley to wheat in Eastern regions having narrowed from £15.40/t to just £11.50/t to likely incentivise farmer selling.

Yet while barley may have received some temporary support, the longer term picture will likely see a further widening of discount to feed wheat.

Although there is some uncertainty as to the actual production figure, there has likely been the largest barley crop harvested in over 30 years. With up to 2.355Mt of surplus barley available for export, the pace of exports from September onwards will have to average a substantial 200kt a month for the remainder of the year in order to prevent a build-up of stocks.

Which even with a fast export pace in October, could well be counteracted by minimal export sales booked for November and onwards owing to Brexit uncertainty. With a picture for larger domestic stocks throughout the season, in order to gain domestic demand, the discount of barley to feed will likely be required to grow to incentivise demand.

Yet wheat sales for November and onwards have too remained minimal. With a forecast exportable surplus of 2.885Mt and only 151Kt exported throughout July and August, an average export pace of 270Kt a month from September onwards would be required to prevent a stock build-up. However this level would be just shy of the maximum pace set throughout the entire 2015/16 season.

So while a Brexit deal and access to EU markets would encourage export sales, contributing factors such as currency support and required export pace will likely keep domestic markets export comparative for the remainder of the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.