Technical selling leaves markets reeling: Grain market daily

Friday, 18 June 2021

Market commentary

- UK feed wheat futures (Nov-21) lost more ground yesterday, closing yesterday at £170.00/t, a fall of £2.00/t on the day. The Nov-22 followed suit yesterday, closing at £164.20/t.

- UK markets followed the general trend of global markets, with Chicago futures, both maize and wheat, declining. Global grain futures have been declining for the past few days, driven in part by technical drivers (read more below).

- French crop conditions (wheat and barley) were unchanged according to FranceAgriMer. Earlier this week, German association of farm cooperatives, DRV, published its latest forecast of German crops. All wheat is expected to increase 839Kt year-on-year, to 22.98Mt

- The German wheat crop will be important for UK markets, likely making up a reasonable proportion of high protein imports.

Technical selling leaves markets reeling

Over the course of the past week, we have seen UK feed wheat futures track lower. Thursday to Thursday Nov-21 UK feed wheat futures were down £5.45/t, at £170.00/t. As has been the case for much of this season, with the UK being a large net importer of wheat, moves in the domestic market have taken their lead from the global market.

This week has been no different, in the five days to Thursday Chicago wheat futures (Dec-21) have lost almost 7%. Changes in the fundamentals will have played a role in movements this week, with bigger EU and Russian crops forecast. However, with the large speculative interest we have seen in grain and oilseed markets over the past season, technical indicators are playing an equally important role in the latest fall.

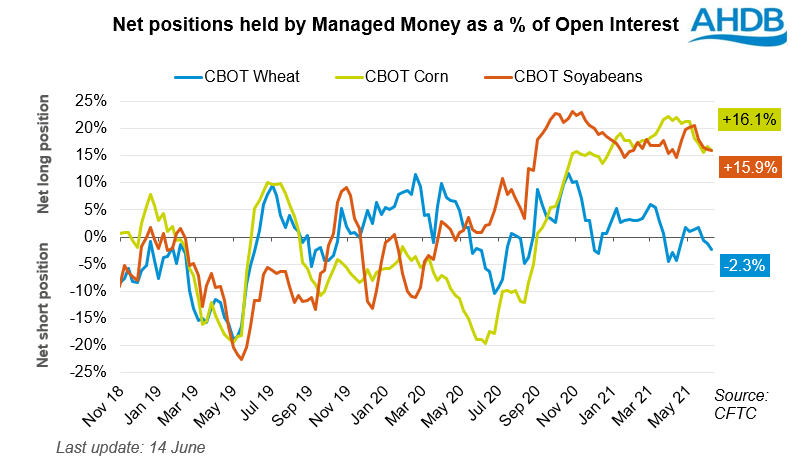

As at 8 June, managed money still held large net long positions in both maize and soyabeans. Continued selling by funds, like we have seen in the past week, could accelerate the fall in prices.

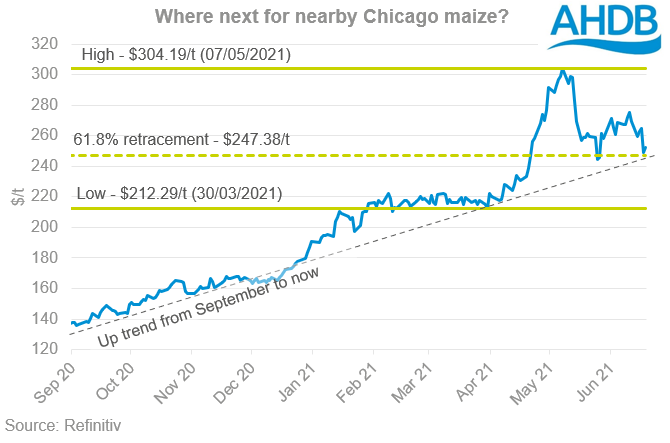

One of the key markets for this speculative interest has been Chicago maize, for this reason, the market is a good indicator of what we may see down the line for UK feed wheat. Chicago maize futures, until yesterday, had been in relative free fall, losing 9.4% Thursday to Thursday. Looking at this move on a short-term graph appears quite alarming. However, if we look back to the beginning of the current season, prices are still ahead of trend.

Furthermore, the recent fall represents the second visit in the past 16 days to the key 61.8% retracement between the start and end of the large rally in April. As prices moved toward the 61.8% level yesterday, they bounced, gaining 1.2% to the close of early trading today.

This level will be an important one for UK feed wheat. If the Chicago maize price can break and hold below this level ($247.38/t) UK feed wheat will likely continue to move lower. If we continue to bounce off this level, there could be technical support for prices at current levels.

What could change this direction?

There have been several stories of late, suggesting funds are coming out of commodities across the board. If this is the case, then it will take some strong fundamental news to break the trend. For grains, the USDA acreage report due 30 June will be crucial for the longer-term direction of prices.

In the meantime, much of the fundamental stories will be heavily weather led.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.