The WASDE watch-out: Grain market daily

Wednesday, 10 November 2021

Market commentary

- UK feed wheat futures (May-22) were up £1.35/t yesterday, to close at £220.50/t, following a tightening global wheat picture painted by yesterday’s USDA release (read more below).

- Paris rapeseed futures (May-22) rebounded yesterday, up €7.25/t closing at €662.75/t. Support was received from the wider oilseed market, with the USDA trimming global soyabean ending stocks more than the trade expected.

- However, slowing soyabean demand could keep a lid on any price increase. Yesterday, the Argentine government reported soyabean sales of 33.6Mt up to 3 November, for the 2020/21 crop year. This is behind the same point a year earlier, when sales of 34.8Mt were stated.

The WASDE watch-out

Yesterday, the USDA released its November World Agricultural Supply and Demand Estimates (WASDE) report. What were the highlights and what might this mean for UK markets?

Wheat

Global wheat outlook was trimmed further this month. Downward production revisions for the EU, UK and Uzbekistan more than offset the 2Mt increase in projected Russian production. In conjunction with this, global consumption [1] and exports were revised up. Exports are now forecast at a record 203.2Mt, with higher exports expected from the EU, India, Russia and Ukraine. All of this leads to projected global ending stocks tightening further, placing a greater squeeze on available supplies.

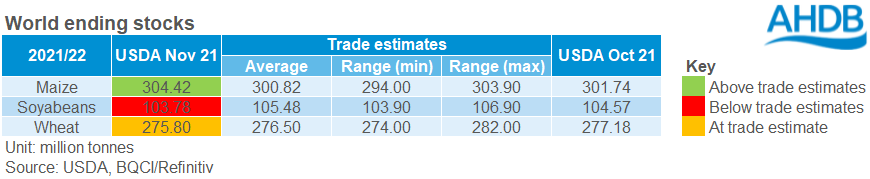

While the trade had anticipated a downward revision in world ending stocks for 2021/22, a figure of 275.8Mt was below average expectation. As a result, the nearby chicago wheat contract jumped $3.86/t yesterday, to $286.02/t. This movement was mirrored in nearby London and Paris wheat contracts closing prices, up £1.35/t (to £211.75/t) and €2.25/t (to €286.00/t) respectively.

Maize

Global maize ending stocks were revised higher for 2021/22. The USDA forecast levels of 304.42Mt (World inc. China), 2.68Mt greater than October’s estimate and above trade expectations. Production increases underpinned this growth. Rises came from the US, as farmers record their highest yield, and Argentina following an expansion in their area.

However, global demand was also increased in the latest WASDE, although not quite offsetting production increases. With demand still looking strong, the market were net buyers of maize yesterday, the nearby Chicago maize contract rising $1.28/t, closing at $218.41/t.

Soyabeans

Soyabeans arguably caused the biggest surprise in yesterday’s WASDE. US yields were reduced, contrasting trade expectations of a rise. This resulted in estimated production dropping 0.63Mt, to 120.43Mt. In addition, Argentine production was also reduced, by 1.5Mt, to 49.5Mt.

For both nations, exports were also pegged back. Chinese demand has been slackening of late, weighing on prices. While nearby Chicago soyabean prices jumped $7.90/t yesterday, to close at $440.70/t, slowing demand may well keep a lid on further price increases that might have been expected on yield and export cuts.

So what does this mean for the UK?

With a tight domestic picture, UK prices will be set at import parity for the months ahead. Therefore, continuing tightness, particularly in global wheat markets, indicates support for the months ahead.

[1] Please note, the global wheat consumption figure stated matches the PDF version of the USDA World Agricultural Supply and Demand Estimates. AHDB note that the 2021/22 wheat consumption figure differs from the data available in the USDA Production, Supply and Distribution database, which includes the latest WASDE numbers.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.