Shifts in Spanish pig meat exports and European pig prices

Thursday, 12 November 2020

By Charlie Reeve

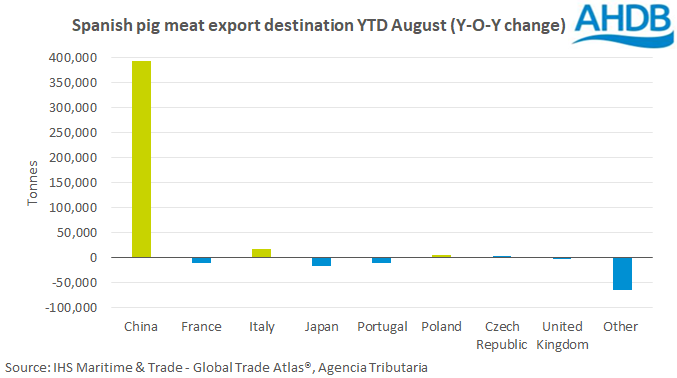

Spanish pig meat exports (inc offal) have continued to increase year-on-year, driven by increases in production and the development of processing facilities in the country. Based on the first eight months of trade during 2020, Spain exported 1,742,000 tonnes of pig meat, up 307,000 tonnes year-on-year.

The destination for Spanish pig meat exports has been shifting with a high proportion now leaving the EU. During the first eight months of 2020, China accounted for 42% (726,000 tonnes) of Spanish pig meat exports, compared to the same period of 2019 when it accounted for just 23%.

Demand for imported proteins in China remains firm although its own domestic pig herd is rebuilding. Spain isn’t the only country benefitting from the increased Chinese demand, Brazil and the U.S. have also been increasing volumes of pig meat exports to China.

Spanish pig meat exports staying within the EU have dropped back marginally so far this year to 734,600 tonnes, during the first eight months of trade. This is likely to be due a combination of higher demand in China and lower demand within the EU following the Coronavirus outbreak.

Production in Spain is a growing force, and further development of new processing facilities is likely to extend this further. Reports of meat processing plants that had been impacted by coronavirus earlier in the year due to staffing issues are returning to normal capacity again. In 2019, Spain bucked the European trend and increased pig numbers to 31,250,000 head at a time when the overall EU pig herd was reducing.

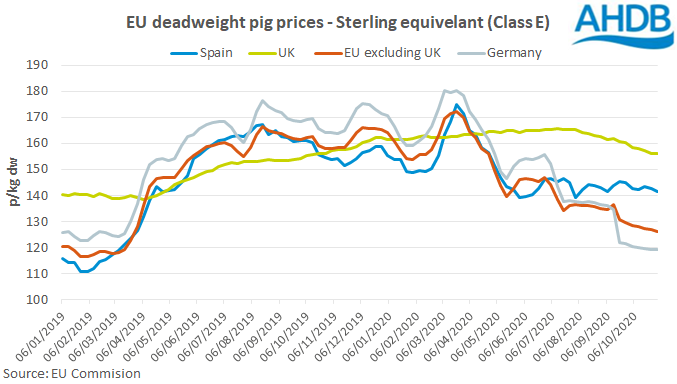

Class E deadweight pig prices in Spain averaged £141.44/100kg for the week ending 1 November, a decrease of £12.11 on the same week of the previous year. Prices in Spain remain 15.3p/kg above the EU (exc UK) average, which has been driven down in recent months by a notable fall in German prices.

The UK deadweight price has remained at a premium to prices on the continent since May, stronger retail demand has helped to towards this, although restrictions and closures in the food service sector in UK has still had detrimental effect.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.