- Home

- News

- Rapeseed planted area intentions see declines from a difficult last season: Grain Market Daily

Rapeseed planted area intentions see declines from a difficult last season: Grain Market Daily

Wednesday, 27 November 2019

Market Commentary

- UK feed wheat futures (May-20) ended yesterday unchanged at £151.00/t. Meanwhile new crop (Nov-20) futures gained another £1.10/t, to close at £156.75/t, responding to continued planting woes and support from global markets.

- Paris milling wheat futures (May-20) closed yesterday at €184.00/t, gaining €2.50/t since last Tuesday. Steady export demand has kept prices firm.

- Chicago soyabean futures (Jan-20) have gained $0.83/t on yesterday’s close, to $325.27/t (12.30pm). The gain in soyabean futures ended a five day run of declines. The rise was checked by increased Chinese buying of South American supplies.

Rapeseed planted area intentions see declines from a difficult last season

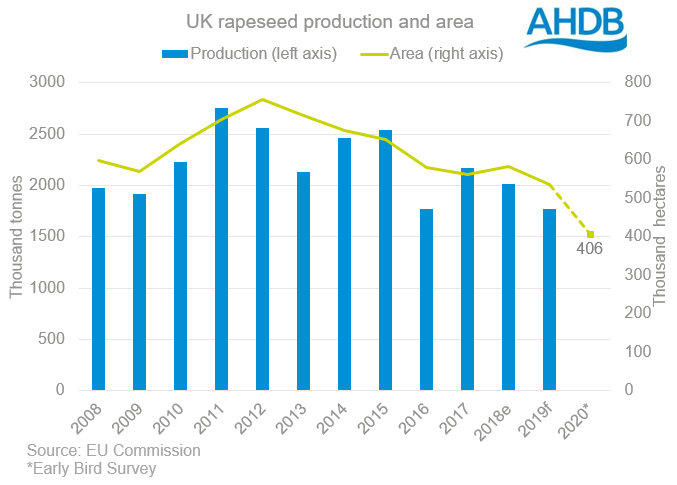

Preliminary figures for GB planting intentions were released on Monday. Oilseed rape planting intentions have seen a 23% drop in area, to 406Kha, from last year. The figures focus on intentions rather than actual planted area, meaning the figures may change following above average rainfall levels for much of winter so far this season.

Last season the UK rapeseed area saw large declines as a result of a difficult growing season, with cabbage stem flea beetle (CSFB) damage prevalent throughout oilseed rape crops. Many growers opted to ‘rip up’ affected fields and replant with another crop where possible. Already this season there have been reports of CSFB damage creating establishment difficulties. As such, a reduction in planted area from current intentions or shifts in the area to be carried through to harvest remains a possibility.

EU28 rapeseed area for 2020/21 is estimated by Stratégie Grains at 5.8Mha, a slight increase of 200Kha from last year, but below the five-year average. The Stratégie Grains report from earlier in the month highlights the potential for cuts to planted area estimates in in the EU, particularly in France following challenging growing conditions.

With potentially tight production in 2020/21 both domestically and on the continent, EU import demand for rapeseed could stretch further beyond the 6.0Mt this year. So far this season 79% of EU rapeseed imports have been of Ukrainian origin, around 2.51Mt.

Ukrainian rapeseed plantings are seen rising marginally for 2020/21 to 1.09Mha, Ukraine could again feature heavily in EU rapeseed markets going forward.

In the New Year, the EBS survey will be conducted again to identify planting intentions following the wet winter. Oilseed rape area may again see revisions which if realised could further impact production figures.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.