Analyst Insight: UK barley trade races out of the blocks, but what next for prices?

Thursday, 15 August 2019

Market Commentary

- UK feed wheat futures (Nov-19) fell considerably yesterday, closing at a contract low of £140.50/t. The move went against the direction of Paris and Chicago wheat futures.

- Futures will now be set for a test at the psychological level of £140.00/t. At 11.00 Nov-19 futures were at £139.50/t.

- The UK is set for a big wheat crop and recent rainfall could increase the volume of feed wheat in the market, potentially pushing the price lower.

- At present UK FoB wheat is competitive and may not need to move too much lower.

UK barley trade races out of the blocks, but what next for prices?

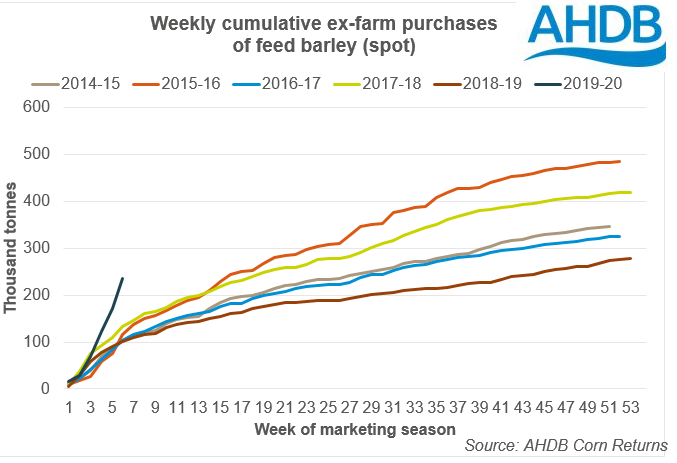

- UK barley corn returns volumes have reached record levels.

- This has been driven by a combination of big old crop carryout, big new crop and Brexit uncertainty.

- UK barley is currently competitive in export markets, but there are still factors which could move the market lower.

In the week ending 08 August 2019, spot ex-farm purchases hit 63Kt, the first time barley purchases have reached that amount on records going back to July 2000. Moreover, cumulative, spot purchases of feed barley have accelerated to 235Kt, a figure not reached until April last season.

So is this a sign of big old crop carryout? Big new crop? Brexit uncertainty? Or all of the above!

More importantly what next for UK barley prices in an uncertain trading environment?

Big old crop carryout

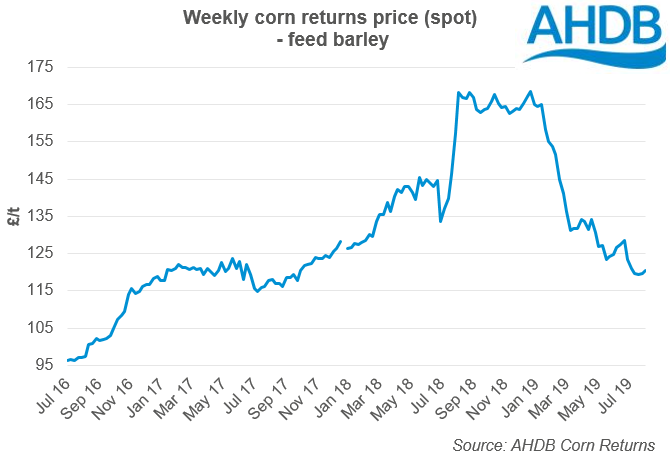

A tough demand outlook with increased competition from maize saw the level of barley available for free stock or export at the end of 2018/19 estimated at 1.18Mt.

While this is a year-on-year decline of 233Kt, production last season was estimated to have fallen 659Kt. This highlights how the lack of barley demand pressured prices toward the end of the season. Much of this carryout stock will have been traded through the tail end of last season and into this season.

Big new crop pressure

Alongside the challenge of larger carryout stocks, this year’s harvest also looks to be more than ample. Early indications from the AHDB harvest progress survey suggested that yields of winter barley were between 7.9-8.2t/ha, at the lowest that’s 0.9t/ha above the UK five-year average.

The next update of the AHDB harvest progress survey is due tomorrow.

Added to the larger yields, we know that the UK area planted to winter barley increased for harvest 2019. Furthermore, the combined area of winter and spring barley up 1% year-on-year, at 1.13Mha.

Assuming yields continue to look positive for both winter and spring barley the UK could be set for a barley crop, the size of which hasn’t been seen since 2015/16.

Big trade pressure

With sizeable carry in stocks and a big new crop, trade pressures accentuates the need for volumes of barley to move quickly, early in the season. With a Brexit deadline of 31 October, barley will likely be moved quickly in order to avoid a tariff.

Does that mean barley prices will move lower?

UK barley is already pricing competitively for its current trading environment. That suggests there is no immediate need to move lower, without a large change in the fundamentals or sterling.

The general sentiment for UK barley would suggest that there is room for it to move lower. Certainly if a tariff is applied to exports into the EU then there will be a need for barley prices to price at least €16.00/t lower than EU barley to remain competitive.

Another potential driver for a move lower in barley prices is the latest developments in the US maize market. On Monday, Chicago maize moved limit down on a surprisingly bearish WASDE for maize. In early trading on Tuesday, the Chicago maize market moved lower still to pre-planting pressure levels. As the world feed grain floor the maize price has the potential to pull barley markets lower.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.