Soya support to allow further rapeseed gains? Grain Market Daily

Tuesday, 1 October 2019

Market Commentary

- UK feed wheat futures continues to recover, Nov-19 up another pound yesterday to close at £139.00/t.

- Support for grain markets has come as US stocks of maize were below market expectations, with Chicago maize futures (Dec-19) jumping $6.50/t yesterday.

- Oilseed markets have also received support from stock levels being below market expectations (read more below).

Soya support to allow further rapeseed gains?

The underlying oilseed complex has been showing signs of support, allowing further upward potential for rapeseed markets. Support for soyabeans is currently being provided by three factors:

Stocks

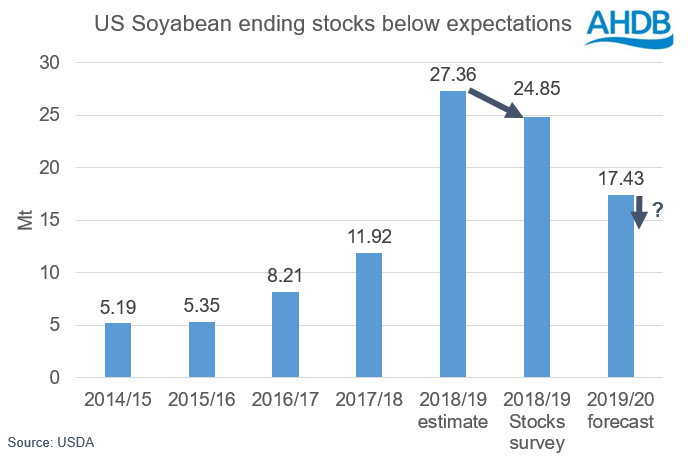

Record stock levels in the US following the trade dispute with China have weighed on the oilseed market. However, in Mondays USDA stock report, US soybean stocks were below market expectations.

At 24.8Mt, stocks of US soyabeans are certainly at record levels, yet well below the 26.7Mt expected in a pre-report trade poll. Additionally, at 24.8Mt on the 1 September, this is well below the previous USDA WASDE US ending stocks forecast of 27.36Mt.

China begins meaningful purchases once more

As well as below market expectations for stock levels, China have returned to buying US soyabeans as part of a tariff-free quota ahead of trade talks.

So far during September, net sales of 982Kt of new crop soyabeans to the US have been confirmed by the USDA, with reports of further buying as part of a ‘good will’ temporary removal of tariffs.

Delayed development

Following the very wet spring, planting of soyabeans was delayed, which has in turn impacted development.

At just 55% of the US crop dropping leaves, this is over 20 percentage points behind average, with key states such as Illinois even further behind.

With development over 20 percentage points behind, harvest has too been delayed. With just 7% of the crop harvested as at September 29, well below the 20% average.

With development and harvest falling behind, further questions over yield will be raised, potentially further reducing the volume of soyabeans in the US for 2019/20. As such, ending stock forecasts may well be revised downward in the next USDA WASDE report.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.