Strong Chinese demand continues to support global prices: Grain Market Daily

Friday, 29 January 2021

Market Commentary

- Old crop wheat futures (May-21) lost £2.00/t on the week from Thurs-Thurs to close at £207.50/t. Over this same period new crop (Nov-21) lost just £0.25/t to close at £165.60/t.

- Chicago old crop wheat (May-21) also lost ground Thurs-Thurs closing last night at $237.89/t, a loss of $5.42/t. However, Chicago maize (May-21) gained on the week, up $3.94/t since last Thursday to close at $211.12/t.

- The Buenos Aires Grain Exchange have slightly reduced Argentina’s soyabean crop once more by 0.5Mt to 46.0Mt due to hot, dry weather.

- Ukraine’s grain exports continue to slow, now 20% behind last marketing year at just 28.7Mt (Refinitiv). Ukraine exported 57.0Mt of grains last year, however the government say this could fall to 45.4Mt in the 2020/21 marketing year.

Strong Chinese demand continues to support global prices

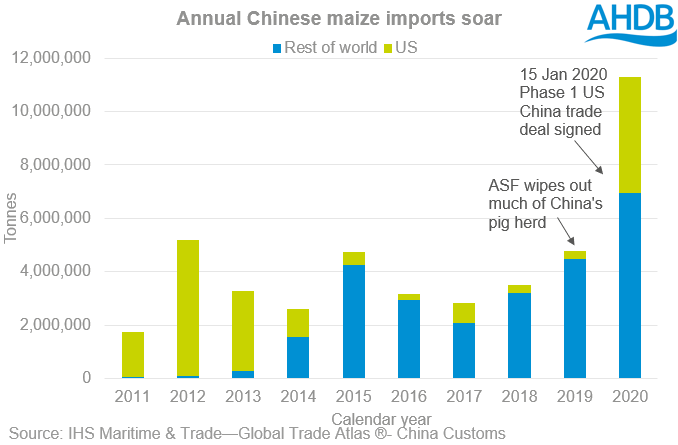

Chinese maize imports in 2020 reached record levels at 11.3Mt. This was more than double levels seen in 2019 and well above their annual quota, which had been set at 7.2Mt.

It is now thought that Chinese maize imports could be 25-27Mt this season (2020/21), with 18-20Mt of this coming from the US, according to AgResource Co. These levels could get up to 40Mt in the coming years, as their pig herd continues to expand.

Maize imports look to stay strong in 2021

This week, two large bookings of US maize to China were announced by the USDA. On Tuesday 1.36Mt was booked. At time the time, this was the largest sale announced since July and the fifth largest ever sale of US maize to China.

After the deal was announced Chicago futures rallied again, having taken a breather at the end of last week. The May-21 contract jumped 3.8%.

Then yesterday, a further 1.7Mt purchase was announced. This is the sixth largest single day sale of US maize in records dating back to 1977, according to Refinitiv.

The majority of this demand has come as China have used a lot of their maize stocks as they rebuild their pig herd. The herd was largely decimated by African Swine Fever (ASF) through 2019.

Soyabeans and ethanol imports rise too

Maize isn’t the only commodity breaking records this season, with soyabean imports also reaching an all time high. At 100.3Mt, this is 13% higher than in 2019.

Again, this rise is mainly driven by pig feed demand as numbers recover. Also, as prices have backed away from recent highs, margins have improved again, incentivising increased production levels.

Chinese demand is not only supporting US grains and oilseeds at the moment, but also US ethanol. China has started buying US ethanol again for the first time in a few years.

China has bought c. 200 million gallons of US ethanol for the first half of 2021, according to Archer Daniel Midlands Co (ADM). The largest annual Chinese imports of US ethanol to date stand at 198.1 million gallons, in 2016.

This is positive news for the US ethanol sector, which has been well supplied in recent years and then was also hit hard by the coronavirus pandemic. However, despite increased Chinese purchasing it is still thought that 10-15% of US ethanol production capacity is currently turned off (Refinitiv).

The reason for this sudden increase in ethanol imports is two-fold. Firstly, the tight domestic supply of maize led to Chinese maize prices reaching levels not seen in 30 years. This makes it financially unviable for China to produce enough ethanol to cover demand. Secondly, ethanol can be used as the alcoholic base of disinfectants, for which demand is very strong due to the ongoing pandemic.

Longer term support for prices?

If China continue this aggressive import campaign, and it would seem it is likely, this will continue to be a factor underpinning US prices. As UK prices are largely led by global factors this could, in turn, continue to provide support for our domestic prices. On the other hand, if we see a large harvest in the US this year, or a big production year in China, supply may be enough to cover demand. This could temper the support for prices or possibly start to put downwards pressure on the market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.