September export data shows record pace continued: Grain Market Daily

Tuesday, 12 November 2019

Market Commentary

- UK Feed wheat futures (May-20) closed yesterday at £150.25/t, down £1.00/t from Friday, possibly a reaction to sterling closing yesterday at £1=€1.1648, up from €1.1588 on Friday.

- In contrast, Nov-20 UK Feed wheat futures closed yesterday at £158.70/t, gaining £6.20/t since the start of the month. Recent adverse weather leading to delayed drilling of new-crop could support this gain.

- EU wheat market weakens as Russian export competition escalates; on Friday the U.S Department of Agriculture revised Russian wheat exports to 34.5Mt (34Mt previously). Dec-19 Paris milling wheat futures closed at €177.25/t yesterday, down €1.25/t.

- AHDB’s 2019 Early Bird Survey of UK planting intentions is due for release week commencing 25 November. Click here for more details.

September export data shows record pace continued

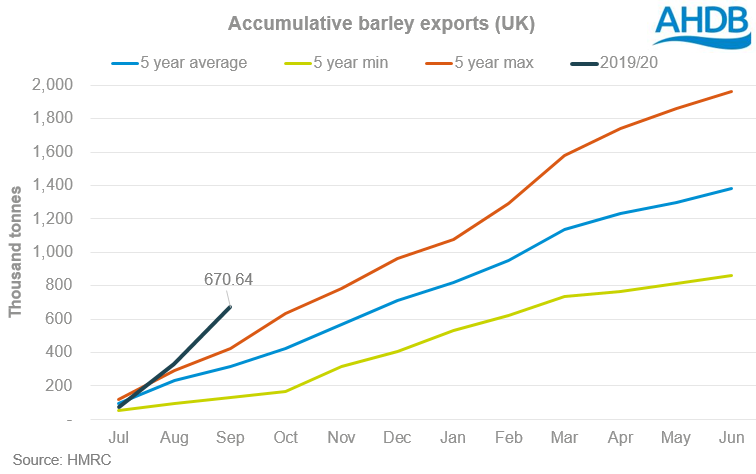

Yesterday’s HMRC export data quoted 341.0Kt of barley was exported from the UK during September. This volume is just shy of the cumulative barley exports from July to September in 2015/16, another large crop year. Cumulative to September, this seasons barley exports total 670.6Kt, 78% of last year’s entire barley exports.

This export push in the first three months, 94% to the EU, will have been partially lead by future trading uncertainty following the then 31 October Brexit. Secondly, a large crop and subsequently sizeable exportable surplus from 2019 harvest was present. The early balance sheet is showing a barley surplus for export or free stock of 2.355Mt this season, meaning that by the end of September only 28% was exported, regardless of the record pace. October exports, up to the middle of the month, are also expected at significant volumes, but this won’t be confirmed by HMRC data until early December.

September wheat exports were the highest since 2010, at 262.7Kt. In total, 603.7Kt of wheat and barley moved out of the UK in September, so unsurprisingly we were hearing ports were “full”. Although September wheat exports were at near-record levels, the accumulative figure is below the same point in 2016/17.

Barley usage for GB animal feed and UK brewsters, malsters and distillers is up!

Thursday’s latest GB animal feed production figures show a decrease in animal feed production for this season (Jul-Sept) for both cattle (and calves) and sheep by (-)12.1% and (-)38.5% respectively versus same period last season. This is unsurprising considering the challenging summer last season resulting in extra feed requirements on farm.

Although more wheat has been used in feed production than barley this year, compared to last year there has been a shift. Season-to-date figures show barley usage in feed production has increased 5.7%, to 285.1Kt, while wheat usage has dropped (-)4.1%, to 927.4Kt.

UK human and industrial usage data, also released on Thursday, highlights wheat used by UK millers throughout September was primarily (88%) homegrown, up 13% versus September 2018. However, the overall wheat milled this season (Jul-Sept) fell by (-)16.3%.

So far this season, UK brewsters, malsters and distillers have used 477.4Kt of barley, up 3.4% from 2018/19. They have also used 11.4% more wheat this season so far, at 187.5Kt. For the month of September alone, the usage of barley is relatively unchanged (down (-)0.3%) compared to last year but wheat usage is down (-)9.2%.

For further information and the full usage data sets, visit our website.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.