Spanish pork exports rise again

Thursday, 5 March 2020

By Hannah Clarke

Spain exported nearly 2.3 million tonnes of pig meat (incl. offal) during 2019, up 14% from the year before. Three-quarters of this was fresh/frozen pork, exports of which totalled 1.7 million tonnes. This was up 12% from 2018.

Higher average prices grew the value of these exports to over €6 billion, up 28% on 2018.

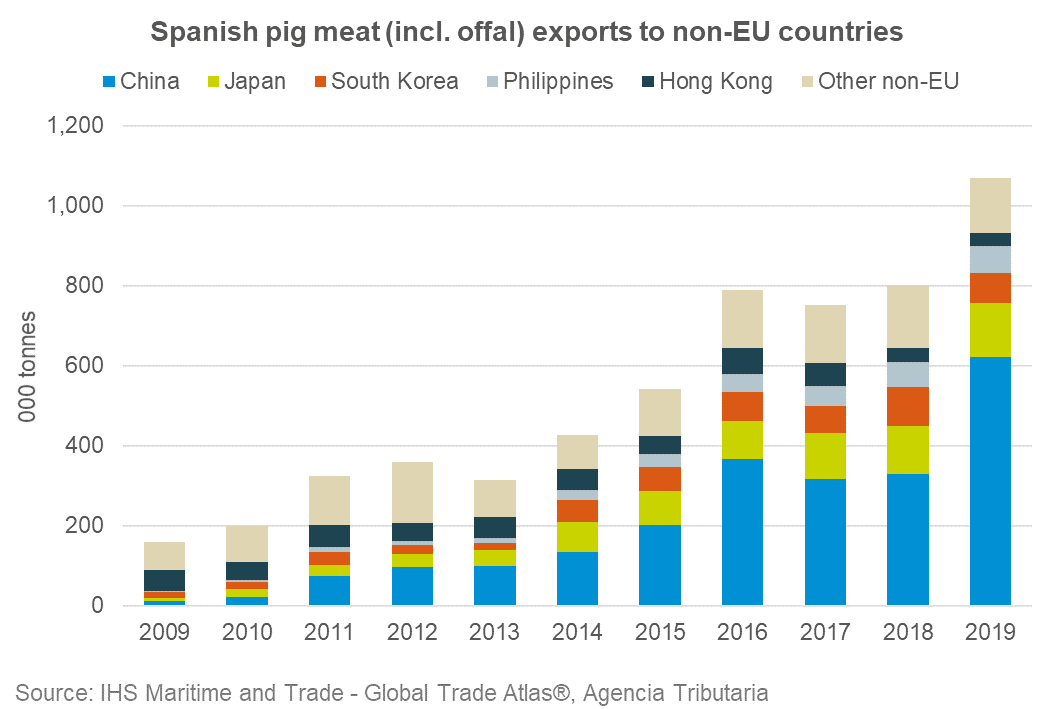

Exports were strengthened by a 33% increase in shipments to non-EU destinations*. In total, Spain sent nearly 1.1 million tonnes of pig meat to third countries during 2019, 268,500 tonnes more than the year previous. This was primarily driven by an increase in shipments to China, which nearly doubled on the year to 620,800 tonnes. Spain was the largest supplier of pork to China in 2019, according to Chinese import data.

Pig meat exports to the EU (including UK) grew 1% on the year, totalling nearly 1.2 million tonnes. Just over 80% of this was fresh/frozen pork, exports of which grew only marginally on the year to 954,700 tonnes.

The growth in Spanish exports has been supported by a continued rise in production during 2019. According to Eurostat data, Spain produced 4.6 million tonnes of pig meat during the year, 2% (+96,700 tonnes) more than in 2018. Total slaughter was 52.9 million pigs, up 1% on the year before. The rise in production follows a period of increased investment in slaughter capacity and cutting plants. Further growth is expected this year, with breeding sow numbers up another 3% year-on-year in December.

Reports suggest that despite China’s large meat deficit, the coronavirus outbreak in the country is disrupting meat shipments and slowing orders. As a result, Spanish frozen stocks are growing in wait for Chinese trade to resume. Spain is already a large net exporter of pig meat products. With domestic consumption idling, it needs a strong export market to manage its growing supplies. However, this year the success of this will be influenced by the management of ASF and coronavirus (both in China and in Europe), and competition from cheaper US pork into China following trade agreements.

*Excluding the UK

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.