Rapid UK oat exports in first half of 2023/24: Grain market daily

Tuesday, 20 February 2024

Market commentary

- European wheat prices continued to fall yesterday, with competition for export demand still the main driver. The May-24 Paris milling wheat contract traded below a key technical price point, which added further pressure.

- The US markets were closed due to a national holiday for Presidents Day.

- May-24 UK feed wheat futures fell a further £3.15/t yesterday to close at £160.00/t, while the Nov-24 contract lost £2.15/t to settle at £178.50/t.

- The Brazilian soyabean harvest reached 29% complete by 17 February according to Conab, up from 23% a year ago. Planting of the Safrinha maize crop also continues to go well, reaching 45% complete by 17 Feb, versus 33% at this point last year.

- Paris rapeseed futures edged lower, following a dip in palm oil futures prices. The May-24 Paris rapeseed contract closed at €426.75/t (approx. £364.50/t), down €0.75/t from Friday’s close. The Nov-24 contract was down by €1.00/t over the same period to €428.25/t (approx. £366.00/t).

Rapid UK oat exports in first half of 2023/24

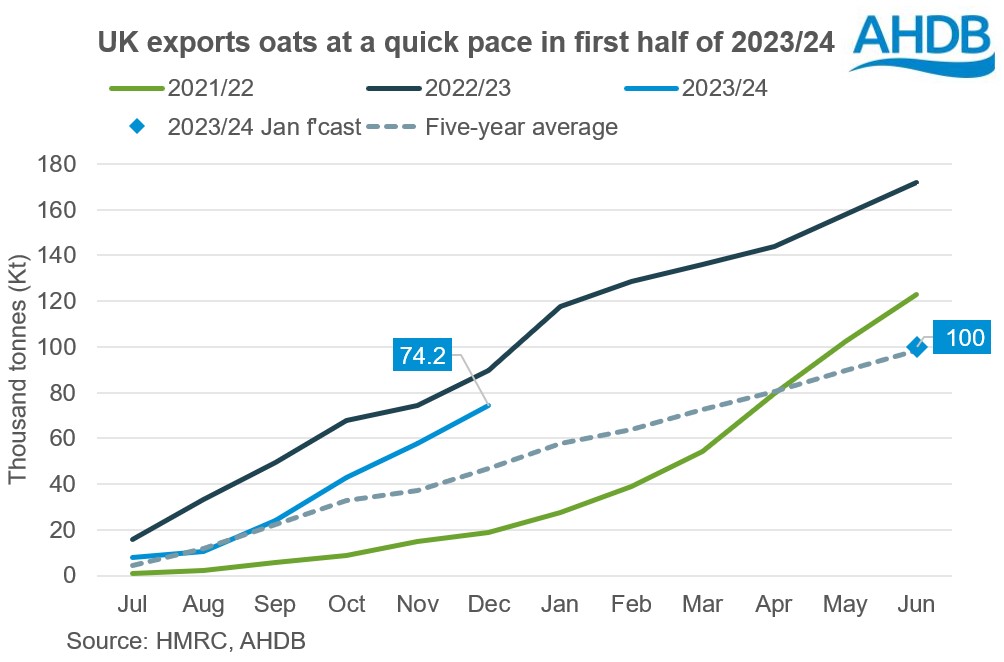

In the first half of the 2023/24 marketing season the UK exported oats at a faster pace than average, despite a below average availability.

From 1 July to 31 December 2023 the UK exported 74.2 Kt of oats (HMRC). This is down from 89.5 Kt in the first half of the 2022/23 season but well above the five-year average of 46.8 Kt for the first six months of the season. This pace is despite total UK 2023/24 oat supply, which was estimated at 995 Kt in January, falling 15% below the five-season average of 1,171 Kt.

The pace is being driven by demand from the EU, with Belgium (33.0 Kt), Spain (13.8 Kt) and Germany (12.5 Kt) the main destinations. This follows a 20% fall in EU-27 oat production in 2023 due to combination of lower area and poorer yields (EU Commission).

In January, AHDB forecast UK oat exports this season at 100 Kt, based on the data and insight available at that point. This leaves 25.8 Kt to be shipped from 1 January to 30 June to meet the current forecast, or 4.3 Kt a month on average. So, if the pace of oat exports seen in the first half of the season continued, the total volume shipped could exceed this estimate. However, is this feasible?

To enable the Jul-Dec pace to continue, demand would need to slip below current expectations, or stocks would need tighten even further. Oat demand is currently forecast to fall 7% year-on-year, while stocks are expected to drop by 41% in 2023/24.

But it does seem like the export pace is slowing. The EU Commission reports that the EU-27 had imported 76.4 Kt of oats from the UK by 12 February, only 2.2 Kt more than what HMRC reports was shipped by end-December. This will continue to be monitored over the coming weeks and months.

AHDB releases its next forecasts of UK wheat, barley, maize and oat supply and demand on 28 March.

Other trade highlights:

- UK barley exports totalled 405.6 Kt from Jul-Dec. This is 32% less than the same period last season but seemingly on track for the current full season forecast of 700 Kt.

- Total UK wheat imports reached 1.01 Mt by end of December, with the pace seeming to accelerate in December. Total season imports are currently forecast at 1.725 Mt.

- The UK exported just 155.9 Kt of wheat by end-December, the slowest pace since 2020/21.

- UK maize imports reached 2.31 Mt at the end of December. To reach the current full season forecast for 2023/24, the UK maize imports need to average just under 179.9 Kt a month from January to June. This compares to average imports of 205.1 Kt per month so far this season.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.