Stronger sterling could challenge UK grain prices: Grain market daily

Friday, 20 September 2024

Market commentary

- Global wheat markets declined yesterday due to strong competition in export markets from Black Sea grain, while US maize futures also declined due to harvest pressure. Lower than expected US wheat exports, and forecasts for rain in US winter wheat areas were also said to be factors.

- Nov-24 UK feed wheat futures fell £2.60/t yesterday to settle at £180.70/t.

- The International Grains Council (IGC) trimmed 1.0 Mt each from its forecasts for global wheat and maize production in 2024/25 yesterday. Lower estimates for the EU following adverse weather were largely offset by better Australian crops. Global wheat and maize end of season stocks were trimmed as a result. The IGC left its global soybean supply and demand forecasts largely unchanged.

- Oilseed futures also edged lower; the drop in grain prices was said to be a factor, though worries about slower harvest progress in Canada and dry weather in Brazil limited losses. Nov-24 Paris rapeseed futures edged lower, down €1.50/t to €464.25/t.

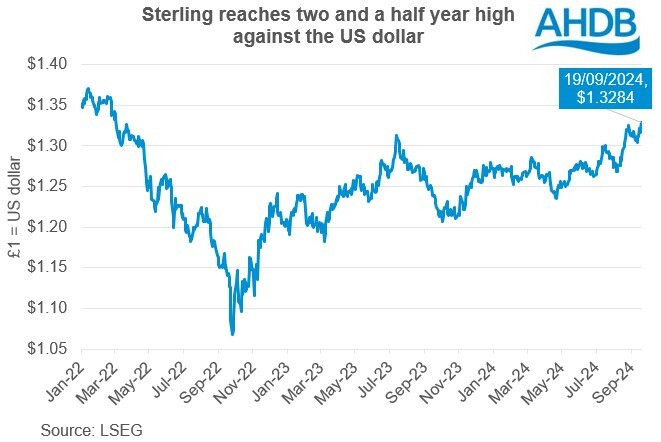

Stronger sterling could challenge UK grain prices

Yesterday sterling reached its highest level for over two and a half years against the US dollar. It also reached the third highest level against the euro since early August 2022, only slightly below the level on two days in July this year. The rise follows the Bank of England’s decision to keep interest rates unchanged at 5.0%, while the US and Eurozone central banks have recently cut interest rates.

The Bank of England voted 8 – 1 to hold the interest rate unchanged. Its governor cautioned that inflation needs to stay low before they can cut the interest rate further. Data out on Wednesday from the Office of National Statistics showed that inflation held steady at 2.2% in August. While this was unchanged from July, it also remains above the Bank of England’s target of 2.0%.

In contrast, the US central bank, the Federal Reserve, yesterday cut US interest rates by 0.5%. This was its first cut in four years and was larger than many had expected. The European Central Bank (ECB) also cut its interest rate last week.

The Bank of England makes its next decision on interest rates on 7 November. With UK interest rates now higher than many other developed economies, there’s potential for the pound to stay firmer compared to other currencies in the weeks ahead. So far this morning (20 September), sterling has made further gains after data showed stronger than expected UK retail sales.

There is some suggestion that a technical resistance level is approaching for sterling against the euro. This could make it harder to sterling to rise against the euro, but it’s no guarantee.

Impact on UK grain and oilseed prices

Stronger sterling usually makes it cheaper to import products priced in the other currency and more expensive to export to those countries. As such, a rise in the value of sterling usually puts downward pressure on UK grain and oilseed prices.

If world markets rise, a strengthened sterling usually reduces the amount of support for UK grain and oilseed prices. But if world prices decline, UK grain and oilseed prices can fall by a bigger amount.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.