Strong demand for EU wheat going into the 2022/23 marketing year: Grain market daily

Wednesday, 20 July 2022

Market commentary

- UK wheat futures (Nov-22) closed at £267.00/t yesterday, up by £4.00/t on Monday’s close. The May-23 contract closed at £273.40/t yesterday, up by £4.50/t over the same period.

- Paris milling wheat futures (Dec-22) closed at €327.00/t, up by €3.25/t on Monday’s close. With hot weather currently impacting spring cropping. Further to that, stronger anticipated export demand has pulled prices higher, read more below as to how this could impact UK domestic prices.

- Spring crops in Germany may be at risk of yield and quality losses, following prolonged hot and dry weather conditions in June and July. But winter barley developed before the current heatwave, and its output I expected to reach 9Mt, from 8.8Mt last year (The German Farmers' Association – DBV, Refinitiv).

Strong demand for EU wheat going into the 2022/23 marketing year

With supply deficits of wheat in parts of the world for 2022/23, it is expected that there will be stronger global demand for European new crop. This demand could offer support to Paris milling wheat futures, which inherently could filter into UK domestic prices.

Over the next few weeks quantifying grain yields from the EU & Black Sea harvests will be key in setting some market sentiment for the 2022/23 marketing year.

With high EU demand to some extent factored into the market, even further demand could help maintain these historically high prices.

EU production to fill supply deficits

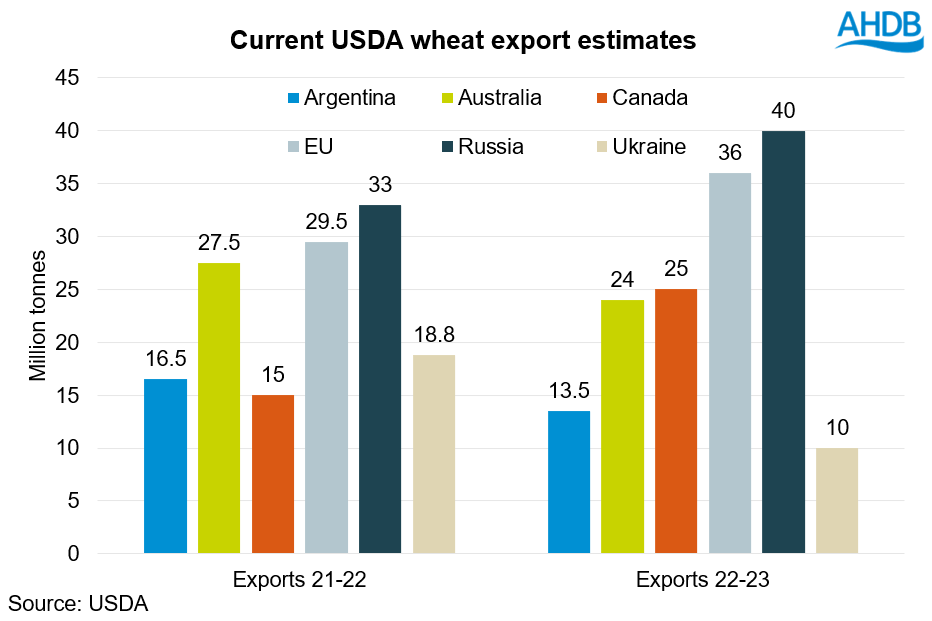

EU wheat exports are expected to reach their second-highest level on record, at 35.5Mt in 2022-23, up by 6Mt on last year.

For example, recent drought conditions and the ongoing war has severely hampered Ukraine’s wheat output prospects for 2022/23. Production is pegged at just 19.5Mt for this season, and export availability is set to reach its lowest in 8 years, at just 10Mt (USDA).

Furthermore, there is year-on-year declines to both Argentina (-2.7Mt) and Australia’s (-6.3Mt) wheat production for 2022/23. This has been reflected in their export capacity too, which is down 3Mt and 3.5Mt, respectively.

Strong demand for EU origin?

Going into 2022/23 North Africa could be set to be a more prominent destination for EU new crop wheat, given its typical reliance on Ukrainian product and its close proximity to EU seller markets.

Egyptian state-run grains buyer (GASC) this month relaxed wheat moisture allowance to 14% to attract more European sellers.

French new-crop sales to Egypt reached 520Kt between 30 June – 4 July, surpassing the 265Kt France sold to Egypt during the entire 2021/22 season (stratégie grains). Further to that, it’s reported that Germany has already sold 1Mt of new-crop in advance to buyers in Africa and Iran (Reuters).

FranceAgriMer projects 10.3Mt of soft wheat will go to non-EU countries this year, in particular to key destinations in North African nations. This would be a three-year high for French non-EU exports, and up by 17% on the 8.8Mt exported out of the bloc in 2021-22.

Conclusion

Although the UK has the potential to export for 2022/23, UK feed wheat futures will still follow the global market sentiment of Paris milling wheat futures. If demand for EU origin is higher than currently anticipated prices could remain supported.

Adding to this support also is the recent hot and dry conditions in the EU. This could have hindered production and created a tighter situation if third country demand is to remain strong.

Next months USDA World Agricultural Supply & Demand Estimate (WASDE) could be a real sentiment setter for the 2022/23 marketing year, as this recent dry weather could be factored into revised estimates.

Further to that, Russian grain consultancy SovEcon is currently pegging wheat output to be nearer 89.2Mt for 2022-23, which outstrips recent WASDE estimates by over 8Mt. If Russian production is revised up this could mean fewer export prospects for the EU, but this is a watchpoint.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.