Record US maize crop weighs on grain prices: Grain market daily

Tuesday, 19 August 2025

Market commentary

- UK feed wheat futures (Nov-25) closed up £0.25/t (0.2%) at £167.25/t yesterday. The May-26 contract was down £0.05/t yesterday, closing at £178.95/t.

- UK feed wheat futures rose yesterday following Paris milling wheat futures. Paris milling wheat futures (Dec-25) increased by 0.1%, while Chicago wheat futures (Dec-25) fell 0.4%. Yesterday, information about the sale of French wheat to Egypt supported Paris milling wheat futures, while Chicago wheat futures were under pressure from an increased production forecast in Russia. IKAR increased its forecast from 84.5 Mt to 85.8 Mt.

- As of 17 August, the proportion of the maize crop in the US in good or excellent condition decreased by 1% compared to the previous week at 71%. There’s more on the influence of US maize prospects below.

- Paris rapeseed futures (Nov-25) increased by €1.25/t (0.3%) to close at €475.00/t. Winnipeg canola and Chicago soyabean futures (Nov-25) fell yesterday, by 1.4% and 0.1% respectively. China has bought its first Australian canola cargo since 2020 (LSEG).

Record US maize crop weighs on grain prices

Last Tuesday, the USDA released its World Agricultural Supply and Demand Estimates (WASDE), which saw Chicago and Paris grain futures decrease. This was mainly due to world maize ending stocks being higher than average trade estimates. Compared to the July forecast, world maize ending stocks for the 2025/26 season increased by 10.5 Mt. According to the latest forecast, global maize production could reach a historic high of 1,288.6 Mt, which is 24.9 Mt higher than in the July WASDE report.

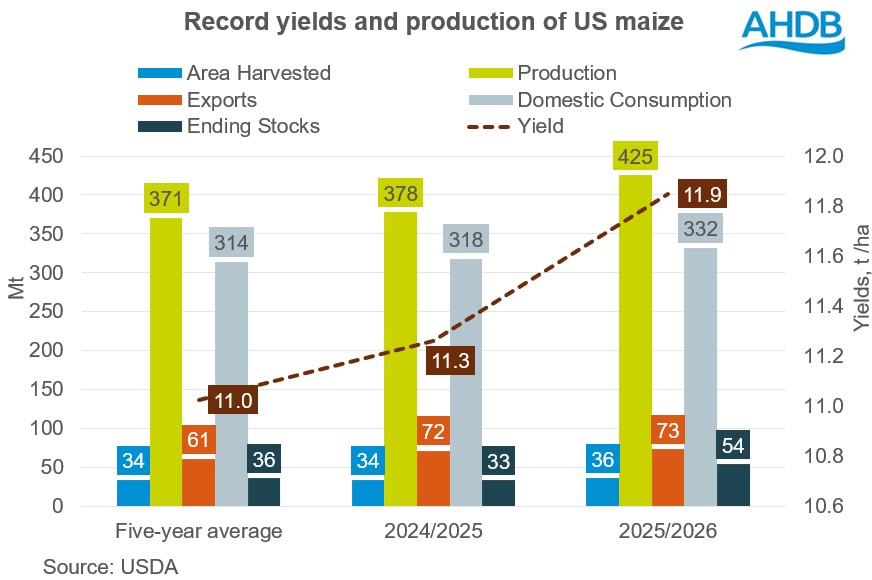

The main driver behind the increased forecast for world maize production and ending stocks for the 2025/26 season was the US crop. Indeed, the increased area of maize in the US, coupled with historically favourable crop conditions, could result in a record maize production of 425.3 Mt.

The forecast harvested area for the 2025/26 US maize is over 2 Mha higher than the previous year and the five-year average. Yields could reach 11.9 t/ha, which is an increase of 0.6 t/ha compared to the 2024/25 harvest and 0.8 t/ha higher than the five-year average.

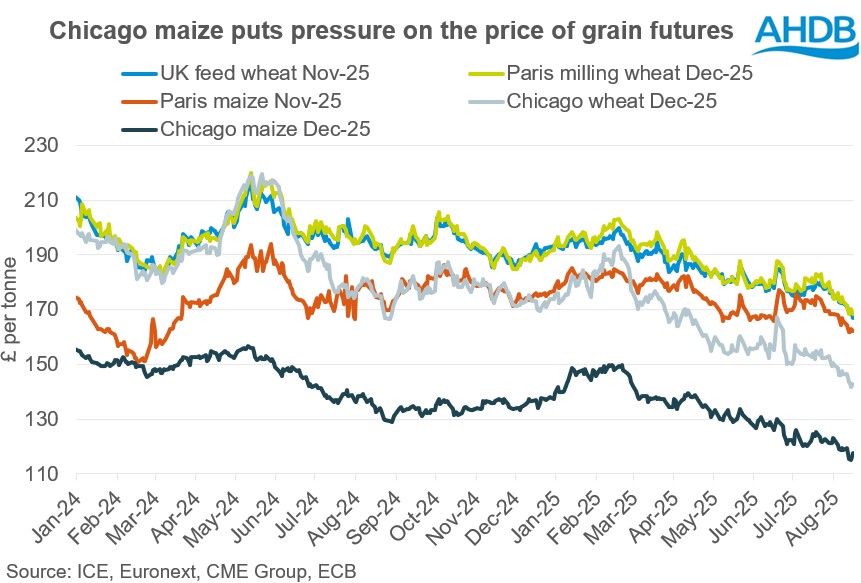

As can be seen in the price chart, global grain futures have been in a downward trend since February 2025. The price difference between Chicago maize futures and other grain futures is high, which puts additional pressure on global grain prices.

Looking ahead

In the short and medium term, especially during the active phase of the US harvest campaign, Chicago maize could come under further pressure. As a result, the global feed grain complex, including UK domestic feed wheat futures, could also be under pressure.

However, despite record-breaking maize production in the United States, global ending stocks in the 2025/26 season are expected to be 6.8% lower than the five-year average. This fact could support maize prices in the long term, depending on the impact of global export rates and domestic consumption.

The Pro Farmer Crop Tour taking place in the US this week from 18 to 21 August. This is an important event to watch this week as it offers more insights into US maize yield potential.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.