Smallest UK oilseed rape crop since 2004/05: Grain Market Daily

Friday, 23 August 2019

Market Commentary

- UK feed wheat futures (Nov-19) continued their recent decline yesterday, closing £0.60/t lower at £135.50/t, and a new contract low.

- With a general bearish trend in UK feed wheat driven by a large supply outlook, the short term moving averages (20-day and 50-day) have continued their fall below the long term average.

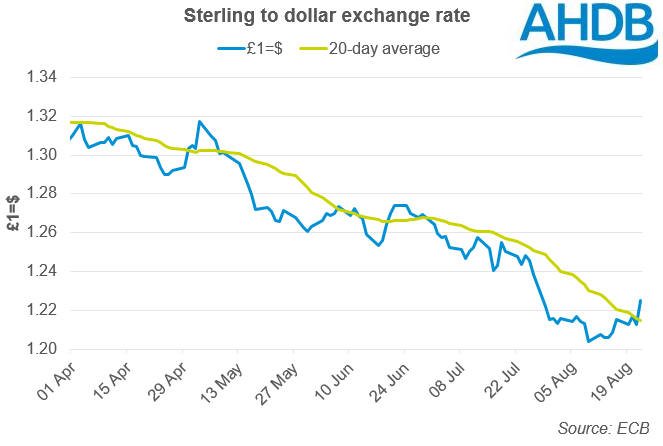

- Part of the loss in UK futures yesterday was dictated by the significant gain in sterling, up more than 1% to £1=$1.2252 on Brexit optimism (read more below). The market is quiet so far this morning in the lead up to Monday’s bank holiday.

Smallest UK oilseed rape crop since 2004/05

- UK winter barley and oilseed rape harvests 98% and 95% comlpete respectively.

- Using harvest survey yield estimates winter barley crop estimated at 3.08Mt to 3.17Mt.

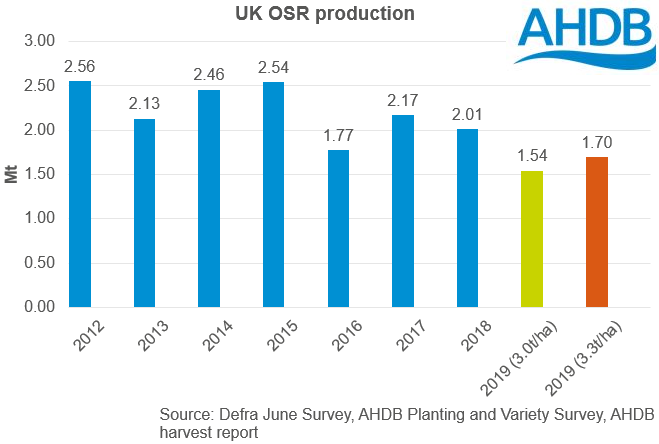

- Oilseed rape crop estimated at 1.54Mt to 1.70Mt, the smallest since 2004/05

The latest AHDB harvest report highlights that the winter barley and winter oilseed rape harvest are all but complete, at 98% and 95% respectively. Yields for winter barley are estimated at 7.3-7.5t/ha, 4-7% above the five year average of 7.0t/ha. Conversely, yields for OSR are estimated at 3.0-3.3t/ha, a 6-15% drop on the five year average (3.5t/ha).

With this in mind we can provisionally estimate the size of the winter barley and oilseed rape crops, based upon the planting and variety survey area estimates;

- Winter barley production – 3.08-3.17Mt, up 17%-20% year-on-year (area – 422kha).

- Oilseed rape – 1.54-1.70Mt, down 16%-23% year-on-year, and the smallest crop since 2004/05 (area – 514Kha).

The latest report also highlights the slow harvest pace following rainfall last week. To the week ending 20 August 31% of the UK winter wheat area had been cut, with yields still above average (8.5t/ha-9.0t/ha vs. 8.3t/ha).

The implication of last week’s wet weather on quality is largely unknown with the report highlighting that the wheat sampled so far is primarily from the south and east and was cut before recent rainfall.

Anecdotally, there are indications that Hagberg Falling Numbers have been dropping, particularly in the West Midlands and South West. This will be watched closely as the wheat harvest progresses.

Rise and fall of sterling pushing wheat

- Sterling gained significantly on Brexit optimism yesterday, pushing the wheat prices lower.

- However, further statements from EU political leaders this morning have seen sterling weaken in early trading.

Sterling ended yesterday at £1=$1.2252 and £1=€1.1056, more than three week highs. The move higher comes with increased Brexit optimism following meetings between EU leaders and Boris Johnson.

Suggestions that the UK could find a solution to the Irish backstop arrangement by 31 October were viewed positively by the market.

However, despite yesterday’s “progress” sterling has lost half of the ground it made up yesterday, following comment from Emmanuel Macron that it is too late for a full renegotiation of the Brexit deal. If the move lower in sterling continues throughout today, UK cereal and oilseed prices will find support against movements in EU and global markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.