Record UK maize imports in March: Grain market daily

Tuesday, 20 May 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £180.45/t yesterday, down £0.90/t from Friday’s close. The May-26 contract fell £0.70/t over the same period, to close at £190.20/t.

- Domestic wheat prices followed movements in the Paris grain markets yesterday. Chicago wheat (Dec-25) gained 0.7%, while Paris milling wheat futures (Dec-25) fell 0.8% at yesterday's close. The stronger euro against the US dollar put pressure on Paris futures and supported Chicago futures.

- Nov-25 Paris rapeseed futures ended yesterday’s session at €488.75/t, up €0.75/t from Friday’s session.

- Chicago soyabean and Winnipeg canola futures (Nov-25) were up by 0.1% and 0.85% respectively. Soyabean oil and palm oil futures gained yesterday supporting the oilseeds complex.

Record UK maize imports in March

On Thursday, HMRC published the latest UK trade data, including figures up to the end of March. The updated data revealed a strong pace of maize and wheat imports for the 2024/25 season overall, as well as in March.

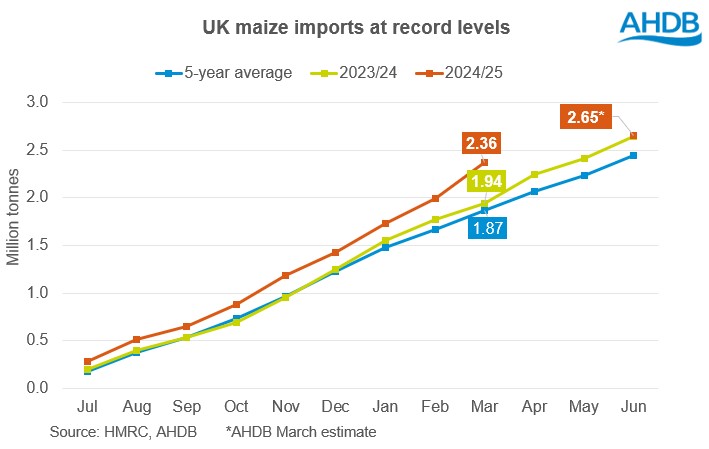

Maize imports in March reached 373.96 Kt, marking a 43.4% increase compared to February and representing the highest monthly import level in five years.

Season-to-date (Jul-Mar) maize imports totalled 2.36 Mt, up 22% on year earlier levels, and 27% on the five-year average. In March, AHDB estimated full-season imports would total 2.65 Mt. To reach this figure, the import pace would need to average 95.8 Kt per month, which is well below the 373.96 Kt imported in March.

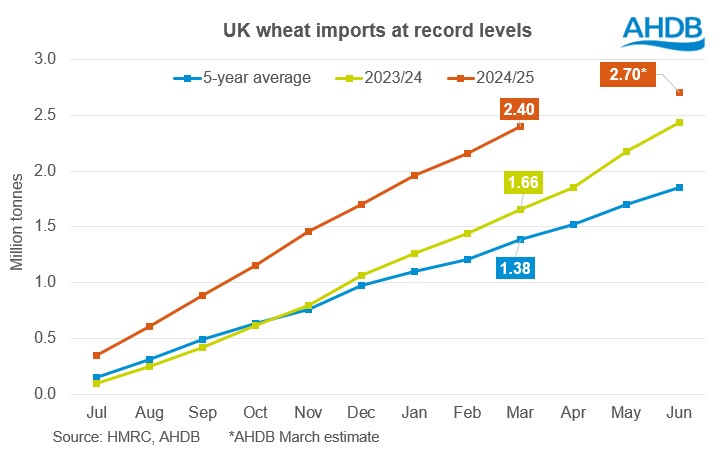

Wheat imports in March, (including durum wheat) reached 243.85 Kt, which is a 25% increase compared to February.

Wheat imports (incl. durum wheat) totalled 2.4 Mt from July – March, up 45% on the same period last year, and up 74% on the five-year average. In March, AHDB estimated that full-season wheat imports would reach 2.70 Mt. As such, in order to reach this estimate, imports would need to average 99.6 Kt a month for the remainder of the season.

AHDB are due to publish updated UK supply and demand estimates at the end of this month. Any changes to expected full season imports, would likely also impact carry in stocks and the supply outlook into next season.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.