Shifting the pecking order - trends in poultry feed: Grain market daily

Wednesday, 25 June 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £180.55/t yesterday down £2.45 (-1.34%) on the previous close

- UK feed wheat futures followed global markets. Crude oil (nearby) closed at $67.14/barrel a fall of 6.1% from the previous day. This was a key driver in the bearish sentiment that surrounded global markets as tensions eased in the Middle East. Declines in the dollar against the euro to recent lows also led to adjustments being made across markets. Selling of funds as well as good weather in the USA has put downward pressure on markets too

- Paris rapeseed futures (Nov-25) closed €13.25/t (-2.61%) lower than the previous session at €494.00/t. This followed global trends with Winnipeg canola (Nov -25) down -2.6% and Chicago soyabeans (Nov-25) down -0.9%

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Shifting the pecking order - trends in poultry feed

With animal feed accounting for over 50% of total domestic cereal usage, monitoring animal feed usage is vital, especially as feed dynamics have shifted slightly in recent years.

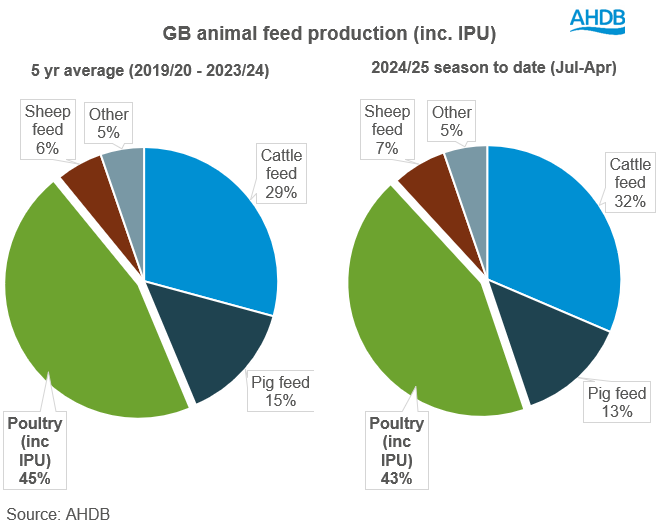

Poultry feed production, including integrated poultry units (IPU), continues to hold the largest share of animal feed demand.

However, the percentage share that poultry feed demand has, has dropped slightly this season (Jul – Apr) compared with the previous five-year average (Figure 1).

After recovering somewhat in 2023/24, total GB poultry feed production (inc. IPU) from July 24 to April 25, is down 2% on the same period in 2023/24.

What has driven the decline?

From a broiler perspective, a number of large UK supermarkets have committed to reducing bird stocking densities to improve welfare standards. This has led to a 21% reduction in stocking rates for some producers, down from 38kg/m² to 30kg/m².

In addition, avian influenza outbreaks and higher energy costs have impacted producer margins.

Feed typically represents around 50% of total broiler production costs. However, in 2023/24 data from the Farm Business Survey showed feed accounted for 64.3% of total costs.

While there has been reductions in costs recently, they have not returned to pre-war levels.

Looking ahead

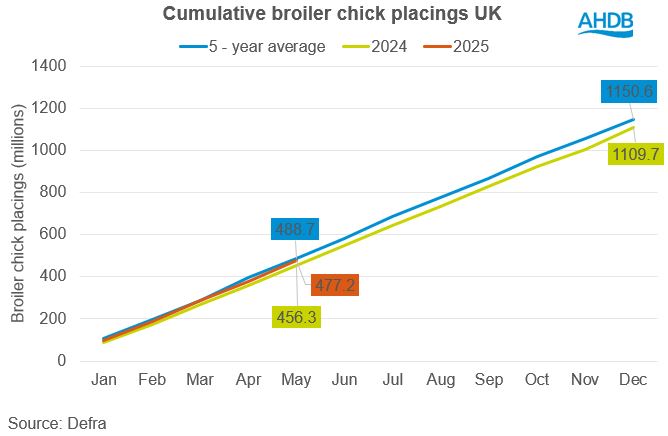

We can look at Defra data on the number of chick placings to gauge numbers of broilers in the UK.

Placements have fallen consistently since their peak in 2021 at just under 1.19 billion chicks down 6.5% to 1.11 billion in 2024.

January to May in 2025 has seen the first signs of growth since 2021 with placings up 4.6% (477.3 million) compared to the same point last year.

There is no slowing in demand either with UK consumption of poultry projected to increase by 250g per person per year by 2028 (retail weight, OECD).

For layers, 2020 was the peak of layer placings in the UK with 40.5 million head. Numbers dropped off after this to a nine year low in 2022 to 34.2 million chicks.

Reasons hold parallel to that of the broiler industry, fuel and heat costs up 12% and 19% respectively (Farm business survey), with prices being paid by retailers, not matching the rise in costs.

As for feed, layers make up a smaller proportion of total feed consumption compared with broilers, but still substantial.

Looking forward, the laying sector still has room for growth and is not yet back to 2020 capacity. However, from January to May, UK layer chick placings were up 3% on year earlier levels, suggesting growth in the sector.

What does this mean for feed?

Looking further ahead, the anticipated rise in demand for poultry meat is likely to drive increases in feed usage.

However, longer-term projections are complicated by external pressures, particularly the uncertainty surrounding future trade agreements and ongoing volatility in global energy and input markets.

These will influence feed and input costs and longer-term production decisions. This is a similar situation for layers.

All this said, the steady rise in broiler and layer placings is somewhat of a positive for cereals demand for the coming season.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.