Rapeseed rally loses momentum: Grain market daily

Wednesday, 10 July 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £196.95/t yesterday, up £1.30/t from Monday’s close. The May-25 contract gained £2.00/t over the same period, to close at £206.65/t.

- Concerns regarding lower wheat yields in Europe supported global wheat markets yesterday. France’s Ministry of Agriculture forecast a 15% decline on the year for their soft wheat crop to 29.7 Mt. There are also concerns that Hurricane Beryl could slow the US wheat harvest in the US plains as it brings increased rainfall.

- Paris rapeseed futures (Nov-24) closed at €490.25/t yesterday, falling €11.25/t from Monday’s close. The May-25 contract fell €10.25/t over the same period, to close at €491.75/t.

- Paris rapeseed futures fell following weakness in the wider vegetables oils complex, see below for more information on this.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Rapeseed rally loses momentum

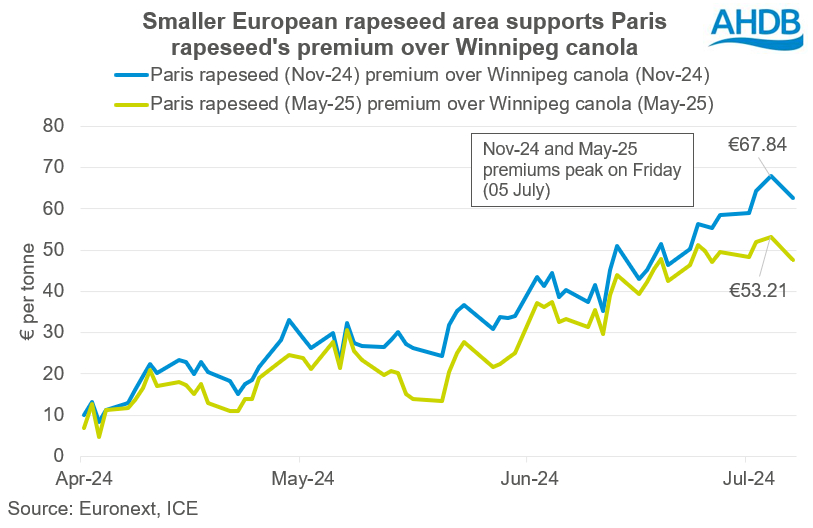

Last Friday (05 July), Paris rapeseed futures (Nov-24 and May-25) closed at highs not seen since November 2022. The Nov-24 contract closed at €514.50/t after rising €45.75/t over the previous eight trading days, while the May-25 closed at €515.75, rising by €41.50/t over the same period.

The main driver for this bullish run was news of poor early harvests in EU (e.g. France) and Ukraine as a result of the continued pressure from unfavourable growing conditions. Considerable heat and dryness in the east of Europe, and substantial rainfall and poor sunlight in the west, has led to downward revisions for the EU rapeseed yield (European Commission). In the latest EU Mars report (24 June), the rapeseed yield was forecast down 2% from May’s estimate at 3.16t/ha. Tightness in the European market, as well as a larger rapeseed crop in Canada, has supported a sizable premium over the Canadian market.

In addition to reports of disappointing OSR yields in Europe, the vegetable oils complex has also been supported by other factors. Lower than expected soyabean plantings in the USDA acreage report (28 June) had buoyed Chicago soyabean futures last week. Also, China potentially increasing tariffs on Indonesian goods (e.g. palm oil) in response to an announced change to Indonesian trade policy further supported gains across the complex.

Why the bullish market has fallen away

At the beginning of this week, the vegetable oils complex lost strength due to expectations of a rise in Malaysian palm oil supply stockpiles. Earlier today, reports showed stocks had reached a four-month high. Furthermore, soyabean oil lost strength as the US soyabean crop was rated 68% good or excellent, up 1 percentage from last week contrasting the news of unfavourable weather conditions across the US Midwest.

As well as this, improved weather conditions in the Canadian Prairies weighed on canola futures, impacting the European market too. Technical signals had also reported Paris rapeseed futures (Nov-24 and May-24) overbought, casting bearish pressure.

What is the market outlook going forwards

While Paris rapeseed futures are trading below the €500/t mark, recent forecasts from the IGC suggest that global rapeseed consumption will outstrip supply for the 2024/25 marketing year. As such, any further news on the rapeseed harvest in Europe will continue to influence rapeseed’s market direction. However, the anticipated record soyabean production in Brazil, which will contribute plentiful global oilseed supplies, is likely to cap any major gains in the oilseed complex in the new year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.