Strong North American pork exports in Q1

Thursday, 14 May 2020

The US and Canada posted impressive export performances in the first quarter of the year, with increases in both volumes and prices.

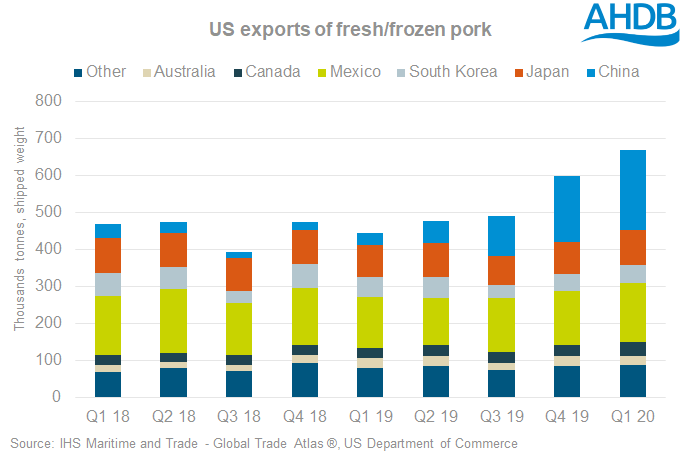

US exports of fresh and frozen pork amounted to 668,000 tonnes in the first quarter of 2020, a year on year increase of 50%. As to be expected, trade was dominated by China, which increased its imports of US pork by nearly 600%, to over 216,000 tonnes. China accounted for nearly a third of US exports. Exports to Mexico, Japan and Canada all increased, albeit more modestly, and volumes to South Korea fell slightly.

Prices achieved by US exporters increased too, by nearly 11%, to $2.65/kg. Prices to China increased by 67% to $2.46/kg. An important development in the trade between the two countries has been in carcasses. China, in the wake of ASF, has found itself with excess processing capacity, and has increased the volume of carcases it buys. The US sent 99,500 tonnes of frozen carcases in the first quarter, having sent none a year ago.

Although more modest, Canada’s export performance in the first quarter was nonetheless very good. Volumes increased by 16% to 290,000 tonnes, again underpinned by trade to Asian countries, in particular the continued strength of the Chinese market. China imported 124,000 tonnes of Canadian pork in the first quarter, up 53% year on year, and Japan imported 57,000 tonnes, up 10%. Again volumes to South Korea fell, by 28% to 6,900 tonnes. Canada also saw its average export prices rise, by 11% to US$2.75/kg.

Of course, these figures pre-date the processing capacity issues caused by outbreaks of coronavirus in important meatpacking plants in the US. Pork production has been cut dramatically, and the positive start that 2020 had in production, was severely derailed in April and May. However, most if not all processors in the US appear to be operating again now although perhaps at reduced capacity. Unfortunately, some lost production will not be regained, and there could be an oversupply of live pigs for some time to come. Sow slaughter has been elevated too in recent weeks, and this can be expected to curtail production growth in the medium term.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.