Successive global gains for wheat: Grain Market Daily

Tuesday, 24 March 2020

Market Commentary

Currency and global markets

There was still a degree of volatility yesterday for sterling, as markets continue to react to global news. The pound finished down again the US dollar (£1 = $1.1548). As a 09:00 today, it is trading £1 = $1.1664 and has continued to strengthen this morning.

There is less volatility seen against the euro, as the value removed from equity and commodity markets is to own physical dollars during a financial market downturn. Yesterday sterling closed weaker against the euro, at £1 = €1.0764. As at 09:00 today, it is trading at £1= €1.0735.

Brent crude oil closed yesterday at $27.03/barrel, up $0.05/barrel on Friday’s close. As at 09:00 today the contract is trading up at $28.07/barrel. Political events and news around the coronavirus outbreak have been affecting crude oil prices in the short term. The slight uptick was reportedly assisted by the Trump administration launching an effort with Saudi Arabia to stabilise oil prices.

Prices

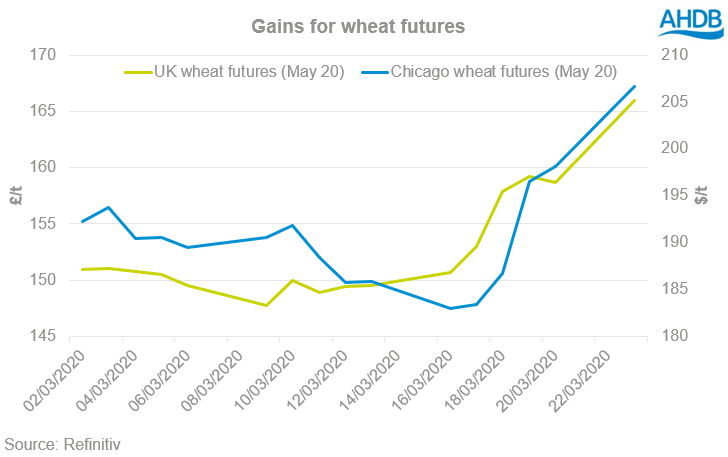

Old crop (May-20) UK wheat futures closed yesterday at £166.00/t, up £7.30/t on Friday’s close. The new crop (Nov-20) contract closed at £174.95/t, up £6.50/t on Friday’s close.

Gains in the short term have been supported by increased demand from panic buying in supermarkets and global wheat market gains. While there are no reports of supply issues as retailers have claimed to be food secure, there have been logistical concerns with the increased demand putting strain on the system.

US wheat futures (May-20) closed yesterday at $206.68/t, up $8.54/t on Friday’s close, with increased purchases from flour millers amid consumer stock piling cited for supporting successive gains.

Further to that, there have been signs of global export business. Chinese imports have signed a deal to purchase 756Kt of US maize for delivery in the 2019/20 marketing year. They have also agreed to buy 340Kt of hard red winter wheat, with 55Kt delivered in the 2019/20 marketing year and 285Kt delivered in the 2020/21 marketing year. This is the first major purchase since the Phase 1 trade deal signed in January. Despite the outbreak of the coronavirus, China vows to increase purchases of US agricultural commodities going forward.

After last week’s successive gains in oilseeds, markets have softened due to the absence of fundamental reactive news. US soyabean futures (May-20) closed yesterday at $324.26/t, down $0.55/t on Friday’s close. Paris rapeseed futures (May-20) closed at €348.75/t, down €0.25/t.

There has been an uptick in palm oil futures with Ramadan approaching and fundamentals around supply becoming more influential around pricing rather than crude oil. Furthermore, while palm oil plantations in Malaysia were exempt from the government lockdown initially, there has now been suspensions of some palm plantations and factories as the coronavirus spreads, threatening supply.

Fundamental news

Yesterday evening the Prime Minister outlined strict new measures to tackle the spread of the coronavirus. These included prohibiting more than two people to gather at one time and only leaving the house if necessary, for work or essential shopping and medical needs.

It will be key to see how this will affect supply chain and logistics around transportation of agricultural commodities. While those involved in the food supply chain are cited as key workers by the government, we have anecdotally heard of some issues around logistics during this and previous weeks. Until yesterday, staying at home was advised, not enforced. Therefore, in the coming weeks this will be something to monitor and feedback on.

For more information on coronavirus guidance for combinable crop deliveries and collections be sure to check out the AHDB’s guidance.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.